Marriott Bonvoy Boundless® Credit Card Review

The Marriott Bonvoy Boundless® Credit Card is one of Marriott's mid-tier credit cards. This card isn't loaded with a ton of benefits, but its perks are enough to justify the modest $95 annual fee. We will go over the welcome offer, card perks, earning structure and share our thoughts in this Marriott Bonvoy Boundless® Credit Card review.

Table of Contents

ToggleWelcome Offer Details

The welcome offer for the Marriott Bonvoy Boundless® Credit Card is as follows:

- Earn 3x 50,000 point free night certificates after spending $5,000 within the first 3 months of card membership.

- The card has a $95 annual fee.

This is a limited time, increased offer for the card.

Bonvoy Boundless Card Application Rules

Like other Chase cards, the Marriott Bonvoy Boundless® Credit Card is subject to Chase's 5/24 rule. It is also not available to anyone that has earned the welcome offer on the Bonvoy Boundless in the last 24 months. That is pretty standard language from Chase but the Bonvoy cards have another layer of family inspired rules.

The Marriott Bonvoy Boundless® Credit Card is not available to those who:

- (1) currently have or had any of the following cards within the last 30 days:

- Marriott Bonvoy American Express Card

- The Starwood Preferred Guest Credit Card from American Express

- (2) applied and were approved for any of the following cards within the last 90 days

- Marriott Bonvoy Business American Express Card

- Starwood Preferred Guest Business Credit Card from American Express

- Marriott Bonvoy Brilliant American Express Card

- Starwood Preferred Guest American Express Luxury Card

- Marriott Bonvoy Bevy American Express Card

- (3) received a new cardmember bonus or upgrade bonus for any of the following cards within the last 24 months:

- Marriott Bonvoy Business American Express Card

- Starwood Preferred Guest Business Credit Card from American Express

- Marriott Bonvoy Brilliant American Express Card

- Starwood Preferred Guest American Express Luxury Card

- Marriott Bonvoy Bevy American Express Card

You really do need a Venn diagram to figure all of this out. Luckily for you, we're created an eligibility chart here.

Bonvoy Boundless Card Earning Rate

The Marriott Bonvoy Boundless® Credit Card earns bonus points in the following categories:

- 6x on Marriott purchases

- 3x on the first $6,000 spent in combined purchases per year on

- Gas stations

- Grocery stores

- Dining (including takeout and eligible delivery services)

- 2x on all other eligible purchases

Marriott Bonvoy Boundless Credit Card Review: Card Perks

The perks and benefits of the Marriott Bonvoy Boundless® Credit Card include:

- 15 elite night credits towards status annually

- An annual free night award every year after your account anniversary, valid for up to 35,000 points

- Complimentary Silver Elite status

- The ability to earn 1 elite night credit for every $5,000 that you spend

- Gold Elite status when you spend $35,000 on the card in a calendar year

- Complimentary in-room premium internet access at Marriott Bonvoy properties

- No foreign transaction fees

Our Analysis

This mid-range Marriott card offers a couple of good benefits to offset its low annual fee. The $95 annual fee gets you a free night award worth up to 35,000 points and 15 elite night credits towards status. Granted, you can also receive 15 elite nights from the Marriott Bonvoy Bold® Credit Card from Chase (review), which does not have an annual fee.

Complimentary Silver Elite status isn't worth much at all. This is the lowest elite status tier in the Bonvoy program. The only notable perks of Silver Elite status are 10% more points on paid stays and priority late checkout, subject to availability. For complimentary Bonvoy elite status, other cards like the Platinum Card® from American Express (review) and the Business Platinum Card® from American Express (review) offer complimentary Gold Elite status along with many other benefits.

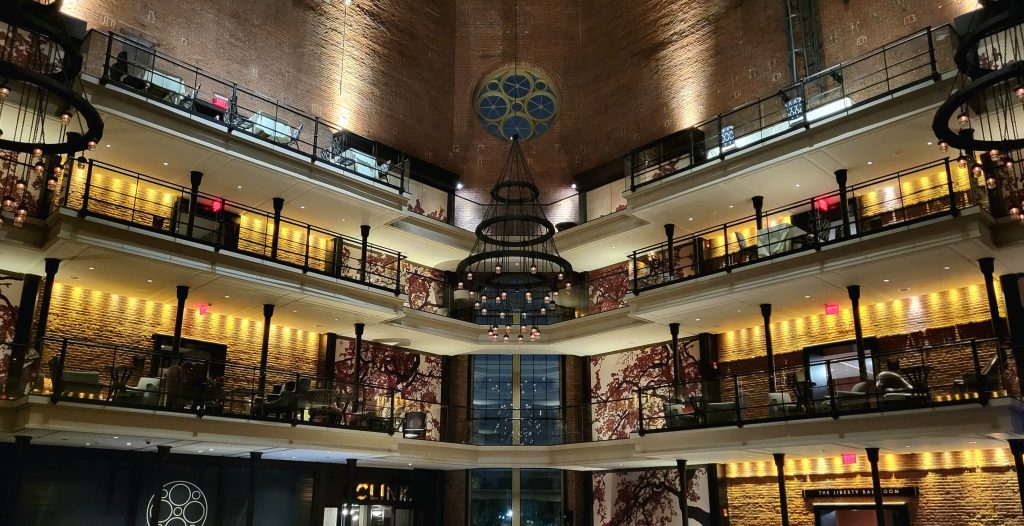

The 35,000-point free night award can be useful for a free stay at an affordable Marriott property, like a Fairfield Inn or even a Courtyard by Marriott. These can come in handy especially when you need a hotel room near an airport for an early flight the next morning. Paying a $95 annual fee for this free night award isn't a bad trade.

Unfortunately, the Marriott Bonvoy Boundless® Credit Card is subject to Chase's 5/24 rule. In our view, the card is not worth a 5/24 slot for the vast majority of folks at the current welcome offer level. If you've already opened all the UR-earning cards and co-branded cards you can and are ready to move past 5/24, then maybe this card could make sense.

Marriott Bonvoy Boundless Credit Card Review: ToP Thoughts

The Marriott Bonvoy Boundless® Credit Card offers a good return for its $95 annual fee, mainly through the annual free night award worth up to 35,000 points. Unfortunately, the Bonvoy Boundless is subject to Chase's 5/24 rule. When compared to other Chase cards, whether Ultimate Rewards earning cards, or co-branded cards with other hotel or airlines, the Bonvoy Boundless falls quite a bit short. This is why we would only ever recommend opening this card if you're pretty much finished with Chase cards and ready to move past 5/24.

What are your thoughts about the Marriott Bonvoy Boundless® Credit Card? Join the discussion in our Facebook group!