Amex Platinum Upgrade Offer

I was poking around my American Express account today and notice an Amex Platinum upgrade offer on my Amex Gold card. I was initially kind of excited since these offers sometimes come with an upgrade offer plus a spending bonus. This one was just an upgrade bonus and it wasn't quite high enough to make it a sure thing. I haven't decided if I will take it or not yet so I figured I would share my thought process with all of you and then come to my final conclusion in real time.

Table of Contents

ToggleRELATED: Our full review of the Amex Platinum Card.

Where Is The Amex Platinum Upgrade Offer Located?

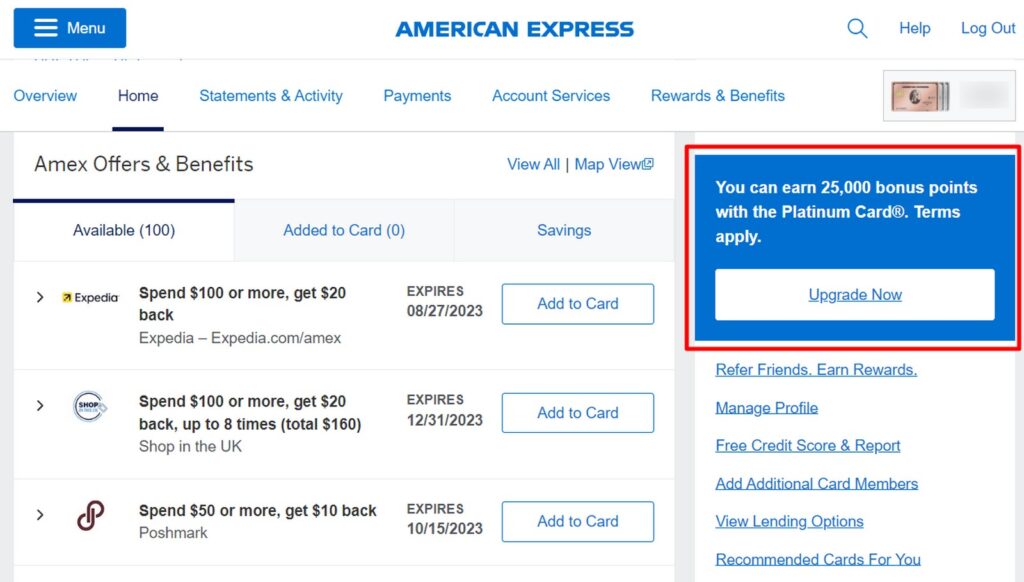

I saw the offer to upgrade my card when logged into my American Express account on a computer. It was about half down on the right hand side and it looked like this:

It could also be located in your Amex Offers section at the bottom of your account, on a scroller (think ad like thing) at the top or via email.

Can You Take An Upgrade Offer Within 12 Months Of A Retention Offer

The really studious of you may remember that I took a retention offer on this Amex Gold card just a few months ago. Okay, probably no one remembers that because I barely do. But, I did, so let's throw it into the mix. You may be thinking, hey, I thought you guys said Amex didn't like you messing with things within the first 12 months of getting a welcome offer or retention offer.

While that is true, their terms are always discussing downgrading or closing an account within the 12 month period. Which makes sense when you think about it, since that would be to take a lesser option. An upgrade, on the other hand, is going to a more expensive product, so my understanding is it should be fine. My buddy Benjy did this a few years back and Amex assured him that upgrading within 12 months of taking a retention offer was okay within their terms.

WARNING

If I accepted the offer then I would need to be locked in from 12 months of accepting the upgrade offer. That is from the upgrade date and not the annual fee date, which trips some people up. I will be charged a prorated annual fee on the Platinum card and then billed the full fee on it again on the anniversary date of my current Gold card. Did you follow those mental gymnastics? That means my “second” annual fee will hit around 9 months into this upgrade. If you couldn't already tell, 9 months is not 12 months so I can not close or downgrade the card when that “second” annual fee hits.

That sounds like I will get billed twice for this upgrade offer essentially. Not really though, I could downgrade back to the Amex Gold card after 3 additional months (12 in total) and get a prorated refund for the difference in annual fee. I could also downgrade to the Green Card if I wanted to recoup more of my annual fee. I would still be out the fee of the Amex Green or Amex Gold card if my plan was to close it there, but at least it isn't the full cost of the Amex Platinum card. This works best if you had planned to keep the Amex Gold (or Green) card long term anyway. then there is no real harm in just downgrading and moving forward with the Gold card back in your portfolio.

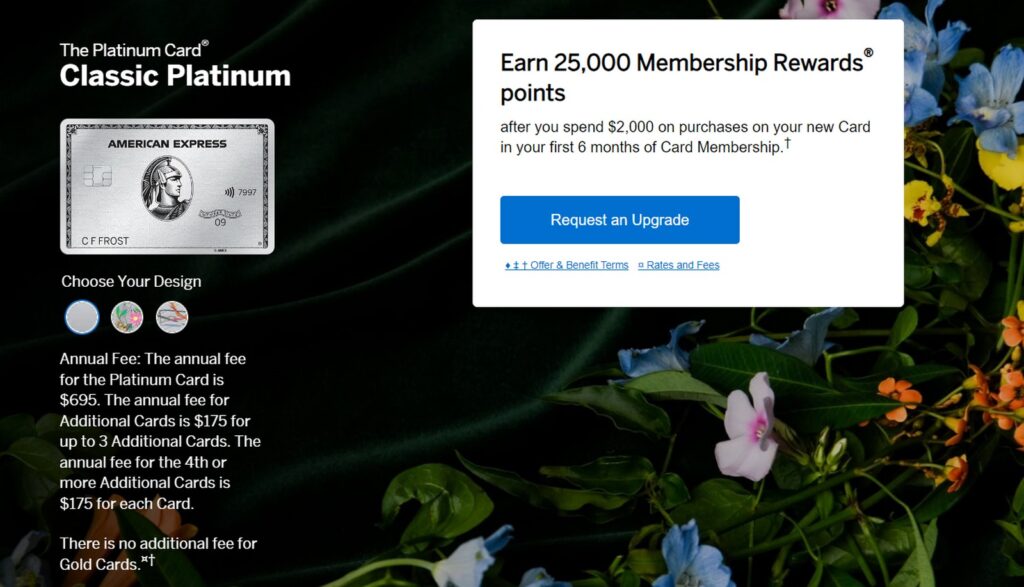

The American Express Platinum Card Upgrade Offer Details

The upgrade offer is for 25,000 Membership Rewards points after spending $2,000 within 6 months of accepting the upgrade. That is a solid offer on its face and the 6 months is a very generous timeline to do it.

That is before you consider the annual jumps from $250 on the Amex Gold card to $695 for the Amex Platinum card. Now those 25,000 points don't seem so good. I should also mention here that this should ONLY be considered if you have had the Platinum card before. If you haven't, then taking this measly offer would mean you are ineligible for the bonus in the future. That is because Amex cares if you have had the card before, not if you have received a welcome offer on the card like other issuers do.

I could offset the annual fee with some of the card perks, which would make the numbers line a bit more. One issue is that many of them overlap my Business Platinum card, like lounge access and hotel status. Let's take a look at each perk / credit individually and see if we can whittle this number down a bit.

Airline Incidental Credit – $200 Per Calendar Year

The perk doing most of the heavy lifting for this Amex Platinum upgrade offer calculation is the airline incidental credit, which is $200 per calendar year. The calendar year part is big because that means I would get it two times in the first 12 months. One now and then one again in 2024, as long as I used it before the 12 months were up. This credit isn't a true travel credit, which makes it a bit of a pain, but I can turn it into some Delta flights if I do some maneuvering. Having said that the pain of use, and having to use a card that only earns 1x on the purchase, devalues it some for me. Let's call it a 15% discount, which puts the total of the $400 in the first year worth $340 to me.

Value: $340

Uber Credits – $15 Per Month – $200 Per Year With Bonus In December

If I thought the airline credit was a pain here comes the monthly Uber credit. It is broken down by $15 per month and you get a $20 bonus in December. Half of the time I use this while traveling so I value those months at around 85%, since I can get Uber gift cards 10% – 20% off most of the time. The other 6 months I use it at UberEats. I value those months at 70% because of the same thing with gift cards and because UberEats prices are inflated versus ordering direct most of the time. Doing pick up helps a lot but there are still baked in costs. Let's split it down the middle and say $85 + $70 = $155 in value to me.

Value: $155

Saks Credit – $100 Per Year, $50 Every 6 Months

I was half joking about hating the other two credits, this one is the one I truly loathe. Who wants some socks from Saks for $50 for Christmas?! You can buy a gift card in store for the credit, and I have one nearby, but I hate even being in there. It has afforded me a shirt or two along the way and the occasional present. If nothing else, it helps rack up some Rakuten Membership Rewards I guess. I value this thing at 50%, and that may be too generous.

Value – $50

Entertainment Credits – $240 Per Year / $20 Per Month

These credits were added a few years ago and they will either be super useful to you or worth almost nothing. There doesn't seem to be a middle ground. If they worked for any streaming etc. it would be awesome, but it doesn't. It comes in $20 per month chunks for the following options:

- Peacock

- Audible

- SiriusXM

- Disney+

- The Disney Bundle, ESPN+, Hulu

- The New York Times

I get Hulu through my cell plan and that is the one thing I would actually pay for. We did have Peacock the last time we had a Platinum card, and my wife likes it, but I think it is worth like $3 a month. With the recent price increases we canceled Disney+ a few months back and haven't missed it much. I would probably pay $5 a month for it. I could cover the cost of both with the credit so let's say this is worth $8 a month to me. For others it could be worth the full $20, it just depends on your situation.

Value – $96

Other Stuff – Practically Worthless

All of the other perks may be worth something to you individually but they are worth almost nothing to me. Some are already covered by other cards, like the CLEAR or TSA credit or lounge access. Others are just pointless to me, welcome to the party the Equinox and SoulCycle credits.

The FHR Hotel credit, at $200 a year, was fun sometimes, but I ended up finding it to be more frustrating then it was worth. I rarely pay cash for a hotel and when I do they never have one in the program where I am going. Or, it is like $700 a night and doesn't make sense for me to use the credit.

I try not to use credits to get a discount on something I would never buy anyway, I try to use them to get me something free. It has become really hard to find a FHR hotel for $200 or less these days. That is unless you want to stay in Vegas mid week in December.

Value – A Big Fat $0

Amex Platinum Upgrade Offer: Adding It All Up

The total amount comes to $641 in value from the world's most expensive coupon book, aka the Amex Platinum. That leaves me paying $54 essentially for 25,000 Membership Rewards points, which is a deal I would take every day and twice on Sunday. That doesn't account for all of the hoops I need to jump through to get there and that needs to be accounted for as well. I really hate wrestling the coupon book to get maximum value if I am being honest, and 25K in points is right on the edge of if it is worth the hassle to me.

Wait, What About The Amex Gold Spending Categories?

One thing we didn't discuss is that I would be losing the Amex Gold's far superior earning categories. Most notable is getting 4x on grocery purchases on up to $25,000 per calendar year. That is among the best there is for your grocery spend. I can do better on restaurant spend and airfare etc. so let's focus on that. If I hadn't maximized my grocery spend on the card, and didn't have a viable alternative for that spend, this could be the breaking point on this decision. Since the cap on grocery is $25,000 per calendar year we could potentially be walking away from 100,000 points for 25,000 points (assuming it is maximized). That is something to consider, as it is the other way if you have no meaningful grocery spend then this could be an easy decision.

For myself, I have hit most of the spending cap in the category already this year with around $2,500 left. I may hold a bit and finish up some of that spend and then take the offer. I would have to hope it doesn't vanish in that time frame, which is always a possibility.

Amex Platinum Upgrade Offer: ToP Thoughts

So, which way am I leaning on this Amex Platinum upgrade offer? I am still split right down the middle. I think I am going to kick the can down the road a bit and let the universe decide. I'll keep the Amex Gold for a few more weeks and try to maximize my grocery spend during that period and if the offer is still showing I'll grab it then. If it is gone, then it wasn't meant to be I guess.

Hopefully you found this post helpful. It was a look into my twisted mind and gives you an idea of how I approach offers like these. You can do something similar, or completely different, when you come across something similar in your miles and points journey. Let me know which way you would go with the offer over in the ToP Facebook Group.