American Airlines is the world's largest airline, in terms of fleet size and passengers flown each year. Its flock of loyal fliers is almost as large, but is seemingly in decline over the last few years. AA is one of two (the other being Alaska Airlines) airlines in the USA that has an international award chart but does not partner with Amex, Capital One, Chase or Citi for points transfers to its mileage program. With this limitation, we look at the best ways to accumulate American Airlines AAdvantage miles.

Table of Contents

ToggleAmerican AAdvantage cards

Despite not having a credit card company as a transfer partner, American does stand out from the crowd by partnering with two different banks to offer AAdvantage credit cards: Barclays and Citi. There are 6 available cards:

- Barclays AAdvantage Aviator Red ($99 Annual Fee)

- Barclays AAdvantage Aviator Business ($95 Annual Fee)

- Citi AAdvantage Platinum Select ($99 Annual Fee, waived for the first 12 months)

- Citi AAdvantage Executive ($450 Annual Fee)

- Citi AAdvantage MileUp (No Annual Fee)

- CitiBusiness AAdvantage Platinum ($99 Annual Fee, waived for the first 12 months)

For personal cards, all cards earn 2x on American Airlines purchases. The Citi MileUp card earns 2x at grocery stores and the Citi Executive card earns 2x at restaurants and gas stations. Otherwise, all personal cards earn 1x on all purchases.

For business cards, both cards earn 2x on American Airlines purchases. The Barclays AAdvantage Aviator Business earns 2x at office supply stores, telecom merchants, and car rental merchants, and 1x everywhere else. The CitiBusiness AAdvantage Platinum earns 2x at telecommunications companies, cable & satellite providers, car rental merchants, and gas stations, and 1x everywhere else.

Other Options

American Airlines is not a transfer partner of any of the main transferable currencies (American Express Membership Rewards, Capital One, Chase Ultimate Rewards, Citi ThankYou Points). However, you can transfer Marriott Bonvoy points to the AAdvantage program at a 3 to 1 ratio. If you transfer in increments of 60,000, you receive a 5,000 point bonus, for a total of 25,000 AA miles. Currently, there are 4 available Marriott Bonvoy cards:

- Marriott Bonvoy Brilliant® American Express® card ($450 Annual Fee)

- Marriott Bonvoy Business® American Express® card ($125 Annual Fee)

- Chase Marriott Bonvoy Bold (No Annual Fee)

- Chase Marriott Bonvoy Boundless ($95 Annual Fee)

For personal cards, the Amex Bonvoy Brilliant earns 6x at Marriott properties, 3x at U.S. restaurants and for flights booked directly with the airline and 2x on all other purchases. The Chase Bonvoy Bold earns 3x at Marriott properties, 2x on all other travel, and 1x everywhere else. The Chase Bonvoy Boundless earns 6x at Marriott properties and 2x everywhere else.

For the Amex Bonvoy Business card, it earns 6x at Marriott properties, 4x at U.S. Restaurants, at U.S. gas stations, for wireless telephone services directly with U.S. service providers and for U.S. shipping, and 2x everywhere else.

Remember, for all Marriott earnings, these points convert to AAdvantage at a 3 to 1 ratio, with a 5,000 point bonus when transferring in increments of 60,000 miles.

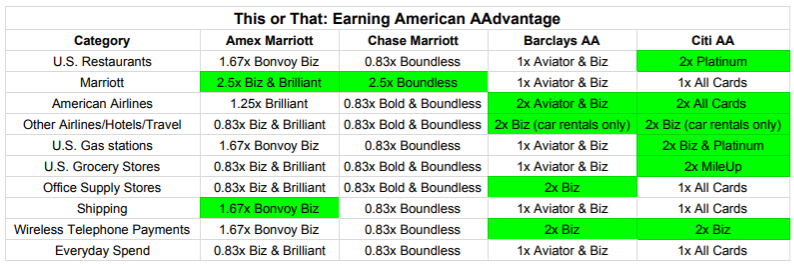

This or That to Earn AAdvantage Miles

Based on the categories listed above, here is our breakdown*:

The overall theme here is that none of these cards offer significant earning potential for AAdvantage members, since no charge earns more than 2x AAdvantage miles. Additionally, both the Barclays and Citi business cards have more bonus categories that those banks' personal card options. If you need to accumulate AAdvantage miles in large quantities, it is extremely difficult with only organic spend, unless you have a business with highly monthly/annual spend. Instead, the best ways to earn AAdvantage miles is through credit card sign-up bonuses (you can obtain a personal and business card from both Barclays and Citi, assuming you are otherwise eligible) or to have status with Marriott and transfer your Marriott points earned on stays to AAdvantage (earning up to 7 AAdvantage miles per dollar spent at Marriott). Remember, you can transfer your Amex, Capital One, Chase or Citi points to Marriott and then to Advantage, but it offers a conversion rate of only 0.416 to 2.08 AAdvantage miles per dollar (rather than 1 to 5 transferable currency on a given card).

Final Thoughts

If you want to accumulate AAdvantage miles, it is very difficult to earn large amounts on organic personal spend. For the majority of us (all those without businesses with large annual spend), it's best to focus on booking American Airlines flights with its partners, like Iberia, or transfer your Marriott points earned on stays to AAdvantage. As always, come join our Facebook group and let us know your thoughts.