Chase 5/24 Rule

One of the first questions new points & miles enthusiasts often have is, why is everyone talking about Chase? Another popular question is, are Chase points (Ultimate Rewards or URs) that much more valuable than all other points & miles? These questions are understandable, and the answers to these questions are foundation setting principles that everyone learns when just starting out. A big reason Chase is on the forefront of everyone's mind, at least when they first get into miles and points, is the Chase 5/24 rule. Just what is the Chase 5/24 rule & why is it so important? We will dive into all of that in our Chase 5/24 guide here.

Table of Contents

ToggleChase Credit Card Application Rules

Chase, like every bank, has lots of rules for credit card applications. Here are the other Chase application rules that you should be aware of outside of the Chase 5/24 rule:

The “2/30” Rule

This application rule means that you will not be approved for more than 2 Chase cards in a 30-day period.

The 0/30 Rule

This Chase application rule means that you can not have applied for any Chase credit cards in a 30-day period before applying for a business card.

The Sapphire Family Rule

This rule deals with the Sapphire family of cards (Sapphire Preferred, Sapphire Reserve and plain Sapphire card – only available via downgrade). The Sapphire family rule means that you can only receive one welcome offer every 48 months from any of the three Chase Sapphire cards. It also means that you cannot apply for a new Sapphire product while currently carrying one of the three cards. You can carry more than one Sapphire product, via upgrades and downgrades, outside of approvals though.

The Southwest Family Rule

The Southwest family rule is similar to the Sapphire rule. It only deals with the personal Southwest credit cards though. The rule means that you can not get a new Southwest personal card offer, from any of their 3 cards, within 24 months of each other. It also means that you can not sign up for a new Southwest personal card while currently holding another Southwest personal card. The business cards do not have this family rule.

The Chase 5/24 Rule Explained

Quite simply, the Chase 5/24 Rule is a count of how many personal credit card accounts you've opened in the prior 24 months from any bank. While most business cards don't count towards this, some do. The quick and skinny of it is these business cards will count against your Chase 5/24 count:

- TD Bank

- Discover

- Some Capital One business card

- For a full breakdown of this check our full Chase 5/24 rule business card guide.

It should also be reiterated that your 5/24 count is based on personal cards that you have actually opened and not based on hard pulls. Some other banks focus solely on hard pulls, while Chase focuses solely on approvals.

You will be automatically denied for Chase applications if your count of new personal credit cards (and a few business cards) exceeds 5 in the last 24 months. That is why it is so imperative to understand the Chase 5/24 rules and to focus on it early in your miles & points journey.

What About Chase Business Cards, How Do They Play Into The Chase 5/24 Rule?

I should also notate that while Chase business cards do not add to your 5/24 count, since they are not listed above, you do need to be below 5/24 to be approved for them. This is something that always trips people up when they are first learning about the Chase 5/24 rule.

Exceptions To This Infamous Rule

There are three very rare exceptions to the Chase 5/24 rule. Those are as follows:

- Some very high net worth Chase Private Client banking customers are able to be approved while above 5/24 with the help of a banker.

- In rare occasions a person can be targeted for an offer in their Chase account that works outside of the Chase 5/24 rule.

- Sometimes Chase let's people through on offers without rhyme or reason. These are 1 in 1,000 or more type cases.

Outside of these very rare instances, you will need to wait until your 5/24 number falls below 5 personal credit card approvals, across all banks, over the past 24 months to be approved.

How Do You Determine Your 5/24 Status?

The easiest way to determine your current Chase 5/24 status (for free) is to download Credit Karma and / or Credit Sesame. You should ignore their credit score models, as they are notoriously inconsistent and attempt to draw you back to their apps with wild fluctuations in your score.

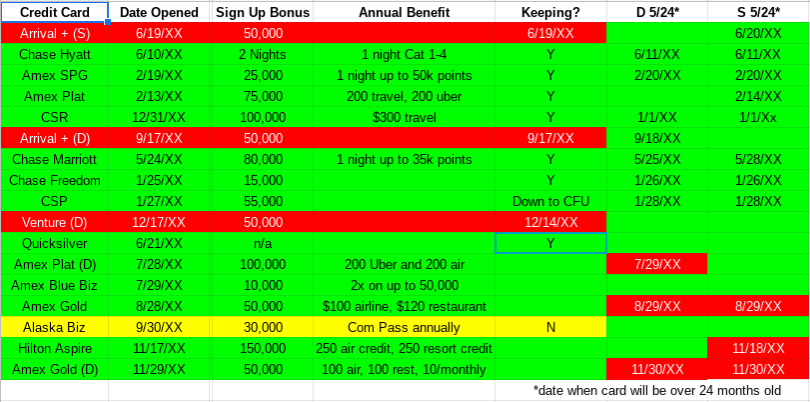

What both apps are great for is looking at all the accounts on your credit report and confirming the date each account was opened. Before you begin your award travel journey, and navigating the Chase 5/24 rule, you must confirm your 5/24 status. Once known, I highly recommend creating a spreadsheet to track your Chase 5/24 status. This spreadsheet can also track your annual fee due dates, sign-up bonus, opening/closing dates, etc. Here is a look at a sample chart that is similar to ours:

Your Plan Of Attack If Just Starting Out & Under The Chase 5/24 Rule

If you're just learning about rewards travel, and you are under 5/24, congratulations! You are now eligible for Chase credit cards. Here is how you should consider getting started on this path.

Chase Sapphire Preferred vs Chase Sapphire Reserve

The first step in the journey is obtaining a Ultimate Rewards earning card. That means you will have to decide between a Chase Sapphire Preferred card and a Chase Sapphire Reserve card. We have a guide breaking down the differences between those two day one cards that you should read.

If you had grabbed one of these previously in your journey just remember it has to have been 48 months since you earned a welcome offer with them.

Figuring Out If You Are Eligible For Ink Business Cards

Once you have a Sapphire Preferred or Reserve in your toolbelt your next step is to look at the Chase Ink Business cards. These are some of the most rewarding cards on the market for your business spend. The points also pair perfectly with the ones earn from your Sapphire card. You can pool all of your Ultimate Rewards together across both types of cards. The Sapphire products even unlock the no fee business card earnings and make them a fully transferrable currency. Pretty cool, huh?

Chase offers the following Ultimate Rewards earning business cards (click the links for our full card reviews):

You may be wondering if you are even eligible for business cards. Many people are and just don't realize it. We discuss that in more detail here. If you are eligible, carrying a few different Ink business cards can really increase your earning ability.

Freedom Flex

Once you have your Sapphire product and your lineup of Ink cards, which don't add to your Chase 5/24 count, it is time to take a look at Freedom Flex card. This card is a great long term earner for Ultimate Rewards points. It offers up 5x rotating categories each quarter that can amount to 30,000 easy Ultimate Rewards each and every year. These are fully transferrable points since you should already have that Sapphire product to unlock them fully.

Chase also has a Freedom Unlimited card, but most would be better off with the Freedom Flex card. That is especially true if you grabbed the Ink Business Unlimited previously, since the earning overlaps quite a bit.

Move Towards Co-Branded Cards

After you have your Sapphire, Ink and Freedom cards, it is time to take a look at the co-branded cards Chase has to offer. These are the cards that you focus on right before going over 5/24. While it is extremely important to understand the Chase 5/24 rule, the intent is not to stay under 5/24 forever after all.

When you get to this portion of your journey it is best to focus on which co-branded cards work best for your needs. This will be based on which ones give you perks that you can use and which brands match up with your travels best. Grab cards that will be long term keepers for you, since you may not be able to come back around to them for a while once you go over 5/24. There are also a few co-branded business cards offered by Chase that will not count against your 5/24 count, just like the Ink cards.

Chase 5/24 Rule: Chase Co-Branded Business Cards (in no particular order)

- World of Hyatt Business

- United Business

- Southwest Performance Business

- Southwest Premier Business

- IHG Premier Business

Chase 5/24 Rule: Chase Co-Branded Personal Cards (in no particular order)

- World of Hyatt Personal

- Aeroplan Mastercard

- British / Iberia / Aer Lingus

- IHG Premier

- IHG Traveler

- Southwest Plus

- Southwest Priority

- Chase Southwest Premier

- United Quest

- United Explorer

- Chase United Gateway

- United Club Infinite

- Marriott Bonvoy Bold

- Marriott Bonvoy Boundless

- Chase Marriott Bonvoy Bountiful

Your Plan Of Attack If You're Over The Chase 5/24 Rule

If you're new to award travel, only to realize that you are over Chase 5/24 (whomp, whomp, whomp!), do not fret. There are TONS of great options out there. Chase is the only bank that unofficially-officially recognizes the 5/24 rule. Other banks do not apply this rule, but have some of their own.

You can still grab many rewarding credit cards and, eventually, get back under 5/24 to open those valuable Chase cards. Your journey will just be different than most others'. Pay attention to our full 5/24 business card guide to give you access to some amazing cards while you await your drop back under 5/24.

Chase 5/24 Rule Explained: ToP Thoughts

Hopefully after reading all about the Chase 5/24 rule you now know what the Chase 5/24 rule is, why it is important and how to navigate it going forward. You should now have a road map to follow whether you are currently over, or under, Chase 5/24.

If you still are having trouble understanding this rule please do not hesitate to reach out to me via email on the Contact Us page or in our Facebook group for a personalized plan moving forward.

Good luck to all as you begin your award travel journey!