Pay Your Taxes with a Credit Card

Nothing in life is certain, except death, taxes, and earning credit card rewards with your tax bill. That's right, let's turn lemons into lemonade. If you owe federal taxes (or think you might), now is the time to open a new card and hit a minimum spend with that tax bill! Paying taxes with a credit card can make this otherwise undesirable time of year a joyous occasion.

Table of Contents

ToggleUPDATE 4/15: (Un) Happy tax day. If you are a serial procrastinator then here is the info you need for today.

RELATED: If You Are Getting Errors Paying Your Tax Bill With Chase Credit Cards Try This Trick

How To Pay Your Taxes with a Credit Card

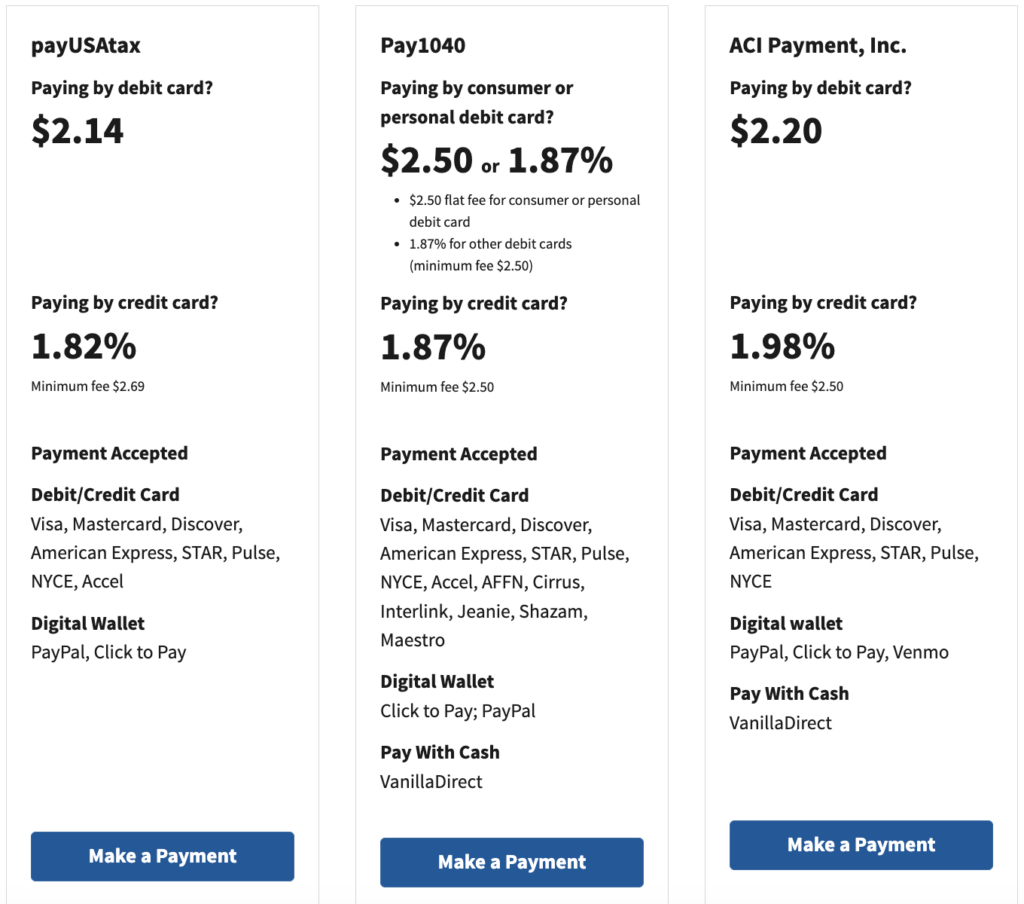

There are three official websites that accept credit cards for your federal tax bill:

- www.payusatax.com accepts Amex, Discover, Mastercard and Visa for a fee of 1.82%

- www.pay1040.com accepts Amex, Discover, Mastercard and Visa for a fee of 1.87%

- fed.acipayonline.com accepts Amex, Discover, Mastercard and Visa for a fee of 1.98%

Of these, payUSAtax is the best option, with its fee lowered by 0.05% since last year! Also, keep in mind you can use these websites to make estimated quarterly taxes as well.

We recently saw some data points of folks having a hard time getting payments through with Chase cards. But don't worry, ToP has you covered with an easy fix, which you can read about here.

Some Rules To Be Aware Of

There are some rules you should be aware of with these tax payment processors. Such as, how many payments you can make with each processor. You can find the entire breakdown of the limits here. For the most part you are limited to 2 payments per processor, per tax payment period. So, if you pay quarterly taxes you are allowed 8 payments in a year for that processor essentially. If you just pay your tax bill once per year then you are limited to 2 payments in total each year for that processor. This seems to be per processor though, so you could make up to 6 different payments each time if you use all 3.

Why Does This Matter?

You may be wondering why this matters. If you have a large tax bill, you may want to spread the payment across multiple credit cards to earn spending bonuses or welcome offers. Or, if you want to pay with Visa or Mastercard gift cards you purchased using a credit card in a bonus earning category, you can do that too. The fees are often cheaper doing this as well, since gift cards often code as a debit card. Which gift cards work depends on the individual payment processor. The gift card caps (usually $200 or $500 per gift card) can be a problem for a larger tax bill. However, by using multiple payment processors quarterly you may be able to make it work for you. You can also pay the remainder with a credit card when you maximize all of your payment slots.

Which Gift Cards Work For Each Processor?

- PayUSAtax.com ($2.20 fee if coding as a debit card)

- Sunrise Visa

- Vanilla Mastercards (not Visa) will sometimes work. It goes in an out

- Pay1040.com ($2.50 fee)

- Metabank issued Mastercards and Visas (goes in and out some)

- Sunrise Visa

- Vanilla Mastercards (not Visa)

- ACI Payments ($2.20 fee)

- Metabank issued Visas (goes in and out some)

- Vanilla Visa

This is not an all encompassing list so some others may work that we are not aware of (HT FM). Let us know if you find anything else, or use anything else, in the ToP Facebook Group.

Best Credit Cards for Paying Your Taxes

The best card for any bill is the card you're working on minimum spend for a sign-up bonus. If you don't have a new card to meet minimum spend, now is the time to open a new one. Always, you can check our latest ToP picks for credit cards here.

However, if you need to take a break from opening new cards, you're in a time crunch, or you can't get a new card for whatever reason, we have you covered. Here are our recommended cards for paying taxes and earning rewards that outweigh the 1.82%+ fees.

Citi Double Cash

You earn 2 Citi ThankYou Points per dollar spent on every purchase with this card. If you have the Citi Premier card, you can transfer those TYPs to Citi's transfer partners for maximum value. By paying your taxes with the Double Cash, you're essentially “buying” ThankYou Points for less than 0.93 cents each. This is an absolute bargain! This card does not have an annual fee and there are no limits on 2x earnings. You can read our review here.

Blue Business Plus Credit Card from American Express

You earn 2 Amex Membership Rewards points per dollar spent, up to $50,000 per year. Afterwards, you earn 1x for any additional spend. Again, you're “buying” MRs at about 0.90 cents each. This is an instant profit with an American Express Platinum for Charles Schwab card (which allows you to cash our MRs at 1.10 cents per point). And if you don't want to cash out your MRs, you can transfer them to Amex's many transfer partners. This card does not have an annual fee, and offers 2x MRs on all purchases on up to $50,000 annually. After $50,000, all earnings are 1x. You can read our review here.

ToP Tip: Assuming the 1.82% fee for paying with a card, the most you can charge to a BBP to earn 2x on the entire purchase is $49,106.26.

Capital One Venture X / Venture Business X / Capital One Venture

These cards earn 2 Capital One Miles per dollar spent, with no cap. Like other transferable points currencies, you can transfer Capital One Miles to different transfer partners for excellent value. These cards have a $395 annual fee, but they have numerous perks to help offset the fee. You can read our reviews linked above for more information.

Chase Freedom Unlimited / Chase Ink Business Unlimited

Both of these cards earn 1.5 Chase Ultimate Rewards per dollar spent, with no cap. Neither of these two cards has an annual fee. The CFU also earns 3x on dining and drugstore purchases, and 5x on travel through the Chase Portal, all with no cap. You can read our review of the Freedom Unlimited here, and our review of the Ink Unlimited here.

Business Platinum Card from American Express

This card earns 1.5x on all purchases over $5,000. This card has a $695 annual fee. Like other Amex “Pay Over Time” cards, you can usually get a temporary credit card number instantly upon approval with the Business Platinum. However, paying your taxes with this temporary card should be avoided since it has recently caused issues. Wait until the card arrives before paying your taxes.

Capital One Spark Cash Plus

This card earns 2% cash back per dollar spent, with no cap. But if you hold a Venture or Spark miles earning card, such as the Capital One Venture X, Capital One Venture Rewards or Capital One Spark Miles for Business, you can convert the cash back into Capital One Miles and transfer them to Capital One's transfer partners for greater value. The card has a $150 annual fee. You can read our review here.

Alliant Credit Union Visa Signature Card

2.5% cash back, up to $250 back per billing cycle (max of $10,000 spend). $99 annual fee, which is waived the first year. This card is one of the highest cash back cards on the market, but the $10,000 cap per cycle isn't very helpful for those with large tax bills.

Credit Cards That Have A Yearly Spending Bonus

On top of putting your tax payment on credit cards with a welcome offer attached, or that have a high everyday spend earning rate, you can also use credit cards with yearly spending offers. These could be cards that earn a free night certificate or one that helps you unlock status with a loyalty program etc. Here are some good options:

World of Hyatt Credit Card

The World of Hyatt credit card would earn 1 point per dollar on the purchase but also earns a category 1-4 free night certificate when spending $15,000 in a calendar year. That is worth up to 18,000 points for a category 4 peak redemption. If you maximize the certificate it is like getting 2 points per dollar, or 3%+ (valuing Hyatt points at 1.5 cents+ each) back in return on the spend. You will also earn 2 elite night credits per $5,000 in spend if you are chasing Hyatt status at all.

Hilton Surpass Card

The American Express Hilton Surpass card earns a free night certificate after spending $15,000 within a calendar year too. The card also earns 3 points per dollar on all spend. The free night certificate goes to the highest category level, over 100,000 points, but requires finding saver award space. Let's say you will get at least 70,000 points from the certificate, giving you an additional 4.5 points per dollar. That is 7.5 points per dollar, on average. If we value Hilton Honors points at $0.0045 each that is a net return of 3.38%.

Hilton Business Card

The Hilton Business American Express is pretty much the same as what we mentioned above for the Hilton Surpass card. The card earns 3x per dollar on all spend and the same uncapped free night certificate after $15,000 in spend each calendar year, although this benefit ends on 6/30/24.

Bonvoy Bevy Card

The Bonvoy Bevy card earns a $15,000 free night certificate that works at properties that cost up to 50,000 points a night. This can be earned per calendar year like the other options on the list. The card earns 2 points per dollar on all spend and adding the free night certificate is like an additional 3.3 points per dollar. That is, of course, assuming a 50K redemption. The net return from the spend and free night is 5.3 points per dollar. That is a return of 3.2% if you value Bonvoy points at $0.006 each.

Cards Used To Earn Elite Status

If you are on the status earning hamster wheel then cards that help achieve that may make sense to you. Such examples are the World of Hyatt Business card, Delta Reserve or Delta Platinum cards. There are some other options as well but I won't dive too deep into it. If you are chasing status then you likely already know which cards work best for your loyalty program. This is something to consider for rare instances, even if the returns are not as good overall compared to everything listed above.

REALTED: Myth Busted! Earning an Amex Welcome Offer By Paying Taxes

Paying Taxes with a Credit Card: ToP Thoughts

Although we all dread paying our tax bill, it's easy to earn a massive welcome offer or at least just some extra points that offset the credit card fee. With fees as low as 1.82%, spending the $4,000 or so for an average minimum spend requirement costs you only $72.80. With many welcome offers worth $1,000 or more, paying your tax bill is a perfect time for a new card.

As always, come join us in our Facebook Group to learn many other tips and tricks like this to save money and earn valuable points and miles!