Collision Damage Waiver Benefit

Renting a car can be a necessary part of many award traveler's plans. Whether you're renting a car on an international trip to site see, or just taking a domestic road trip, you are going to want to know about your card's potential collision damage waiver benefit. If you have the right coverage, it could end up saving you hundreds of dollars in extra fees. Perks like the collision damage waiver benefit can help offset, or completely cover, your credit card's annual fee.

Table of Contents

ToggleWhat Is The Collision Damage Waiver Benefit Exactly?

Collision damage waiver is a supplement that covers damage to your rental car. By having the collision damage waiver benefit, it removes some or all of your liability if your rental car is in an accident. Rental car agencies will offer this coverage at an additional charge. Some countries even make this coverage mandatory, which can be quite costly. Fortunately for us award traveler's, many cards include this coverage as a card benefit. In order to waive the rental agencies coverage, you will need to retrieve your proof of coverage from your credit card. In this article, we will walk you through how to easily retrieve your proof of coverage for this benefit online, without ever making a call.

What Cards Does this Work For?

You can retrieve the proof of coverage online for most Visa cards issued in the US. This includes Chase Visa card that offers the collision damage waiver benefit. Popular travel cards such as the Chase Sapphire Preferred and Chase Sapphire Reserve are amongst those included. When I was playing around with this, I was also able to retrieve the letter for my cobranded Chase cards and Chase Business Ink cards.

How the CDW Benefit Can Be Valuable

Many car rental agencies will require collision damage waiver coverage in order to take the car. These fees can really add up. On a recent trip to the Dominican Republic, I was renting a car for five days. The rental car agency wanted $40 a day for this mandatory coverage. However, since I have this benefit on my Chase Sapphire Preferred, I was able to avoid those fees by having the proof of coverage with me. This coverage is especially valuable when you realize it is a perk of so many cards. It is essentially a free and easy perk that almost every traveler has in their wallet.

How to Retrieve the Collision Damage Waiver Proof of Coverage

The good news is that the proof of coverage letter for these cards can be retrieved online in a few short steps.

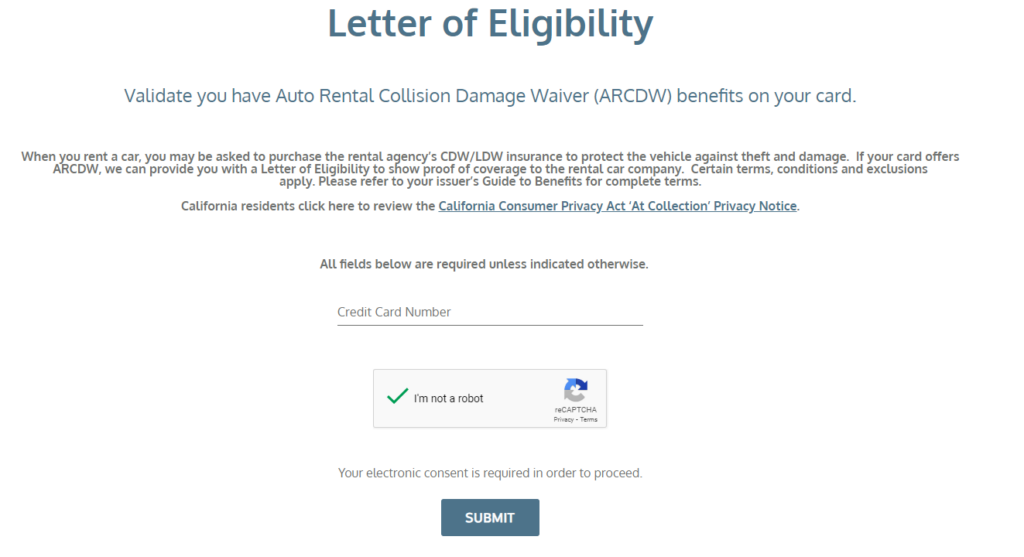

Step 1: EClaimsLine

Head over to the website for eclaimsline and enter the card number for your eligible credit card.

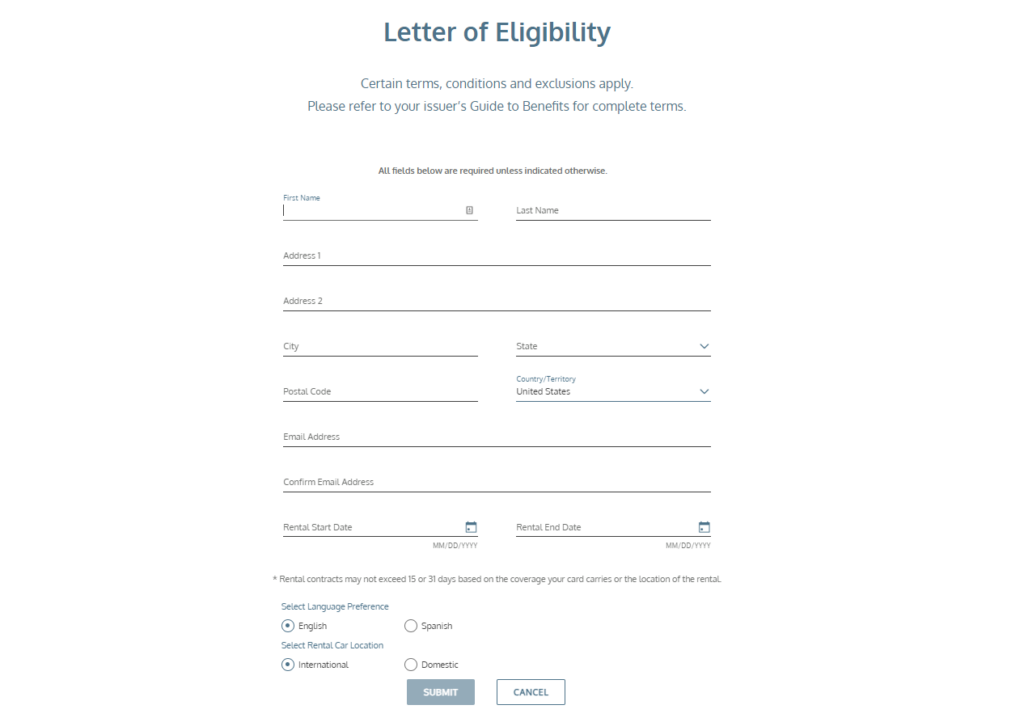

Step 2: Enter Personal Information

If your card is eligible for benefits, you will be prompted to provide your address and contact information for the letter. You can request the letter in both English or Spanish, which I feel like is pretty cool in case you are traveling to a Spanish speaking country.

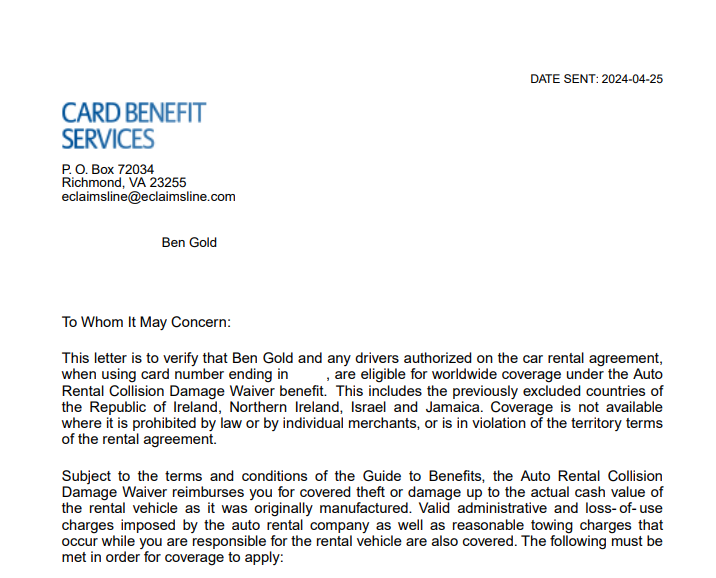

Step 3: Receive Your Letter

Once you hit submit, you will receive the letter. A copy will also be emailed to you. This letter can then be presented to a rental car agency to waive mandatory collision damage waiver benefits and associated fees.

Primary Versus Secondary CDW Coverage

Some cards that offer collision damage waiver coverage have primary coverage, while others have secondary. The short story here is you want to use a card with primary coverage. Secondary coverage will only pay for amounts not covered by another policy that the driver has. This means you would first need to file a claim with your other insurance (this could be car insurance or another travel policy you may hold). This can take a long time and be frustrating, as insurance claims can require documentation etc. Therefore, it is best to go with a card that offers primary coverage.

Quick Tip: Cards that offer Primary CDW Coverage

The following cards offer primary coverage:

- Chase Sapphire Preferred

- Chase Sapphire Reserve

- United Explorer

- United Quest

- United Club Infinite

- BILT World Elite Mastercard

- Capital One Venture X

- US Bank Altitude Reserve

The following business cards offer primary coverage for business travel only:

- Chase Ink Business Preferred

- Chase Ink Business Cash

- Chase Ink Business Unlimited

- United Business Card

- United Club Business Card

Collision Damage Waiver Letters Online: ToP Thoughts

I wish I had known about this sooner. I've had to call and painfully walk through the steps to get the letter with a live agent. It's much easier to fill out a form at your own convenience and quickly pop out a letter. Packing and getting ready for a trip can be stressful in itself. It's nice to see a few steps to getting ready for a trip be automated. This benefit is incredibly helpful if you are renting a car in a place where they require this coverage. Not only do you get additional coverage, but perhaps a cost savings as well. Were you successful in retrieving your letter online? Let us know over in the ToP Facebook group!