Convert Capital One Cash Back to Miles

Capital One offers a slew of cards, some of which earn cash back, and some of which earn Venture Rewards miles. We generally focus on earning points and miles here at Travel on Point(s)–but there may be one notable exception. That exception is earning Capital One cash back in order to later convert it to Venture Rewards Miles. Because of this, it may make sense to add a Capital One cashback card to your line-up. Shocking, I know, but you can convert those earnings to miles. We will break down which cards you can do this with, and how you can even convert Capital One cash back into miles with other cardholders.

Table of Contents

ToggleWhich cards can this work with?

To be able to convert your hard-earned cash back to miles, you need to hold (or have someone in your circle who holds) one of the following Venture Rewards-earning cards:

- Capital One Venture X

- Capital One Venture X Business

- Capital One Venture Rewards

- Capital One VentureOne

- Capital One Spark Miles for Business

Then, once you have identified the card that can be used to house the miles, you can turn cash back from any of these cards to miles:

- Capital One Savor Cash

- Capital One Savor One

- Capital One Quicksilver

- Capital One QuicksilverOne

- Capital One Spark Cash Select

- Capital One Spark Cash Plus

With one card from each of the above lists, you will be able to convert your cash back into more valuable rewards points. One cent of cash back will be converted into one Venture mile. This can be extremely lucrative, since you could potentially double (or more) the value of your rewards. I often value transferable points like Venture miles at 2 cents per point or more. That is what I try to shoot for when redeeming my points.

Converting Capital One Cash Back to Miles via another person

I just mentioned that miles pose a much higher value potential. But there is actually a way to pull this off even if you don't have a Venture Rewards earning card. That makes this process potentially even more flexible, which we love to see. This is because you can convert Capital One Cash back to Miles via another persons rewards account. You may have a Spark Cash Plus for example, and have no way to redeem them as miles. However, if a trusted family member or friend holds a Venture rewards card, you can use their card as a vehicle to hold the points.

How to Combine Cash Back to Miles on your own accounts

If you hold both a cash back card and a Venture rewards-earning card, the process can be completed all online. Simply follow these steps to combine your cash back to rewards.

Step 1: View your Rewards

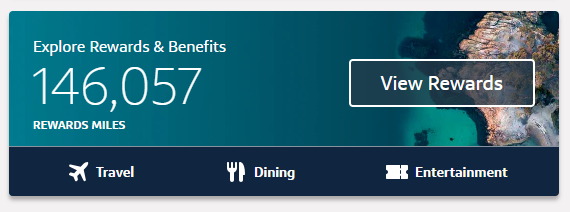

Firstly, from your account home you will click on ‘view rewards'.

Step 2: Move Rewards

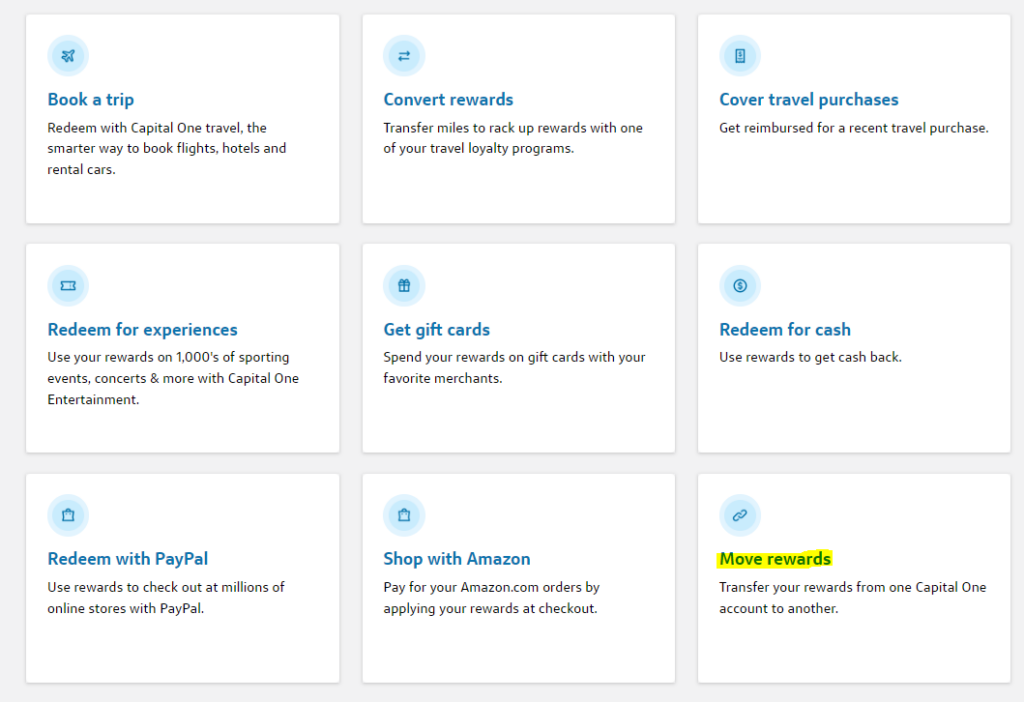

From there, you will want to select the option ‘move rewards'. If you click that option, your eligible accounts will be shown, and you can combine cash back to miles.

Step 3: Confirm Amount of Rewards to Combine

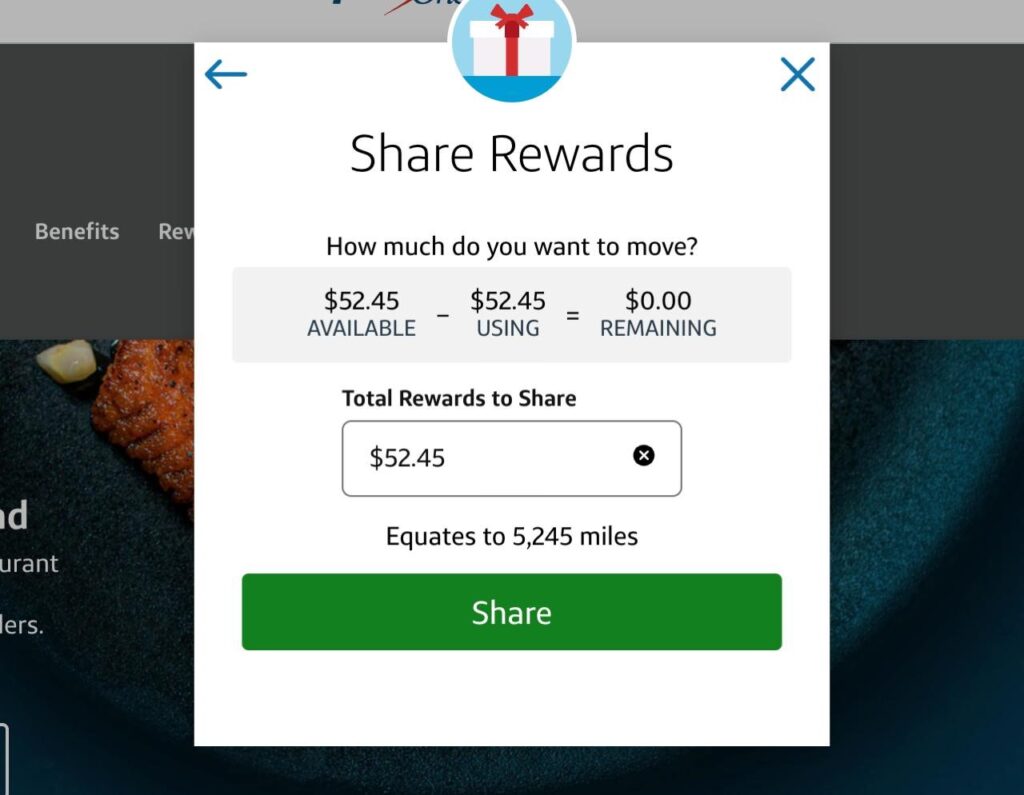

Next you will want to confirm the amount of cash to combine, and to which card you are sending the miles. Then, click the green “Share” button to proceed.

Step 4: Confirmation

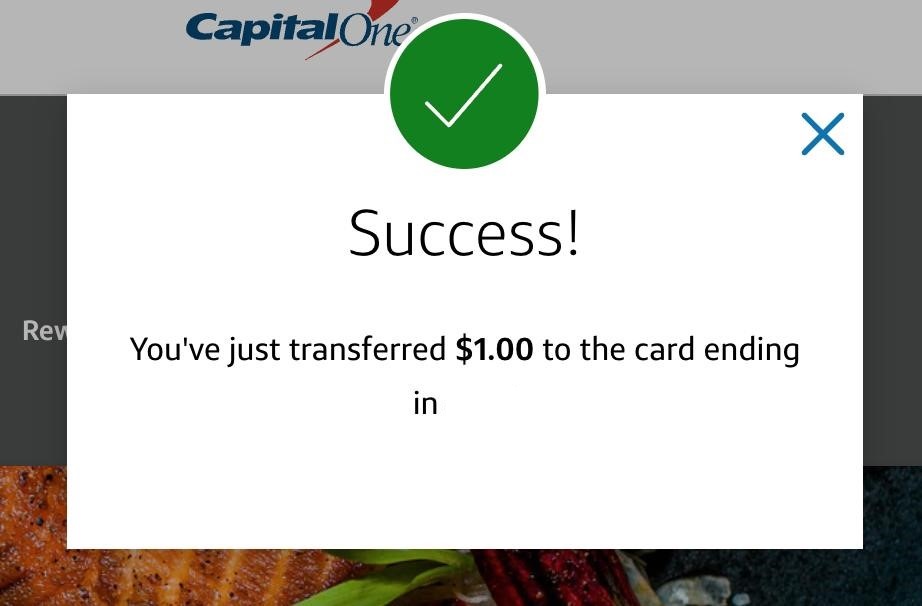

You will see a confirmation screen showing that your cashback has now been moved to your miles-earning card, and converted to miles.

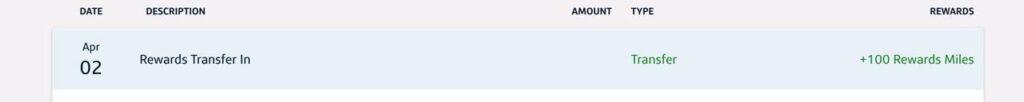

The transfer will also show up pretty quickly in your history:

How to Combine Cash Back to Miles with another person's account

Capital One is extremely flexible with its policy on sharing rewards. You can move rewards with any other Venture or Spark Miles cardholder. The process is fairly straightforward too, but cannot be completed online. Instead, you just need to call the number on the back of your Capital One card. There is no requirement that the person you are sharing the rewards with to live in the same household. To complete the transfer, you will need the name and full credit card number of the person to whom you are transferring to.

A quick note on Hang Up, Call Again:

Some agents at Capital One don't know about this option. If you call and an agent tells you they are not able to combine cash back to rewards, you should hang up and call again. Repeat this process until you find a rep that is willing to help. In my experience, I had to call twice to get to a rep that would process the request.

My Experience Combining Cash Back to Miles

I was able to take advantage of this process when I opened a Capital One Spark Cash Plus a few years ago. I had opened that card in 2022 when it had a very high welcome offer. However, I had no way to redeem these points at first due to not holding a Venture rewards card. I had an immediate use for these points, though and needed to figure a way to transfer this cash back to rewards on the fly. I knew I would not be eligible for a new Capital One card myself due to their one card every six months rule. Instead, I was able to have my partner open a Capital One Venture X to be able to convert Capital One cash back to miles. As you can tell from my story, it was extremely helpful that Capital One offers this option to combine rewards with other members.

Converting Capital One Cash Back to Miles: ToP Thoughts

It's extremely helpful to know that Capital One allows you to combine cash back into rewards. This can allow you get more value out of that cash back, and perhaps makes earning a welcome offer on a cash back card worth it. Since transferable currencies are often worth more than cash back, this can help you take more trips with fewer points! This perk may be small but it can be mighty. Remember that in the world of points and miles, flexibility is key.

Have you had success combining your Capital One cashback to rewards? Let us know over in the ToP Facebook group!