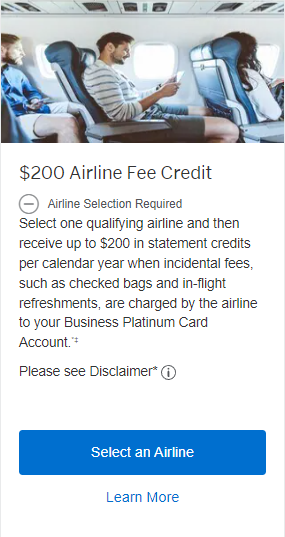

Amex Airline Fee Credit

The Amex airline fee credit is one of the most popular benefits from American Express's premium credit cards that can help offset the cards' high annual fees. This perk is intended to cover airline incidental charges, such as checked bags or in-flight refreshments. But, as with many things in the points & miles world, folks have found other (and better) uses for these credits.

Table of Contents

ToggleThis ToP Guide covers everything you need to know about the Amex airline incidental credits. That includes which cards offer this benefit, which airlines you can use it with, how the credit works, and what kinds of other purchases can trigger the credit, depending on the airline.

Updated 3/3/24

Which Credit Cards Offer An Airline Fee Credit?

Currently, these Amex cards offer an annual airline incidentals credit:

- Platinum Card from American Express ($695 annual fee)

- Business Platinum Card from American Express ($695 annual fee)

The Amex Platinum and the Business Platinum airline fee credits cover up to $200 each each calendar year. Since it is based on calendar year, it does allow some to triple dip the credit on new accounts. The Hilton Aspire card used to be included as a card with an airline incidental credit but they changed the set up for the card in 2024.

Which Airlines Can You Select For Your American Express Incidental Credit?

Amex offers 8 airlines to choose from for using your fee credit:

- United Airlines

- Hawaiian Airlines

- Spirit Airlines

- American Airlines

- JetBlue Airways

- Southwest Airlines

- Delta Air Lines

- Alaska Airlines

To select your airline, just click on the Benefits tab on Amex's website and find the airline fee credit. Click on that benefit and the website will prompt you to make your airline choice.

Once you have selected an airline, you cannot change it for the rest of the calendar year. You can change your airline once per year in January. In the past, Amex has allowed folks to change their airline later in the year as long as none of the credits had been used so far in the year. This is by no means guaranteed and very much YMMV. If you do not change your airline in January, then your selected airline remains the same as from the previous year with no action required on your part. Here is some more detail on how to change Amex airline fee credit selection in year 2.

If you have multiple cards that offer the airline fee credit, you can select a different airline for each card.

Tips For Selecting Your Airline

You shouldn't take your selection lightly, since you changing it later can be tough, or not possible at all. One approach is to select whatever airline you fly the most. This might seem like an obvious choice, but it might not be the most helpful.

If you have status with that airline, you'll likely have free checked bags, preferred seating, and other perks that you won't need to pay cash for. The same could be said if you carry an airline credit card with perks. So what would you use the Amex airline fee credit for with that airline?

That's why some folks prefer to select an airline they fly less often. So that in the rare occasion that you have to fly that different airline, you can get such things as checked bags and preferred seating for free without relying on status.

Yet another approach is to select the airline with which the credit is easiest to use. As we discuss below, different purchases with different airlines can trigger the credit even despite not falling within Amex's terms & conditions.

There is no right or wrong approach. Just give it some thought before making your selection.

Lastly, keep in mind that if you're selecting an airline with the Business Platinum card, that airline will also be your airline of choice for the 35% points rebate benefit for economy flights. (All business and first class flights qualify for the 35% points rebate regardless of your selected airline.)

How Does The Airline Fee Credit Work?

The airline fee credit itself is quite simple. Once you've selected your airline, any qualifying purchase will trigger the credit. The credit works with purchases by the primary cardholder or any authorized user or, in the case of the Business Platinum card, employee cards.

To trigger the airline fee credit, the purchase must be processed by the airline. For example, in-flight Wi-Fi generally does not trigger the credit because they are not charged by the airline directly.

The terms & conditions make it clear that purchases charged before you select your airline are not eligible for the fee credit.

According to the terms & conditions, statement credits take between 6 and 8 weeks to post. But in practice, they often post a lot faster; sometimes, in a matter of days. That said, they can take a couple of weeks at times.

What Purchases Does The Amex Airline Fee Credit Cover?

According to the terms & conditions, the following purchases are not considered incidental fees and should not work:

“airline tickets, upgrades, mileage points purchases, mileage points transfer fees, gift cards, duty free purchases, and award tickets.”

- Airline tickets and airfare

- Upgrades

- Mileage points purchases

- Mileage points transfer fees

- Gift cards,

- Duty free purchases

- Award tickets

And these are the types of charges that should work as they are usually charged as incidentals by the airline:

- Checked bags (including overweight/oversize fees)

- In-flight purchases charged by the airline (food, beverages, etc.)

- Seat assignment

- Pet fees

- Lounge day passes and lounge membership

But in practice, this varies widely depending on the airline. Before we get into how you can maximize the credit with each airline, remember this: if you purchase something listed above and it doesn't trigger the credit, do not call Amex. That purchase isn't supposed to work in the first place, so calling Amex will do you no good. The terms are pretty clear on what doesn't shouldn't count.

Below is what we have seen work with each airline. There are additional data points here and there that we did not include either because those examples were too old, too sporadic, or just not entirely reliable.

Alaska Airlines (AS)

Alaska is among the tougher airlines to use the Amex airline fee credit. Uses are mostly limited to what you would expect:

- Award redeposit fees

- Checked bags

- Seat assignment

- Pet fees

- Lounge passes

- In-flight purchases

- Link to most recent data points on what works here

American Airlines (AA)

American is another tough airline to use your credits. Here is what we have seen work for American:

- Checked bags

- Seat assignment

- Pet fees

- Admirals Club day passes and membership (including premium food and drink purchases at Admirals Clubs)

- In-flight purchases

- Mileage multiplier when booking a cash flight

- Link to most recent data points on what works

We have also seen mixed data points about Main Cabin Extra seating purchased online. In this regard, we note that Amex's terms & conditions state that “upgrades” are not eligible for statement credits.

JetBlue Airways (B6)

JetBlue is a pretty easy option. Here is what we have seen work with JetBlue:

- Fares under $100

- Even More Space seating

- Checked bags

- Seat assignment

- Pet fees

- In-flight purchases

- Link to most recent data points

Fares under $100 on JetBlue typically will trigger the credit, just like Southwest (see below), even though it codes as airfare rather than an incidental charge.

Even More Space seating on JetBlue also usually trigger the credit, even though Amex's terms & conditions exclude upgrades.

Delta Air Lines (DL)

Delta is another pretty easy alternative. Here is what works with Delta:

- Paying a balance under $250 when combining airfare purchase with an existing gift card or flight credit

- Companion ticket taxes

- Checked bags

- Seat assignment

- Pet fees

- Sky Club access

- In-flight purchases

- Link to most recent data points on what still works

The most common option with Delta is to use an existing gift card or flight credit and pay the balance with your Amex card to trigger the credit. The balance paid has to be under $250 for this to work. When the purchase is processed, Delta adds an “additional collection” to the transaction instead of showing a fare booking like regular airfare purchases. Mark was able to confirm that this works when booking over the phone and paying in part with a gift card. That is true even if one of the passenger's tickets are booked with Delta credit in full.

Hawaiian Airlines (HA)

Hawaiian offers very limited uses. Here is what we have seen work:

- Airfare under $50

- Checked bags

- Seat assignment

- Pet fees

- In-flight purchases

- Link to most recent data points

We have seen reports of airfare under $50 working. But unless you're planning on taking some intra-Hawaii flights, this is unlikely to be helpful in the long run.

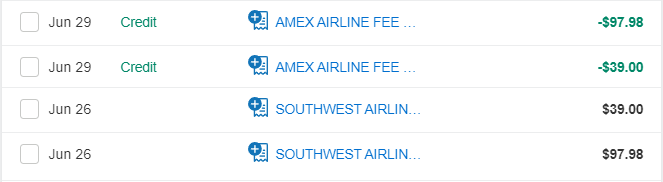

Southwest Airlines (WN)

Southwest is one of the easiest airlines to trigger the credit. The usual things that would trigger the credit include overweight bag fees, Early Bird Check In, Upgraded Boarding, and pet fees.

Here is what we know works with Southwest:

- Purchases under $100 each (including airfare)

- Overweight bag fees

- Early Bird Check In

- Upgraded Boarding

- Pet fees

- In-flight purchases

- Link to most recent data points on what still works

If you find a cheap flight for under $100, you can charge it to your card directly (assuming you selected Southwest as your airline) and you'll receive a statement credit. If you want to book a flight that costs more than $100, you can first book a couple of flights for under $100 each, and then cancel both of them for Southwest travel funds. Then, book the flight you want and pay for it with those travel funds.

We have a seen some airfare charges slightly over $100 also triggering the credit. However, I recently tested this with a flight that cost $112 and it did not trigger the credit.

You can also use the airline fee credit for award bookings with Southwest. Southwest charges $5.60 in fees for domestic award bookings. Fees for international flights are a bit higher. These fees will also trigger the fee credit.

If you have the Southwest Companion Pass, then selecting Southwest as your airline is an excellent option.

Spirit Airlines (NK)

Spirit charges a fee for just about anything other than the basic fare, making it a decent option as an airline selection. Here is what typically works with Spirit:

- Spirit Saver$ Club membership

- Checked bags and carry-on bags

- Seat assignment

- Pet fees

- In-flight purchases

- Link to most recent data points on what still works here.

Spirit's Saver$ Club offers access to lower fares and discounted prices on bags, seats, and other perks. Essentially, using the airline fee credit to cover a Saver$ Club membership is an indirect way to use the credit towards airfare, since Saver$ Club will save you cash on your Spirit flights.

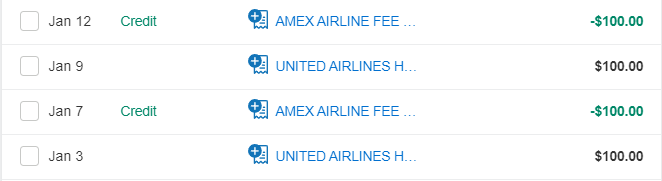

United Airlines (UA)

United Airlines is another easy option. Officially, the fee credit applies to such things as checked bags and in-flight refreshments. But the United TravelBank is by far the easiest way to essentially turn your credits virtually into cash.

Here is what we know works for United:

- United TravelBank deposits of up to $50 or $100 each

- Checked bags

- Seat assignment

- Pet fees

- United Club Lounge access

- In-flight purchases

- Link to most recent data points on what still works

United TravelBank lets you add money to your United account and then use those funds as payment on United's website or on their mobile app. You can use TravelBank Cash alone or in combination with other forms of payment to pay for flights on United.

TravelBank deposits of up $50 or $100 are known to trigger the airline fee credit. It's as simple as that.

In the past, United TravelBank has been unavailable for brief periods of time. This is a good reminder that none of these methods are ever guaranteed to stick around indefinitely. Best to avoid procrastinating with your airline fee credit!

Amex Airline Fee Credit: ToP Thoughts

Amex's airline fee credit can be almost as good as cash when you think outside the box of how to use it. As with many things in points & miles, what works today may not work tomorrow. And if you're unsure whether something will trigger the credit, we encourage you to be the data point you want to see and try it for yourself!

What is your favorite airline for redeeming your airline fee credits? Come share your thoughts in our Facebook group!