Amex Pop Up Jail

How do you end up in Amex pop up jail? This is one of the most frequent questions we hear in our Facebook group. More importantly, how do you get out of it? We can solve half of that mystery, with the second part having varying data points. Unfortunately, there is no “get out of jail free” card here to help.

Table of Contents

ToggleWhat is Amex Pop Up Jail?

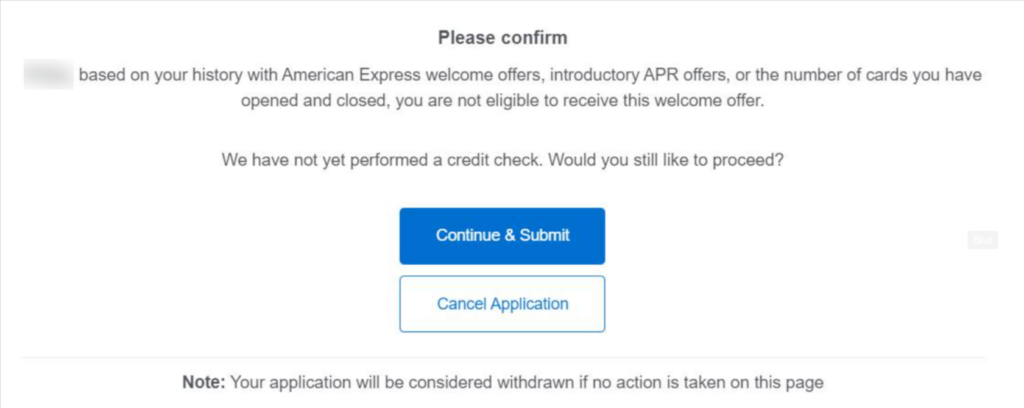

When you apply for an American Express card, many folks get a pop up window stating “you are not eligible to receive this welcome offer. We have not yet performed a credit check. Would you still like to proceed?” This is referred to as the “Amex pop up” or “Amex pop up jail.” This pop up occurs for a variety of reasons. The language on the pop often confuses applicants based on wording and oftentimes makes little or no sense why it would appear.

Why am I in Jail?

The most popular reason for the Amex pop up jail is that you have had that particular card before. American Express has a lifetime language rule for its cards. Absent a no lifetime language offer, you cannot open a card that you have, or have had, in your lifetime (known in credit circles as 7 years). In many cases, however, you get the pop up even though you've never had the card. Additionally, American Express has rules for personal cards in the order you must get them and receive the welcome offers. Again, this is only for the personal cards.

Another reason for pop up jail is American Express, and an internal algorithm, has identified you as not being a valuable customer. It could be that you are not spending enough on cards, you are grabbing the welcome offer and moving on, and/or you are opening and closing cards with regularity. The banks want you spending on their cards throughout the year, rather than spending up to the minimum spend requirement for a welcome offer and then never using the card again. Amex wants you as a valuable customer who is spending and utilizing credit with them if they are giving you more cards (and more welcome offers).

Finally, it is possible that if you are trying to use a spouses or friend referral link, you may get the pop up message. Sometimes using a affiliate link such as here at Travel On Point(s) or a direct link with American Express may bypass the pop up.

Breaking Out!

Once you're in Amex pop up jail, the first question is, “how do I get out of jail?” There is no easy answer and as we say in this hobby, your mileage may vary (YMMV). What works for one, may not work for another. Assuming you have not had the card before, and are otherwise qualified, consider these tips to get out of jail:

- Spend more on existing Amex cards- This is the most obvious one. If you do not use Amex cards for ongoing spend, consider doing so for several months. There is no magical number or formula for how much spend is required. It might require putting your monthly spend on a American Express card or two for several months and trying again.

- Application Links- Using a Player 2 link (spouse or friend) may be the issue. Try using an affiliate link, such as your favorite group/website link (which we appreciate). If that does not work, try and American Express direct link on americanexpress.com. Both of these have been known to help overcome the pop up.

- Business card- Applying for a business card is a popular way to get out of jail, as many people get the Amex pop up only on personal cards.

Amex Pop Up Jail: ToP Thoughts

Getting the pop up window can be frustrating. In this hobby there is a fine line of working on welcome offers and putting spend on your existing cards for category bonuses. Sometimes, you just have to slow down and focus on the task at hand. Putting spend on cards makes the credit card companies money and keeps you in favorable eyes with the banks. Remember, you want a long term relationship with the banks. Most importantly, this hobby is a marathon and not a sprint! Have you had the pop up and overcome it? Come over to our Facebook group and share your thoughts.