Move Credit Across Amex Accounts

One cool thing that many lenders let you do is reallocate credit between your accounts. Some let you do it only between certain cards, like personal to personal or business to business, but some let you move it between personal and business or even between two different businesses. No one makes it easier to do than American Express though. Since I recently had to move credit across Amex accounts, I figured I would share how to quickly do it online.

Table of Contents

ToggleWhy Transfer Credit Between Your Credit Card Accounts?

Before we get into the how, we should get into the why. Why move credit across Amex accounts, or at any bank for that matter? Sometimes it helps to turn a denial to an approval on a new application, especially with Chase and Bank of America. But, that isn't really the same thing here if we're being honest. Here, we are reallocating credit from one account to another that you already have. These are some of the reasons you may want to do that:

- You get a approved for a new card with an insufficient credit limit (what happened to me)

- You have a card you use often but have a lower than needed credit limit

- There is a card you are going to close soon but don't want to lose access to that credit

Those are the main reason to transfer credit from one credit card to another.

Why I Needed To Reallocate Credit Between American Express Cards

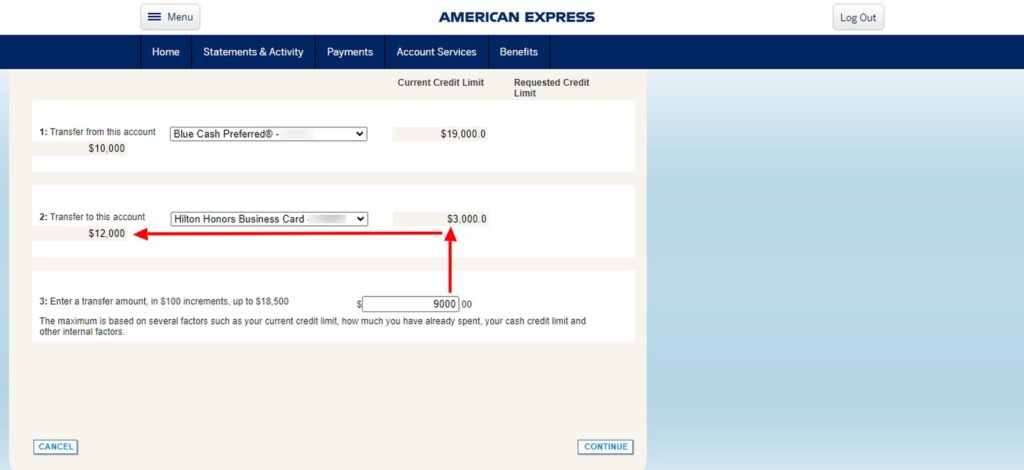

I hinted at this above, but I was recently approved for a Hilton Business credit card and it came with only a $3,000 credit limit. While that would have been sufficient to earn the welcome offer, which only requires $3,000 in spend, it wasn't enough to earn the free night certificate that requires $15,000 in spend by the end of the year.

As luck would have it, I was also recently approved for a Blue Cash Preferred card that came with a healthy $19,000 limit. I didn't need anywhere near that for the Blue Cash Preferred so I thought it was the perfect opportunity to move credit across Amex accounts.

Rules For Moving Credit Between American Express Accounts

The good news is there are less rules than there use to be for moving credit between your Amex credit cards. Here are some of the notable ones:

- You CAN move credit from a personal card to a business card (as I did myself)

- However, you CAN NOT move credit limits from a business credit card to a personal one

- You CAN use new cards to move credit from OR move credit too (as I did both ways myself)

- There used to be a once every 30 day rule in place for moving credit between accounts, but I am not sure if that is still enforced or not.

How To Move Credit Across Amex Accounts

Alright, let's get into this now. Here are the step by step instructions on reallocating credit between your American Express cards.

Step 1: Go Amex's Transfer Available Credit Page

While you should be able to get here from your account while logged in, it is just easier to go straight to the source. Go to THIS LINK (you will need to log into your American Express account).

Step 2: Select The Cards You Want To Transfer To & From

Once you are logged in you should see a screen pictured above, straight out of the 90's! From the drop down boxes you can select which card you want to transfer your credit limit from and the card you want to transfer the credit limit to. Remember the rules listed above! You can process the transfer in multiples of $100. Once everything is set up click continue.

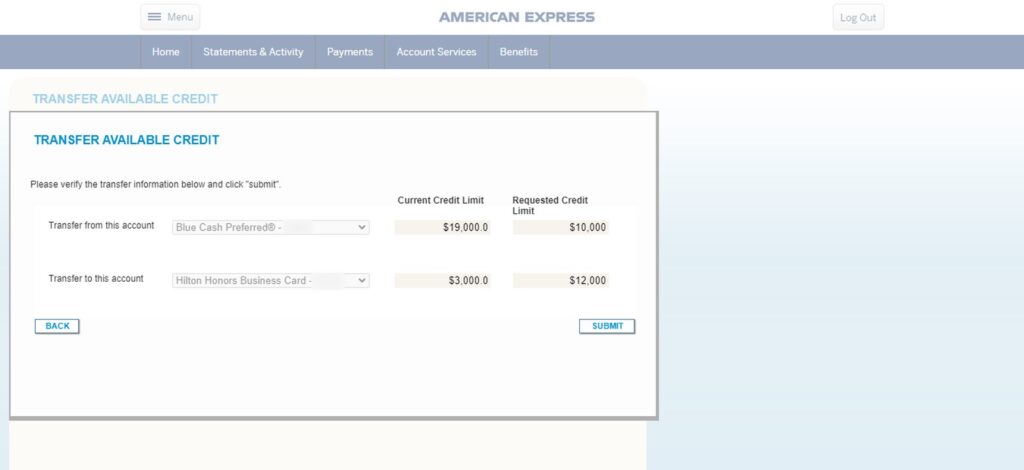

Step 3: Verify The Numbers Are Accurate

Once you hit continue you will be taken to this screen that shows the cards you selected and what the new limits will be if approved. If everything looks correct to you then hit submit.

Step 4: Approval Should Be Near Instant

Hopefully your transfer request is approved. On the next screen it says it could take up to 15 minutes to complete the transfer, but I noticed the change on my credit card accounts immediately.

Move Credit Across Amex Accounts: ToP Thoughts

I love how easy it is to move credit across Amex accounts online. I wish every issuer would allow you to do something similar without needing to call in or secure message them. Why these banks won't automate more things to make it more beneficial to their cardholders has always been beyond me.

Hopefully you found this guide on reallocating credit between your American Express cards useful. Let me know if you end up using this, or have in the past, over in our ToP Facebook Group.