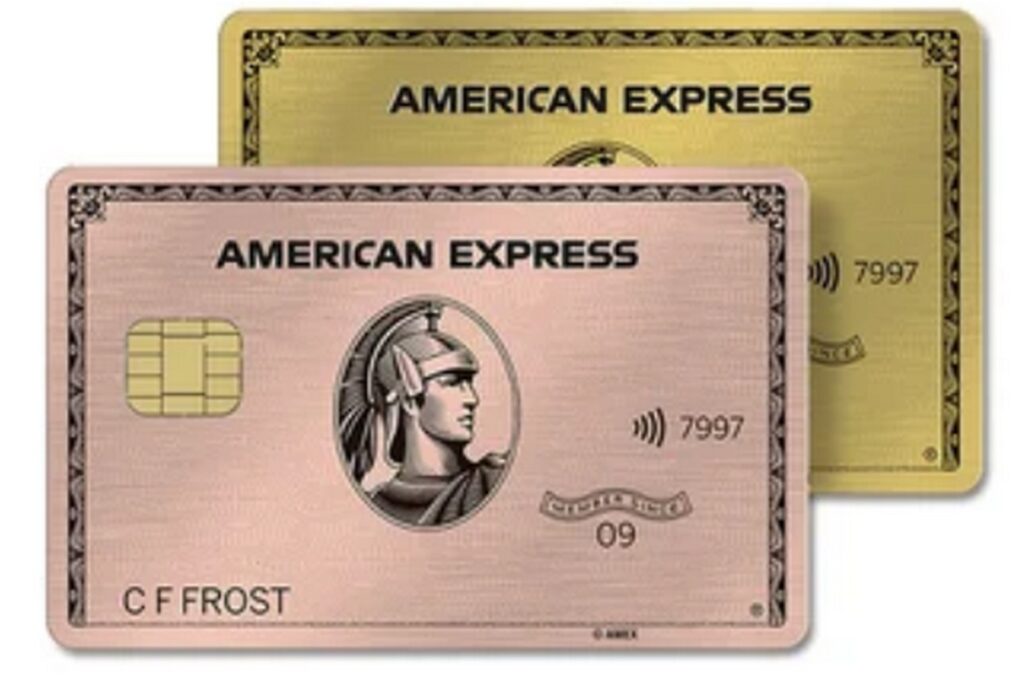

American Express® Gold Card Review

The American Express® Gold Card is one of our favorite cards at ToP. The card is one of the best cards for spending at restaurants and supermarkets as it earns 4x Membership Rewards® points per dollar. This makes the Gold card a permanent fixture on many award travelers' wallets. It is pretty to look at too! In our American Express® Gold Card review, we will look at the welcome offer, card benefits, earning structure, and share our overall thoughts on this workhorse.

Table of Contents

ToggleCurrent Welcome Offer

Amex usually has many different welcome offers for its cards at any given time. The current public welcome offer for the American Express® Gold Card is the following:

- Earn 60,000 Membership Rewards® points after $6,000 spend on eligible purchases in the first 6 months. Terms apply.

- The card has a $325 annual fee. See Rates and Fees.

**There may be better welcome offers available to select cardmembers.

Amex Application Rules

If you choose to apply, remember that Amex typically will not approve you for more than two Amex credit cards during a 90-day period. They also have a 10 card limit on the colored Membership Rewards earning cards (of which this is one). This includes personal and business cards. This is separate from the 5 card limit on credit cards.

Due to the new family rule, you should follow our application guidance found here. Order of Amex Membership Rewards applications now matters and you need to strategize what card to open and when! You are now ineligible for the welcome offer on this card if you have, or have had, any variety of the same card, the (now defunct) Premier Rewards Gold or any variety of the Amex Platinum.

Amex also has a once per lifetime welcome offer rule on each card. This is more like every 5 – 7 years in reality though, and not actually your lifetime. That timeline is based off of when you last held a card, not when you last earned a welcome offer on the product though. If you are ineligible for the welcome offer for any reason American Express will usually let you know that with a pop-up before the application is processed. You can cancel the application at this time with no hard pull.

American Express® Gold Card Review: Earning Structure

The American Express® Gold Card has the following earning structure:

- 4x per dollar in the following categories

- 4x at Restaurants worldwide on up to $50,000 in spend per year

- Then 1x for the rest of the year after that.

- 4x at U.S. supermarkets on up to $25,000 per calendar year in purchases

- Then 1x for the rest of the year after that.

- 4x at Restaurants worldwide on up to $50,000 in spend per year

- 2x points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com.

- 3x on travel booked directly with airlines and via the American Express® travel portal.

- 1x on all other eligible purchases.

Amex Gold Card Benefits

The American Express® Gold Card comes with many benefits that essentially pay for the card's annual fee.

- Up to $120 annually of Uber cash distributed as $10 monthly.

- You need to add your Gold card to your Uber profile as a payment option to activate the credit.

- Effective 11/8/2024, an Amex Card must be selected as the payment method for your Uber or Uber Eats transaction to redeem the Amex Uber Cash benefit.

- To receive this benefit you must have downloaded the latest version of the Uber App and your eligible American Express Gold Card must be a method of payment on your Uber account. The Amex Benefit may only be used in the United States.

- Up to $84 Dunkin' Credit distributed as $7 monthly (U.S. locations only).

- Enrollment required.

- Each month you can earn up to $7 in statement credits when Dunkin' charges are billed to your card.

- Up to $100 Resy credit each calendar year distributed as $50 in credits semi-annually

- Enrollment required. You must pay with the Amex Gold card to dine at U.S. Resy restaurants or make other eligible Resy purchases.

- Up to $120 annually of food credit distributed as $10 statement credits monthly (enrollment required) when you pay with the American Express® Gold Card at

- Grubhub

- The Cheesecake Factory

- Goldbelly

- Wine.com

- Five Guys

- No foreign transaction fees. See Rates and Fees.

ToP Analysis

The American Express® Gold Card deserves a spot in most wallets. The card's earning structure makes it a true workhorse of a card. Earning 4x Membership Rewards at U.S. supermarkets is huge, despite the cap at $25,000 per calendar year. No other card offers these many points per dollar at supermarkets regularly. In addition, 4x at restaurants worldwide (up to $50,000 per year) is also great.

Based on the new Amex “family rule” for this card, applications for Amex Membership Rewards cards are very strategic. We discuss the preferred breakdown and order here.

In addition to great earning, the Amex Gold card still offers a few decent benefits. Monthly Uber cash is pretty easy to use. Once you add your card to your Uber wallet, the benefit kicks in automatically at the start of every month. Meanwhile, the $10 monthly food credit depends more on your eating habits, so we don't consider it as easy as the Uber cash.

The American Express® Gold Card does provide some travel coverage. However, both the Chase Sapphire Preferred® Card and the Chase Sapphire Reserve® offer more comprehensive trip protection benefits. But in a pinch, the Gold is not a bad option for travel protection, either.

American Express® Gold Card Review: ToP Thoughts

The American Express® Gold Card is a workhorse for spending on all things food-related: 4x Membership Rewards® points at restaurants worldwide and U.S. supermarkets. Despite having a $325 annual fee, you can easily utilize the benefits to pay for the card. Combine this with the opportunity to earn over 100,000 Membership Rewards annually at U.S. supermarkets, on ToP of the welcome offer, and the Gold deserves a permanent place in many people's wallets.

What do you think of the American Express® Gold Card? Come share your thoughts in our Facebook group!