We often discuss in our Facebook group about how transferable points are so much more valuable than miles or points with a single airline or hotel. This is because transferable points are the key to unlocking incredible value from credit card points. Transferable points are valuable for two main reasons: flexibility and redemption value. In this part 1 of this 2-part article, we explore flexibility: how it works and why it makes transferable points so valuable.

Table of Contents

Toggle**Note that some offers may have changed since the time of writing this article.

What Are Transferable Points?

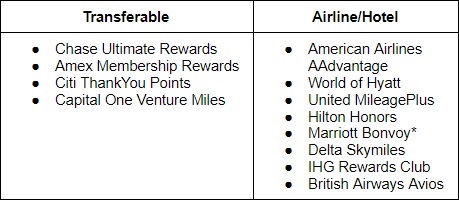

Points fall under one of two major categories: transferable or airline/hotel. Transferable points (also known as transferable points currencies) are points issued by banks through their own rewards programs. These include Chase Ultimate Rewards, Amex Membership Rewards, Citi ThankYou Points, and Capital One Venture Miles.

The following table lists a few examples of transferable and airline/hotel points and miles.

Transferable points are much more valuable than miles or points belonging to a single airline or hotel loyalty program. This is because transferable points offer incredible flexibility. For example, if you hold Chase Ultimate Rewards (URs), your points can be transferred to any of Chase's 14 travel partners. So instead of having points with a single airline or hotel, through Chase URs, you hold points with 11 airlines and 3 hotel chains! The same goes for Amex's 21 transfer partners, Citi's 17 transfer partners, and Capital One's 19 transfer partners.

Booking Award Flights with Transferable Points: An Example

Say you want to fly from New York City to Chicago. Delta, United, and American Airlines all have flights between these two cities and their multiple airports. If you only had Delta miles to use, you would be limited to searching for availability on Delta flights. The same goes for United and AA miles.

But if you had Chase URs to use, you could redeem those URs to fly on any three of these 3 airlines. Here's why:

- United is a Chase transfer partner, meaning you can transfer your Chase URs to United at a ratio of 1:1 (meaning 1,000 Chase UR = 1,000 United miles).

- British Airways and Iberia are Chase transfer partners and are members of Oneworld alliance. American Airlines is also a Oneworld member. That means you can use British Airways or Iberia miles to fly on American.

- Virgin Atlantic is a Chase transfer partner and a Delta partner. This means you can use Virgin Atlantic miles to fly on Delta.

With the above in mind, earning 60,000 points after spending $4,000 within 3 months from the Chase Sapphire Preferred's current welcome offer, means you can have over 60,000 combined across United, British Airways, or Virgin Atlantic. By relying on a transferable points currency like Chase URs, you gain access to multiple airlines and hotel partners.

Amex Membership Rewards (MRs) would also be helpful here. Like Chase, Amex also has British Airways, Iberia, and Virgin Atlantic as transfer partners. So that covers flights for American and Delta. On top of that, Delta is a direct transfer partner of Amex. As for United flights, Amex has Air Canada and Singapore Airlines among its partners. Both airlines are Star Alliance members, meaning you can use their miles to book flights on United.

Citi ThankYou Points (TYPs) would also be useful. Like Chase and Amex, Citi has Virgin Atlantic as a transfer partner, which covers Delta. For Star Alliance, Citi has Singapore Airlines and Turkish Airlines as transfer partners. And for AA, you can transfer TYPs to Qantas or Etihad, both of which include AA as a partner (like AA, Qantas is a Oneworld member). More importantly, Citi added AA as a direct transfer partner temporarily until November 13, 2021.

Other Ways to Use Transferable Points

In addition to transferring to dozens of travel partners, you can also use transferable points to book flights through a bank's travel portal, where points are typically worth anywhere from 1.1 to 1.5 cents per point. You can also cash out points where you literally redeem your points for cash. This method varies among banks, but Chase offers Pay Yourself Back, Amex lets you cash out your MRs if you hold the Charles Schwab Platinum card, and Citi offers multiple cash out methods.

Cashing out points will net you a lower cents per point value than if you transfer to partners. That said, cashing out can still be useful when there is no award availability. For example, if none of United, AA, or Delta in the NYC-Chicago example above had any award availability, you could purchase a seat with cash and cash out your points to cover that cost. This approach is especially useful when you have a specific flight you have to catch on a particular day and no other flight options work for you. Cashing out points to cover the cost of that flight is still better than paying cash out of pocket.

Final Thoughts

Transferable points are one of the most important keys to award travel. They offer several benefits, including flexibility to fly multiple airlines, which means you have better odds of finding availability. Miles or points from a specific airline or hotel can still be useful in very specific situations. But when given a choice, earning transferable points is usually the better option.

Stay tuned for the second part of this article, where we'll talk about redemption value and why that makes transferable points even more important.

Do you have questions about how to best redeem transferable points for your dream trip? Come join the discussion in our Facebook group to learn more!