Transferring Chase Business Credit Limits

One of the most frustrating parts of receiving Chase Small Business credit cards is the small credit lines most sole proprietors receive. Hundreds, if not thousands, of data points in our Facebook group suggest most sole proprietors are approved for Chase Ink Cash and Chase Ink Unlimited cards with credit limits at or below $4,000 and Chase Ink Preferred cards with limits at or below $6,000. This is very difficult for making large purchases on these cards. We know you can transfer credit lines between personal cards, between business cards, but not between business and personal (or vice versa). This begs the question: can you transfer credit lines between a registered business (LLC or otherwise) card and your sole proprietor card? We investigated this ourselves to learn if it is possible. Here are the results.

Table of Contents

ToggleSarah's Chase Business Cards and Credit Limits

Sarah currently has 5 Chase business cards:

- sole proprietor Ink Cash (formerly an Ink Preferred) with a $5,000 credit limit

- sole proprietor Ink Cash with a $3,000 credit limit

- LLC Ink Cash card with a $38,000 limit

- LLC Ink Unlimited card with a $32,000 limit

- sole proprietor Hyatt business card with a $5,000 limit

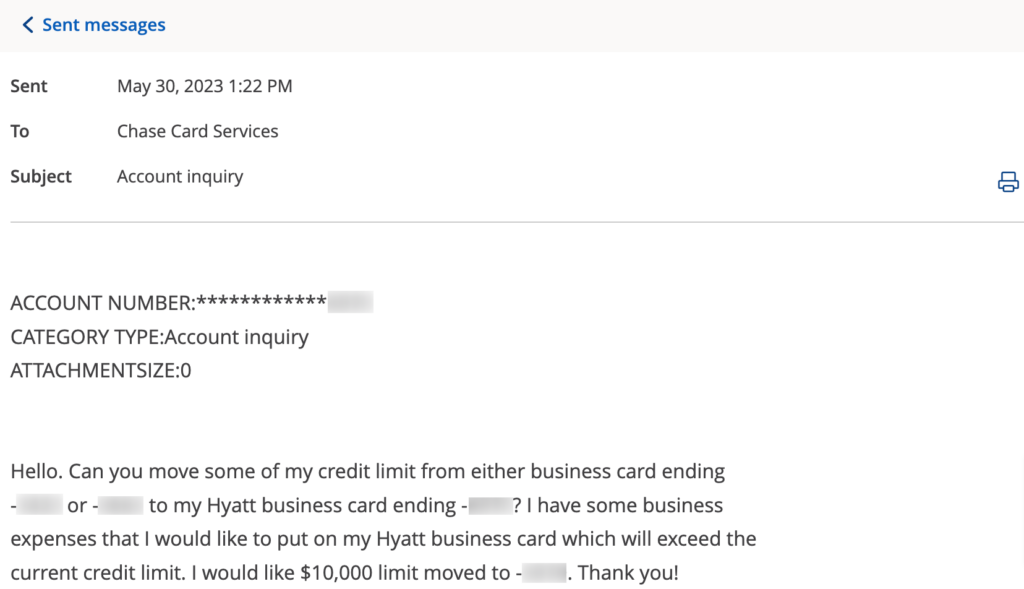

In part for research for this article, and in part to balance out credit limits between these cards, Sarah inquired via secured message if she could move $10,000 of credit limits from either of the LLC business cards to the sole proprietor Hyatt business card. Frankly, I was not expecting success. While Chase business cards are secured with the applicant's SSN as a personal guarantor, the credit limits for each business approval is based upon the business revenue listed for that business. If this works, it is a back-door way to get higher sole proprietor credit limits.

A Secured Message Leads to Success!

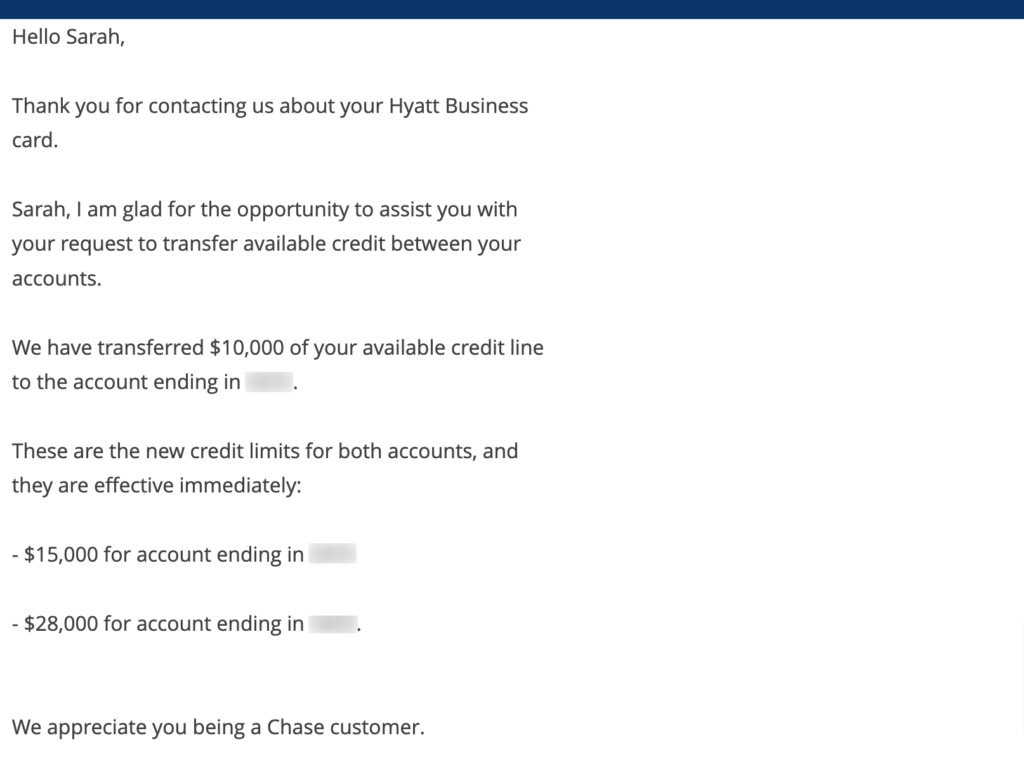

Due to a software glitch, there was no response to the above secured message for almost 2 weeks. After following-up, Sarah received a response within a few hours. Chase quickly moved $10,000 from the LLC Ink Cash card with a $38,000 credit limit to the sole proprietor Hyatt business card with a $5,000 limit. Based upon this result, we will message again and move credit to Sarah's two other sole proprietor cards with low limits!

Transferring Credit Limits: ToP Thoughts

Since most Chase sole proprietor business cards are approved with low limits, it is great news that you can transfer chase credit limits between businesses. For those with Chase business cards for multiple businesses, you can quickly move credit limits between the two to allocate your credit as you see fit. Keep in mind most Chase cards have minimum credit limits for particular cards, so you can't go below those limits when transferring credit.

Have you moved Chase credit limits between multiple businesses? Have any questions? Come over to our Facebook group and let us know.