Las Vegas Trip Report and Some Concerning Observations

Rick visits Las Vegas once again and shares his observations with you. He found some concerning observations at more than one property.

Rick visits Las Vegas once again and shares his observations with you. He found some concerning observations at more than one property.

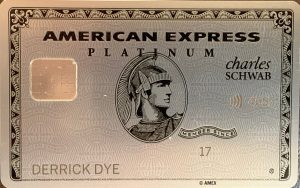

Now might be the time to add an American Express Platinum Card to your wallet, specifically a Charles Schwab Platinum. Let me explain why I added this card to my wallet back in late May and why you may want to do the same.

Chase’s new “Pay Yourself Back” promotion remains available for Chase Sapphire Reserve® and Chase Sapphire Preferred® Card cardholders for another 3 months. During this time, it is worth it to scrutinize your redemption activity and determine how you typically use your Ultimate Rewards.

I am always excited about free money and that is no different with the Pei app. You’re earning cash-back for merchants that you were planning purchases anyway, usually at a 1% return. It’s nice to cash in that $25 a few times a year or even once a year. Combined with other apps, you can easily earn hundreds of dollars a year!!!

Chase had long been at the top of the food chain when it came to desirable credit card products and having a valuable transferable points currency. Ultimate Rewards became known for their ease of use, wealth of transfer partners, and versatility.

It’s really nice to see Chase make changes to the Sapphire cards to make each card more competitive during this time of staying at home and social distancing. While we’re not traveling, you can decide whether you want to use your Ultimate Rewards as cash or whether you want to stockpile them for future travel. Either way, you get tremendous value from these cards. As always, come on over to our Facebook group to discuss these changes in more detail.

AA is one of two (the other being Alaska Airlines) airlines in the USA that has an international award chart but does not partner with Amex, Capital One, Chase or Citi for points transfers to its mileage program.

Business spend is anything that you need to spend for your business. This can range from food to office supplies to cell phones to toys to travel. For the purposes of this article, we focus on what most consider “typical” business spend and how to maximize flexible currencies, rather than any co-branded cards.

No matter where you live, what you do, or how you commute to/from the places you regularly frequent, we all

Once you have your first travel rewards credit card, a Chase Sapphire Preferred or something similar, the focus typically switches to how to earn more points & miles. Once of the most frequently asked questions we hear is “how do you earn points and miles after you’ve signed up for all the cards?”

We promise to keep things short, sweet, and packed with awesome insights!