This post is not regularly updated or maintained. To see all relevant credit card offers, see our Credit Cards page.

Table of Contents

ToggleChase had long been at the top of the food chain when it came to desirable credit card products and having a valuable transferable points currency. Ultimate Rewards became known for their ease of use, wealth of transfer partners, and versatility. But over the last year or so, Chase may have been resting on its laurels. Today we’ll assess the state of Chase’s Ultimate Rewards-earning credit cards.

At the Top of the World

The Chase Sapphire Preferred card had been one of the best credit cards for points and miles enthusiasts. When the CSP is paired with the Chase Freedom [Note: This product is no longer available for new applications] and Chase Freedom Unlimited, they form what’s known as the Chase Trifecta, a formidable avenue for earning Ultimate Rewards points. For years folks have bent over backwards to comply with Chase’s 5/24 rule to reap the benefits of Chase’s several credit cards. [See our updated article on the “new” Chase Trifecta as of September 2020 here]

In August 2016, Chase rocked the points and miles world by introducing the Chase Sapphire Reserve. Everything about the CSR was a hit: the sleek design, the 100,000-point welcome bonus, the 3x earning on travel and dining, and the many benefits (including Priority Pass membership). The CSR’s astounding success extended beyond award travelers and reached average consumers. Despite a higher annual fee than the CSP, the CSR was so successful that Chase ran out of the metal used to make the CSR cards.

We’ve seen little change to Chase’s credit cards and the Ultimate Rewards program since the launch of the CSR. In fact, Chase lost Korean Air Skypass as a transfer partner in 2018, though it did add Emirates Skywards in 2019.

How the Competition Caught Up

Chase’s main competitors–American Express and Citi–have done plenty to respond to Chase’s successes.

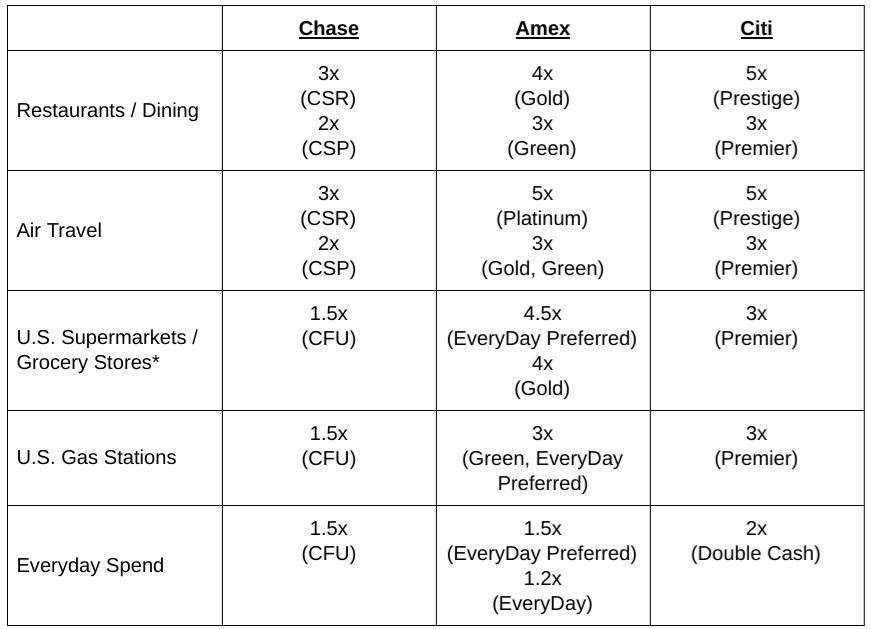

After the CSR’s introduction in 2016, Amex revamped its Gold Card in 2018 to much fanfare, including with a Rose Gold design. The Amex Gold Card now earns 4 Membership Rewards points per dollar spent at restaurants and U.S. supermarkets, and 3x points per dollar spent on flights booked directly with airlines and amextravel.com.

Amex has other credit cards in its portfolio that compete with Chase’s, including the Amex Platinum (5x points on flights booked directly through airlines or via Amex Travel) and the Green Card (3x points for travel and restaurants worldwide).

Citi, meanwhile, has upped the ante on the earning side with the Citi Prestige now earning 5x ThankYou points per dollar spent on air travel and restaurants, and 3x points per dollar spent on hotels and cruise lines. Also, Citi has announced upcoming changes to the Citi Premier card, which, as of August 23, 2020, the card will earn 3x points per dollar spent at restaurants, supermarkets, air travel and hotels, and gas stations.

As for travel partners, Citi has added Turkish Airlines Miles & Smiles and Emirates Skywards, while Amex has added Avianca LifeMiles and Qantas Frequent Flyer.

The Current State of Affairs

As a result of changes from Amex and Citi to their cards over the last couple of years, Chase does not have a single personal card as the top earner for any category. More importantly, Chase cards are no longer the top dog among the premium cards, mid-tier cards, and no-annual fee cards.

Premium Cards

As mentioned above, the CSR has lost a lot of ground since its debut. The card is no longer the top points earner for dining or travel. What’s interesting here is that the CSR is also outmatched by the Amex Gold card, which has a much lower annual fee. And the CSR’s 3x earning ties cards with much lower annual fees like the Amex Green card and the Citi Premier.

The CSR still offers plenty of other benefits that make the card worth having, but on the earning side, the king has long since been dethroned.

Mid-Tier Cards

Like the CSR, the CSP has lost a lot of ground to competitors on the earning side. As mentioned above, the Amex Gold and Green cards earn more on restaurants and air travel than the CSP does. Likewise, the Citi Premier trumps the CSP on those two categories while also offering additional bonus categories such as gas stations and grocery stores.

As with its big brother, the CSP’s additional benefits make this card a keeper for many people, but like the CSR, it is easily out-earned on the points side.

No-Annual Fee Cards

This tier is actually where Chase still competes strongly. The Chase Freedom card’s rotating quarterly categories offers cardholders the opportunity to earn 5x points on many different categories throughout the year. Chase also offers the Chase Freedom Unlimited, which earns 1.5x points on every purchase. Both cards are actually cash back cards, but when paired with a UR-earning card like the CSP or the CSR, the cashback can be converted to Ultimate Rewards points.

The Amex EveryDay card offers 2x points per dollar spent at U.S. supermarkets (up to $6,000 per year) and 20% extra points per billing period when the card is used at least 20 times during that period. Meanwhile, the Citi Double Cash earns 2% cash back on all purchases. Like the Chase Freedom and Freedom Unlimited, cashback earned through the Citi Double Cash can be converted into ThankYou points if you hold the Citi Premier or the Citi Prestige.

How Easy Is it to Earn Points Across Chase, Amex, and Citi?

The table below shows what each of Chase, Amex, and Citi have to offer for maximizing points-earning in some of the more common categories of spend. Two things should jump out here: Chase cards are not the top earner in any category, and Chase offers fewer bonus categories than either Amex or Citi (unless you count the CFU’s 1.5x).

* For May and June of 2020, Chase has offered bonus spend at grocery stores. The CSP is earning 3x and the CSR is earning 5x on up to $1,500 in spend per month at grocery stores. Here’s hoping Chase makes this change permanent.

Final Thoughts

Chase Ultimate Rewards remain incredibly valuable, but Amex Membership Rewards and Citi ThankYou points have become much easier to earn. Ever since the CSR’s debut in 2016, Chase appears to have rested on its laurels and is now behind its competitors in offering credit cards with significant points-earning potential.

None of this means that Chase cards are no longer worth having. On the contrary, some Chase cards have great benefits unmatched by competitors and Ultimate Rewards should be part of every award traveler’s inventory. But if Chase wants consumers to swipe their Chase cards more often, they have to up their game.

Join our Facebook group to learn how to maximize the benefits of your Chase cards.