Navigating Amex Family Rules

Last week I shared the newest family rule from American Express, when the new terms hit the Green card. I promised I would come back and create a guide for navigating these new application rules. I guess you could call it an Amex application decoder ring of sorts. There is now a best path we need to follow, otherwise you could miss out on hundreds of thousands of points. Because of that I wanted to put together a guide for navigating Amex family rules. This should help everyone keep track of what is going on and who is eligible for what.

Table of Contents

ToggleIMPORTANT:

These rules do not apply to business cards at this time, only personal cards. It is also discussed below, but people are missing this point.

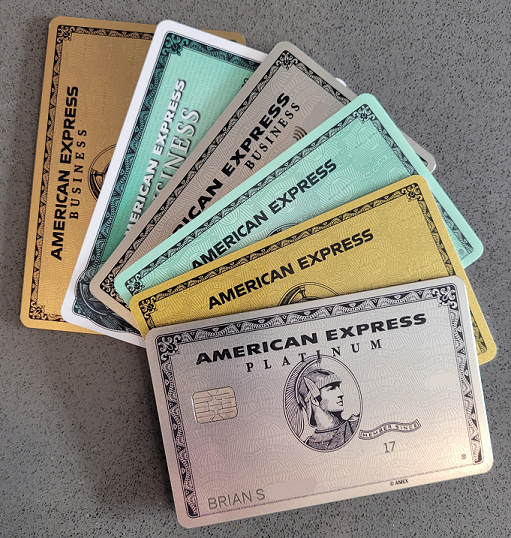

Premium Membership Rewards Earning Card Family Rule

Let's kick this thing off with the most important cards American Express has to offer, the premium Membership Rewards earning cards. These have also had the clunkiest rollout of all of the Amex family rules. That is because American Express rolled them out in waves instead of all at once like the other family rules.

The Preferred Application Path For Premium Membership Rewards Earning Cards:

- Amex Green Card

- Then Amex Gold Card

- Then One Of The Platinum Cards

- Vanilla / Original

- Charles Schwab

- Morgan Stanley

This path ensures that you can get the welcome offer for each variety. For the Platinum card you would need to choose which of the three you want to receive the welcome offer for. The vanilla / original version normally has the best offer, getting as high as 200K. Because of that I would originally sign up for that version for the welcome offer. If you decide to keep it long term then I would pivot to the Charles Schwab or Morgan Stanley version for extra perks. Which one of the two is best for you will depend on your needs. You won't receive a welcome offer for it, but if you time the application right you can kind of create your own.

What If You Already Have One, Or More, Of These Cards?

Navigating Amex family rules becomes a little bit tougher if you already have one, or more, of these cards. So let's go through the scenarios so that you know where you stand.

- Have / have had only Amex Green

- Can get Amex Gold

- Can get Amex Platinum

- Have / have had only Amex Gold

- Can NOT get Amex Green

- Can get Amex Platinum

- Have / have had only Amex Platinum (any version)

- Can NOT get Amex Green

- Can NOT get Amex Gold

- Have / have had Green & Gold

- Can get Amex Platinum

- Have / have had Green & Platinum

- Can NOT get Amex Gold

- Have / have had Gold & Platinum

- Can NOT get Amex Green

EveryDay Family Rule

Next up we have the other Membership Rewards earning cards, the Everyday family of cards. These two cards are similar versions of each other. One has no annual fee and the other one has a $95 annual, with improved earning.

The Preferred Application Path For EveryDay Cards:

- Amex EveryDay card (no fee version)

- Then Amex EveryDay Preferred card ($95 annual fee version)

This family rule is pretty straight forward. Start with the no fee card and then move on to the EveryDay Preferred card which has the $95 annual fee. Think of it as kind of like graduating to the next tier.

What If You Already Have One, Or More, Of These Cards?

- Have / have had only Amex EveryDay card

- Can get Amex EveryDay Preferred

- Have / have had EveryDay Preferred

- Can NOT get EveryDay card

Delta Airlines Family Card Rules

Next up for navigating Amex family rules we have American Express' most popular cards, at least for the general public, the Delta cards. These family rules work from the bottom up as well.

**I should note I am leaving the Delta Blue card out of this because it isn't worth getting. It could be a downgrade option but do not grab this card for a welcome offer.

The Preferred Application Path For Delta Cards:

- Delta Gold card

- Then Delta Platinum card

- The Delta Reserve card

What If You Already Have One, Or More, Of These Cards?

- Have / have had only Delta Gold card

- Can get Delta Platinum

- Can get Delta Reserve

- Have / have had only Delta Platinum card

- Can NOT get Delta Gold

- Can get Delta Reserve

- Have / have had only Delta Reserve card

- Can NOT get Delta Gold

- Can NOT get Delta Platinum

- Have / have had only Delta Gold & Delta Platinum card

- Can get Delta Reserve

- Have / have had only Delta Gold & Delta Reserve card

- Can NOT get Delta Platinum card

- Have / have had only Delta Platinum & Delta Reserve card

- Can NOT get Delta Gold

Marriott Bonvoy Family Card Rules

The Marriott Bonvoy family card rules make the toughest application rules in the business a little tougher. Mainly because they already had terribly confusing rules. This just adds another layer to all of that craziness.

The Preferred Application Path For Marriott Bonvoy Cards:

Remember to check all of the other rules before applying for any Marriott card. These also include the Marriott Bonvoy cards issued from other banks outside of American Express.

What If You Already Have One, Or More, Of These Cards?

- Have / have had only Marriott Bonvoy Bevy card

- Can get Marriott Bonvoy Brilliant

- Have / have had only Marriott Bonvoy Brilliant card

- Can NOT get Marriott Bonvoy Bevy

Blue Cash Family Card Rules

Last up on our navigating Amex family card rules guide is the Blue Cash family. This set up is similar to the EveryDay family above, but they earn cash back instead of Membership Rewards. The Blue Cash family has one card that is the no annual fee version and then a card with an annual fee that offers better earning rates. The terms also include the Cash Magnet and Morgan Stanley version of the Blue Cash Preferred card. This is a set up similar to the Platinum card above. Just like the Platinum varieties, you can get one or the other for the Blue Cash Preferred spot, not both.

I am going to leave the Cash Magnet out of the application path below because it isn't a card worth getting. I will put it into the eligibility list below in case you grabbed it before you knew better.

The Preferred Application Path For Blue Cash Family Cards:

- Blue Cash Everyday Card

- (Cash Magnet isn't worth getting in this spot – they are considered a one or the other option)

- Then Blue Cash Preferred / Morgan Stanley Blue Cash Preferred

I think almost everyone should just stick with the Blue Cash Preferred and ignore the Morgan Stanley version. It requires you having an additional account and the main difference is you get $100 after spending $15,000 on the card. Most won't want to chase that anyway.

What If You Already Have One, Or More, Of These Cards?

- Have / have had only Cash Magnet card

- Can NOT get Blue Cash Everyday

- Can get Blue Cash Preferred or Morgan Stanley Blue Cash Preferred

- Have / have had only Blue Cash Everyday card

- Can NOT get the Cash Magnet card

- Can get Blue Cash Preferred or Morgan Stanley Blue Cash Preferred

- Have / have had only Blue Cash Preferred

- Can NOT get the Cash Magnet card

- Can NOT get Blue Cash Everyday

- Can NOT get Morgan Stanley Blue Cash Preferred

- Have / have had only Morgan Stanley Blue Cash Preferred

- Can NOT get the Cash Magnet card

- Can NOT get Blue Cash Everyday

- Can NOT get Blue Cash Preferred

- Have / have had only Blue Cash Everyday and / or Cash Magnet card

- Can get Blue Cash Preferred / Morgan Stanley Blue Cash Preferred

- Have / have had only Blue Cash Preferred and / or Morgan Stanley Blue Cash Preferred

- Can NOT get the Cash Magnet card

- Can NOT get Blue Cash Everyday

- Can NOT get the other Blue Cash card version

Navigating Amex Family Rules: Is A Hilton Family Card Rule Coming?

The last domino we are waiting on to drop is the Hilton family of cards. Will they be next, or is Hilton blocking American Express from instituting family rules? No one knows at this point. If I were starting out on my Hilton card journey then I would start from the bottom up to ensure that I would be safe.

- Hilton Honors Card

- Then Hilton Surpass

- Then Hilton Aspire

This would likely keep you safe if a new rule does come out. If you already have one of these cards should you act quickly to grab a new one? That depends on your journey. If you are over 5/24, and are not planning on getting back under anytime soon, then jumping on a card could make sense. Especially if you have the Aspire currently, which would cost you access to the other two should they add a family rule. If I only had the Surpass card then I wouldn't worry about it since the no fee card is nothing great.

If I was under 5/24, and was still in need of grabbing some cards while under it, then I wouldn't change course. Just push forward and hope for the best in terms of a Hilton family rules.

What About Business Cards?

Currently you don't need to worry about navigating Amex family rules on business cards. If I was a betting man, I would lean towards them not rolling these rules out for business cards. The business and personal card teams seem to be run as separate entities within the same company. With all of the no lifetime language offers the business team sends out it doesn't appear they are looking to trim cardholders any time soon.

Navigating Amex Family Rules: ToP Thoughts

This guide on navigating Amex family rules should hopefully make things a bit more clear to you. Starting from the bottom up is the best way to approach American Express applications. If you have already grabbed a card or two then work the examples above and see what you are still eligible / not eligible for. There is a good chance that you are no longer eligible for an Amex card or two, but you can stop the bleeding now. Follow the American Express application path going forward and you should avoid missing any offers in the future.

Let me know if you have any questions on this over in the ToP Facebook Group.