Amex Temporary Card Limits

One of the many things I love about American Express is the ability to get a card number you can use right away after approval. The fact that they mail you premium cards within a day or two is very nice (in my best Borat voice) too. I never realized it before but there are Amex temporary card limits. That is true even when the temporary credit card number comes from an account without pre-set spending limit. These are cards like the Amex Business Platinum and Amex Business Gold etc. I had always assumed the temporary card numbers would have the same rules and limits as their physical counterparts, but I was wrong.

Table of Contents

Toggle

Temporary Card Spending Limits

Earlier this week Brian put together an great guide on using credit cards to pay taxes. Wouldn't you know it, one of our ToP Facebook members decided to do just that. The reader wanted to take advantage of their hefty quarterly tax bill for their business and earn a welcome offer out of it. Might as well squeeze some lemonade out of those lemons! To do that they signed up for an Amex Business Platinum card and their quarterly payment would pretty much take care of the minimum spend requirement. After approval they received the temporary credit card number and went to work making a payment via one of the processors in Brian's article.

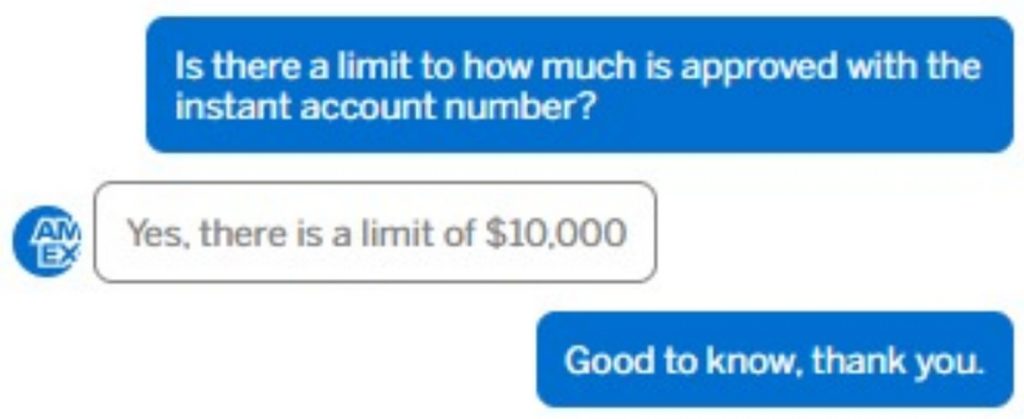

While trying to make the payment they kept getting an error that the payment wasn't approved. This wasn't a Chase card tax payment error either, where PayPal is a good workaround, it was something else. Our Facebook Group member decided to reach out via Amex chat and ask what is going on. After some back and forth they were informed that there are Amex temporary card limits of $10,000. Aha, the purchase denial finally made sense since their tax bill was above that amount.

The reader decided to try their luck with a $9800 payment. That amount, plus the fee attached, would be below the $10,000 temporary card credit limit, and it worked! The nice thing is you are allowed to make two payments per processor each tax period. That means the group member can put the rest of the bill on another card or wait for the physical one to come in the mail. Check out Brian's post for all of these great details.

From some comments in our Facebook Group it sounds like these limits can vary by person and it is worth checking with Amex to see what yours is before making your purchase.

Amex Temporary Card Limits: ToP Thoughts

I have added a note about this in Brian's guide on paying credit card with taxes too. I figured it was worth a separate post though in case anyone is planning on doing something similar to what the group member tried. It is always good to know you can get these temporary numbers on approval with Amex. But, it is also good to know the Amex temporary card limits in case it gums up your well laid plans.