Wait, what?! Add a card with a $550 Annual fee? During a pandemic, when almost no one is traveling frequently?! Yes, you read that correctly. Now might be the time to add an American Express Platinum Card to your wallet, specifically a Charles Schwab Platinum. Let me explain why I added this card to my wallet back in late May and why you may want to do the same.

Table of Contents

ToggleAmex Platinum Overview

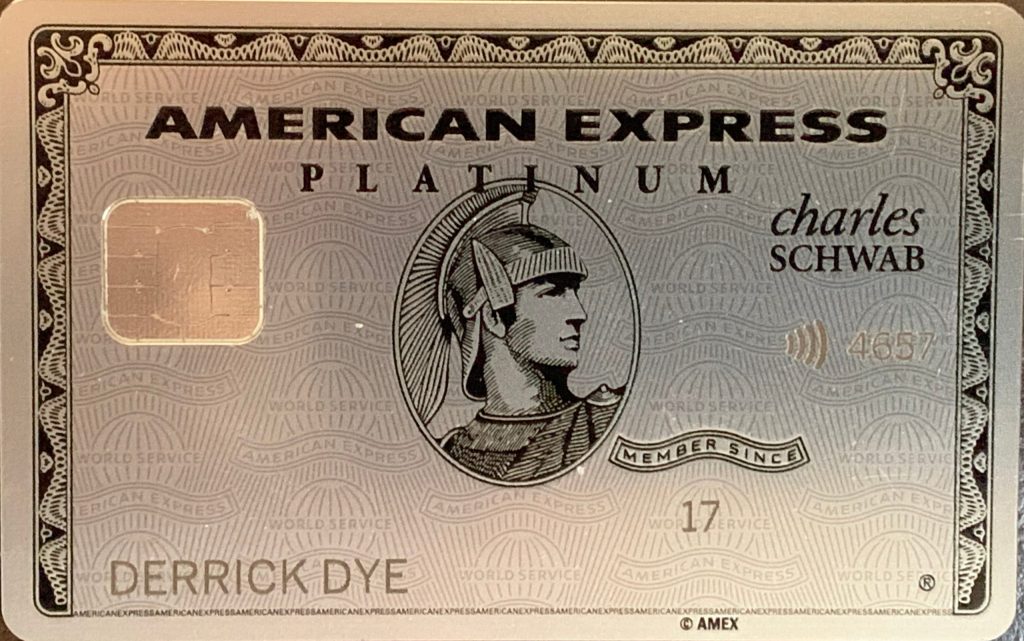

Currently, American Express offers two versions of the personal platinum card: the Platinum and the Platinum for Charles Schwab. Also available is the American Express Business Platinum. The two versions of the personal Platinum offer similar benefits and perks.

Despite American Express' “once-per-lifetime” sign-up bonus per card, you can obtain a sign-up bonus for each version of the personal Platinum. A standard welcome offer for the personal platinum is 60,000 Membership Rewards after spending $5,000 in 3 months. For the standard Platinum, however, targeted offers regularly extend welcome offers of 100,000 Membership Rewards. Each personal platinum card comes with a $550 annual fee.

A personal Platinum card comes with numerous benefits and perks, including:

- a $200 annual airline incidental credit. This credit can be used for fees charged by your selected airline, although “airline tickets, upgrades, mileage points purchases, mileage points transfer fees, gift cards, duty free purchases, and award tickets” are not considered incidentals that trigger the credit.

- a $200 annual Uber credit, $15 per month January-November and $35 in December.

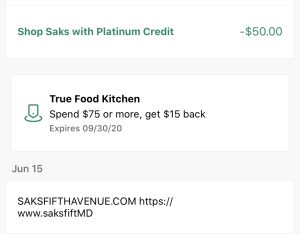

- a $100 annual Saks Fifth Avenue credit, $50 January-June and $50 July-December.

- Centurion Lounge, Delta Sky Lounge, and Priority Pass Select Lounge access (note: Priority Pass Restaurants are now excluded).

- Earn 5 Membership Rewards per dollar spent directly with airlines and prepaid hotels via amextravel.com.

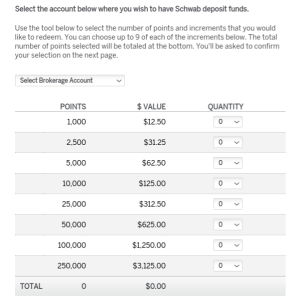

- the Amex Platinum for Charles Schwab allows you to liquidate your Membership Rewards for 1.25 cents per point and the cash is immediately deposited in your Charles Schwab account.

Limited-time Benefits

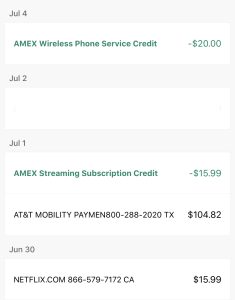

After global travel ground to a screeching halt in early 2020, American Express announced numerous benefits across a variety of its cards. ToP covered those changes here. For the personal Platinums, American Express added a $20 monthly credit for wireless telephone charges and a $20 monthly credit for streaming services through December 2020.

Is Now the Time for a Platinum or a Second Platinum?

With the additional perks introduced in late May, I decided it was time to consider adding a Platinum card to my wallet. As I had already held a Platinum card, which I downgraded to a Gold in summer 2019, I began looking at the benefits of the Platinum for Charles Schwab. After crunching the numbers, the answer was a resounding “yes.” There was no time like the present to open a new Platinum card. I then immediately applied, and was approved for a Platinum for Charles Schwab card!!!

My analysis for the first year was this:

- $550 annual fee

- a welcome offer of 60,000 Membership Rewards (for $5,000 spend in 3 months): $750 via liquidating via Charles Schwab

- $200 airline incidental credit (2020 and 2021): $400 total

- Uber credit (May 2020-June 2021): $230 total

- Saks Fifth Avenue credit (Jan-June 2020; July-Dec 2020; Jan-June 2021): $150 total

- Streaming Credits (May 2020-December 2020): $127.92 total (cost of Netflix monthly)

- Wireless Telephone Credits (May 2020-December 2020): $160 total

- COST: $550 Annual Fee; VALUE/CREDITS: $1,817.92

- TOTAL: $1,267.92 PROFIT

As you can see, adding a Platinum card, specifically the Platinum for Charles Schwab, easily pays for itself in 2020! By my calculations, the card makes a PROFIT of almost $1,300 in the first year, even after paying the annual fee. I have already received over $300 in credits since opening the card less than 45 days ago.

Additionally, as everyone's travel has slowed down, it is likely that most award travelers are earning points and miles faster than they can use them. Having the ability to cash-out Membership Rewards at 1.25 cents per point is a great perk to have. The process is extremely easy and the cash is in your Charles Schwab account instantaneously. There is no cap on the number of Membership Rewards you can liquidate per year.

Final Thoughts

With the addition of up to an additional $40/month in credits through December 2020, the two versions of the American Express Platinum are both lucrative cards that are even more lucrative through the rest of 2020. If you are considering either of the Platinums, don't delay! Each card currently offers $55/month in expiring credits. Have you added either or both of the personal Platinum cards to your wallet since May? Are you considering it? Come over to our Facebook group and let us know your thoughts.