Delta Credit Card Changes

Since I coined the term coupon book for the Amex Platinum I have now coined the book'd version of it too. Because these Delta credit card changes are American Express & Delta sending you to coupon book he – double hockey sticks. They are simply more things you need to justify using to offset the higher annual fee. Which is sadly the Amex way these days. Let's go through all these changes and see who they may work for, and who they probably won't work for.

Table of Contents

ToggleAnnual Fee Increases

First up is the really negative aspect of these Delta credit card changes, the annual fee increase for all Delta cards.

Personal Cards:

- Amex Delta Gold – From $99 to $150

- American Express Delta Platinum – From $250 – $350

- Amex Delta Reserve – From $550 to $650

Business Cards:

- Amex Delta Gold Business – From $99 to $150

- American Express Delta Platinum Business – From $250 – $350

- Amex Delta Reserve Business – From $550 to $650

It is a $100 jump for all 4 of the premium cards and a $51 one jump for the lower tier Gold cards. You may wonder what we get for these increases? Credits of course! Plus some other stuff, to be fair.

New Delta Card Credits, AKA The Delta Coupon Book

Let's take a look at these credits that you get with the Delta credit card changes that just rolled out.

Personal Cards:

- Amex Delta Gold

- $100 annual credit for Delta stays

- American Express Delta Platinum

- $10 per month in Resy credit

- $10 per month in rideshare credit

- Needs to be paid for with the credit card, not an account credit

- $150 annual credit for Delta Stays

- Amex Delta Reserve

- $20 per month in Resy credit

- $10 per month in rideshare credit

- Needs to be paid for with the credit card, not an account credit

- $200 annual credit for Delta Stays

Business Cards:

- Amex Delta Gold Business

- $150 annual credit for Delta stays

- American Express Delta Platinum Business

- $10 per month in Resy credit

- $10 per month in rideshare credit

- Needs to be paid for with the credit card, not an account credit

- $200 annual credit for Delta Stays

- Amex Delta Reserve Business

- $20 per month in Resy credit

- $10 per month in rideshare credit

- Needs to be paid for with the credit card, not an account credit

- $250 annual credit for Delta Stays

I find it interesting that they give the business cards a slightly better Delta Stays credit when the annual fees are the same.

What Is Resy?

Resy is a restaurant booking program & app. There are only certain restaurants enrolled in the program and my guess is that people will need to pay the tab via the Resy app. Similar to what people have had to when using the Resy Amex Offers.

If you are traveling to, or live in, a larger city then you can probably find some restaurants that work. Personally, I don't think I'll ever want to mess with the Resy program to save $20 on a meal.

How Does The Rideshare Credit Work?

If this rideshare credit was just an Uber credit, like the Amex Platinum, then I wouldn't hate it so much. That way you don't need to move your credit cards around in your account. That set up ensures it also works towards Uber Eats. It seems like American Express didn't like that aspect so much. This time around they switched it to a statement credit you get when you pay for your ride. The fine print excludes bike share, scooters and delivery services for food.

I find this a little surprising since I am guessing they were getting a deal from Uber on the previously set up credits other Amex cards offer. Maybe Uber was tired of doing that and Amex set it up this way to ensure more breakage. Or, they are hopping you forget to switch back to a better earning card after you use your credit. That way they capture all of your spend when you set it and forget it.

If you are diligent on swapping cards in & out, and use ride-share services monthly, then this could be money in the bank. I wonder if loading your account will work though. We will have to see how rules and reality mesh there.

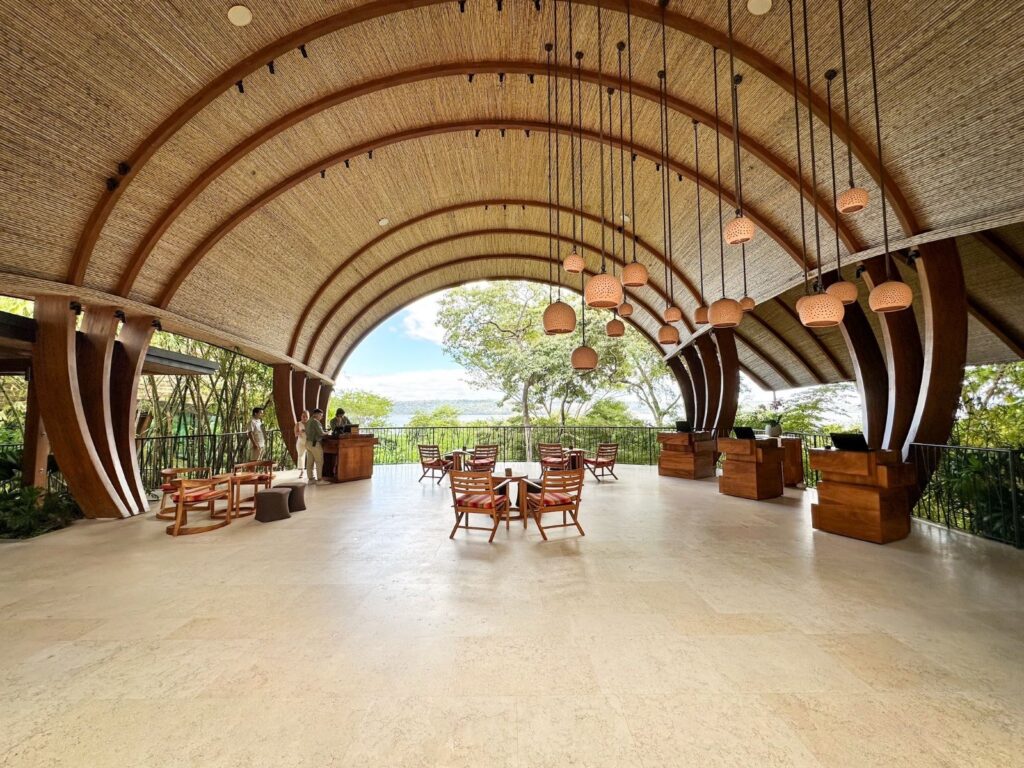

What Is Delta Stays?

Delta Stays is their travel portal but just for hotels. Where Delta Vacations can cover most all aspects of travel, this will be specific to hotels and will be where you use the credit. That means no elite night credits or status perks when booking via Delta Stays. I would imagine the prices will often be higher versus booking direct with a hotel too. Both of those things greatly reduce the value you actually get.

If you have a trip once or twice a year where a non chain hotel works the best, and it is in the Delta Stays program, then this could be useful. That is a small target though.

New Earning Multipliers For Business Cards

One of the positive Delta credit card changes, even if a modest one, comes to the business cards only. It seems like a pattern here. Amex seems to want the business spend more than the personal spend. The cards are getting some new multipliers for bonus earning on your spend.

- Amex Delta Gold Business

- 2x Miles per dollar on U.S. shipping and U.S. providers for Advertising in select media on up to $50,000 per year. After that you will earn 1x on every other eligible purchase.

- American Express Delta Platinum Business

- 1.5x Miles per dollar on the following purchases

- Transit

- U.S. Shipping

- Purchases of over $5,000 (maximum of $100,000 of spend per year)

- 1.5x Miles per dollar on the following purchases

- Amex Delta Reserve Business

- 1.5x Miles per dollar on the following purchases

- Transit

- U.S. Shipping

- U.S. office supply stores

- 1.5x Miles per dollar on the following purchases

There is nothing here that moves the needle for me. You can do better in every category with a lower annual fee.

Delta Gold Cards Flight Credit Earning

Next up with the Delta credit card changes is another modest positive change. This one is for the Delta Gold cards. You will now be able to earn a $200 flight credit after spending $10,000 in a calendar year. This is double the old flight credit amount of $100 after spending $10,000 in a calendar year.

With the low earning rates on the Delta Gold cards, and the lower valuation of Delta Skymiles, I don't think anyone should actively spend $10,000 on these cards to earn the flight credit.

Delta Expands Companion Certificates Past The Lower 48 States

This might be the cream of the crop for the Delta credit card changes to some. If you carry the Delta Platinum or Reserve cards, whether personal or business, you get a yearly companion certificate for paying the annual fee. Think of this like a bogo coupon (there is that word again!). You just need to pay taxes and fees for the second person. These were always limited to the continental U.S., but not anymore!

The companion certificates can now be used in Alaska and Hawaii too. They can also be used in the Caribbean, Mexico and Central America. That is a big positive change, and my favorite overall. The downside is the fare buckets to use these can be painful to find. There in lies the rub people!

Delta Credit Card Changes: ToP Thoughts

I don't find much to like about these changes personally. What you think about them may be different, if you can use some of the credits listed above. I don't plan on changing around my Uber account every month to get $10. If it were a straight deposit into my Uber account, like with other Amex cards, then I would think that would offset the fee increase for many.

I really like the companion certificate changes, but they are not the easiest to use. It seems even worse these days, with less and less flights that seem to qualify. I checked 4 different trips we have upcoming, trying to use the one I have, and came up empty handed. My personal experience is I can use them maybe 1 out of every 3 years. That just isn't good enough to call it a perk. My friends are always trying to give them away at expiration … and we live at a Delta hub!

This is a win for American Express really. They will get higher annual fees, and be able to tout how profitable the credits can be, all while realizing most will never come close to using them all. Many won't even cover the $100 increase.

Let me know your thoughts in the ToP Facebook Group.