Chase Credit Card Applications Flowchart

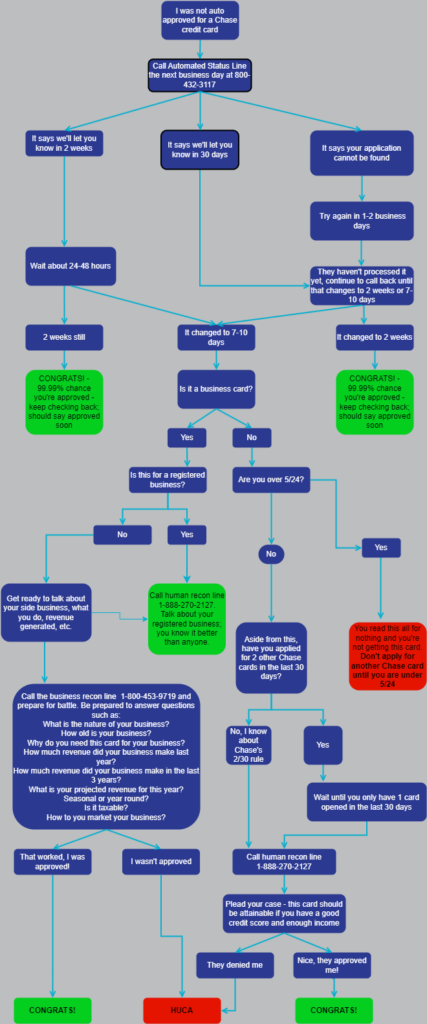

The fastest way to earn Ultimate Rewards is via welcome offers from opening new Chase credit cards, like the Chase Sapphire Preferred or the Chase Ink Business Preferred. Not every credit card application leads to an instant approval, though. Sometimes, the application may go pending or you may get denied. That is why we created this Chase credit card applications flowchart so you know exactly what to do should this happen.

Table of Contents

ToggleStay On The Path

Thankfully, the flow chart below walks you through the steps for just about any scenario involving a Chase credit card application. You will notice from reading the flow chart that there are lots of paths to end up getting approved. But of course, you have to know your 5/24 status and follow Chase's other application rules. Remember that if your application isn't instantly approved, there is no need to panic. Review the flow chart and work through your next steps. If you do end up needing to call reconsideration, we have some tips for that too.

Even with this flow chart you may run into a snag or need some clarifications on a part of it. If after reviewing this flowchart for Chase credit card applications you still have questions, come ask in the ToP Facebook group, where the ToP team and our more than 70,000 members can help and share our own experiences.

The Easy To Follow Chase Applications Flowchart

You can follow this flow chart if your Chase credit card application was not instantly approved. We have adapted this from a chart that we did not create.

Terms Explained:

Here are some shorthand terms from the chart explained. You can see our points & miles glossary if you ever come across something that doesn't quite make sense.

- HUCA – hang up and call again (to get a new agent / try again)

- Recon – reconsideration department (who you need to speak to in order to get a denial overturned) (here is our guide to reconsideration calls)

- DP – data point (please share any unique ones you have in the group)

- 5/24 – Chase's most notorious application rule (more details on it here)

- 2/30 Rule – another one of Chase's application rules. You can not apply for more than 2 of their cards in the last 30 days. (more info on all of their application rules here)

Chase Credit Card Applications Flowchart: ToP Thoughts

We would love it if all Chase credit card applications were instantly approved. If that doesn't happen, though, there is no reason to panic. This Chase credit card flowchart provides a helpful guide to navigating next steps. If you end needing to call the reconsideration line, make sure to check our tips for how to handle reconsideration calls.

Have you had to work through this flow chart before? Come share your thoughts in our group!