Credit Card Annual Fees

Many people balk at the idea of paying an annual fee for a credit card. Why do that when so many cards don't charge any annual fee? The answer is simple: because credit card annual fees are generally worth it. We almost always get way more value out of the card than the annual fee we have to pay. The not-so-simple part is figuring out which cards are worth their annual fees and which aren't.

Table of Contents

ToggleThe analysis also depends on whether you are looking at opening a new card or paying the annual fee for keeping the card another year. Below, we cover some factors you should consider.

The Price to Play the Game

Simply put, annual fees are the price we pay to play the points & miles game. Many of the best credit cards come with annual fees. And in fact, most banks require you to have a specific credit card to be able to transfer your points to transfer partners.

To transfer Chase Ultimate Rewards to transfer partners, you must have one of three cards. You need either a Chase Sapphire Preferred ($95 annual fee), Chase Sapphire Reserve ($550), or Chase Ink Business Preferred ($95). So to get the most out of your Ultimate Rewards, you have to pay at least $95 per year in credit card annual fees. This is absolutely worth it for the amazing things you can do with Ultimate Rewards points.

Likewise, Citi requires you to hold the Citi Premier ($95 annual fee) to transfer Citi ThankYou Points to partners. Again, the $95 price of admission is an absolute bargain here for this keeper card being your ticket to the magical world of ThankYou Points.

Amex actually has a couple of cards with no annual fee that let you earn Membership Rewards. These are the EveryDay card and the Blue Business Preferred card. But of course you'll still want to open plenty of other Amex cards to earn Membership Rewards points from those juicy welcome offers.

Whether Other Credit Card Annual Fees Are Worth It

Now that we have to pay at least a small annual fee with certain banks to transfer their points to partners, the question becomes whether paying annual fees for other cards is worth it. The answer depends on whether we're talking about opening a new card or keeping a card open for another year.

Since a card's welcome offer alone can justify the annual fee, we split the analysis between new cards and existing cards.

Opening a New Card

We all know that sign-up bonuses are the fastest way to earn points. It's a lot faster to earn 60,000 Ultimate Rewards by spending $4,000 in three months with the Chase Sapphire Preferred‘s typical welcome offer than it is to maximize the card's bonus categories. To earn those same 60,000 points with dining expenses, you would have to spend $20,000 earning 3x per dollar! (The offers discussed in this article may have changed since the time of writing)

These large amounts of points make it easy to justify these card's annual fee for the first year. The Sapphire Preferred's 60,000-point welcome offer is worth $750 when redeemed through the Chase Ultimate Rewards portal at 1.25 cents per point. This means you're paying $95 to earn $750. This sounds like an easy decision. And of course, we can get way more than $750 in value out of 60,000 points through valuable transfer partners.

The same goes for any other welcome offer regardless of the card's annual fee. Yes, even the Amex Business Platinum card's $695 annual fee is worth it for the first year when you're earning 150,000 Membership Rewards or more.

While the welcome offer alone justifies the annual fee, the card's perks are the icing on the cake for that first year. You can always downgrade your card to one with a lower annual fee or no annual fee after the first year.

Even then, product changing your card should not be your primary option. First, you should check to see if you are eligible for any retention offers. Retention offers are when a bank offers you a statement credit or a some bonus points in exchange for you keeping your card open for another year. To learn more about retention offers, check out our ToP Guide to Credit Card Retention Offers.

If you are not eligible for retention offers, then you must decide whether it is worth keeping the card and paying the annual fee again.

Keeping a Card After the First Year

Deciding whether to pay the annual fee after the first year is more nuanced. The analysis now boils down to weighing two sides of a scale, with the annual fee on one side and the card's benefits on the other. Card benefits that can tip the scale include lounge access, bonus categories, statement credits, etc.

So you must now look at the card's benefits and overall usefulness to you. Here are some popular credit card benefits that can help justify or at least offset an annual fee:

- Lounge access

- Free night certificate

- Hotel status

- Strong bonus category earning potential

- Free checked bag

- Statement credits for goods and services

- Primary car rental insurance

- Trip protection

It's worth highlighting how to think through some of these benefits.

Lounge access is very popular, and for good reason. It can be a great money saver, and it's also nice to wait for your flight somewhere a little quieter. That said, a lot of cards offer lounge access, with Priority Pass being the most popular. So lounge access could be an important factor for someone who does not have any other cards offering this perk. But even then, you must ask yourself whether you have used or expect to use airport lounges enough to offset that card's annual fee.

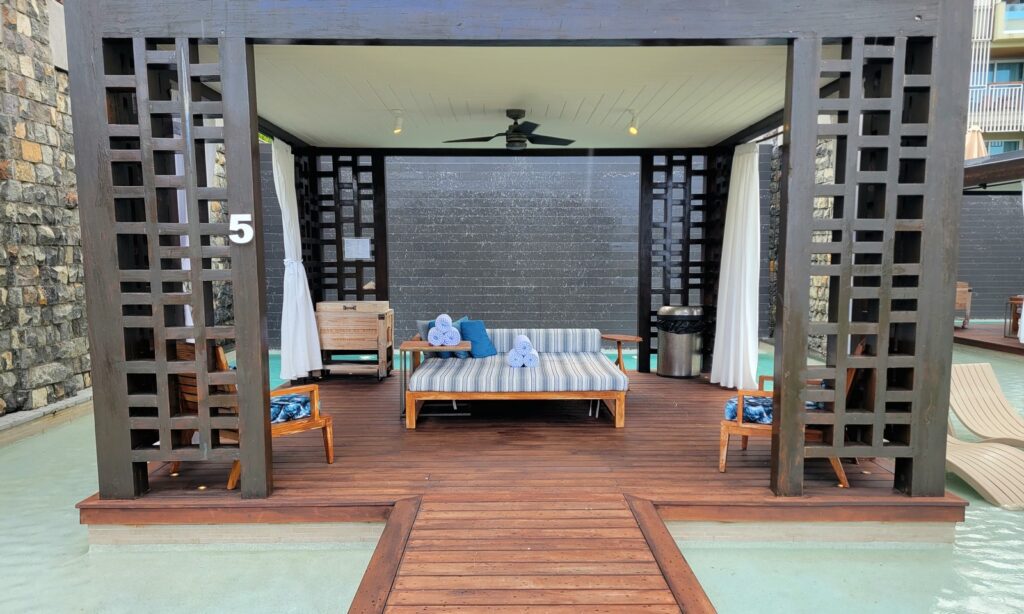

Free night certificates are a common benefit for some hotel credit cards. Based purely on numbers, it is usually worth paying the annual fee in exchange for a free night certificate. It's easy to find hotel rooms where the cash price far exceed the annual fee you paid to receive the free night certificate. However, you should consider the brand in question. For example, if you have Marriott free night certificates but have become a Hyatt loyalist, how likely are you to stay at a Marriott property? Has that hotel made any changes to their redemption structure that renders those free night certificates less useful?

Hotel status is similar here. Does your card grant you elite status for the brand you plan to stay with the most? Or at least often enough to justify the annual fee? How many free breakfasts or room upgrades would you need to justify paying the card's annual fee?

Lastly, remember to consider the effort it takes to maximize your benefits. For example, Amex has turned cards like the Platinum card and the Business Platinum card into glorified coupon books with several statement credits across different merchants. However, many of these are small monthly amounts that require you to remember to use them each month. We all value time differently, so just make sure to factor that in to your thought process.

Credit Card Annual Fees: ToP Thoughts

Credit card annual fees should not scare anyone away from earning points and miles. This is especially true when opening a card with a good welcome offer. But at the same time, we should all keep track of our annual fees are reassess the utility of our cards every year when a fee posts.

Have any questions about whether your card's annual fee is worth it? Share your question in our Facebook group to learn more!