Earlier this week, we examined the most common misconception about credit cards: explaining why opening up several credit cards does not harm your credit. In fact, your credit score typically improves! With that hurdle out of the way, today we explore several other common credit card beliefs and let you know if they are true or false. Once you read both articles, you're ready to dive in to the world of award travel, if you haven't already!

Common Credit Card Beliefs:

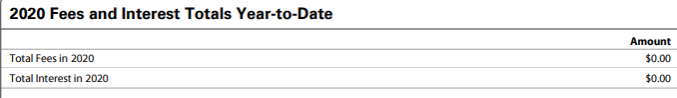

- By signing up for credit cards, you must pay interest and fees. FALSE. Other than annual fees on some cards, there is never a good reason to pay ANY fees or interest on ANY travel card. The interest on travel rewards cards is oftentimes 18%+. If you are carrying credit card debt, please consider paying it down and/or putting it on a 0% credit card before starting this game. Sarah and I have not paid a dime of credit card interest in the last 3 years, despite using our travel rewards credit cards for everything.

- I should pay attention to how many credit cards I sign up for. TRUE. As you've heard us talk about numerous times, the 5/24 rule is a very real thing. It impacts what you can sign up for now and in the future. Don't do anything until you understand the 5/24 rule, know your 5/24 status, and have a plan for your future applications!

- I don’t earn/spend enough to accrue enough miles to go anywhere. FALSE. This game is for blue collar workers and millionaires. You can use points to upgrade your vacation from a road trip in an old jalopy to a Greyhound bus or to go from flying paid business class to flying around the world in private jets. It’s all possible. I know people who have done/are doing both! Also, you probably don’t know how cheap it can be to go somewhere. In the last twelve months, we've flown for 3,100 miles each way per person. I flew to Chicago last October for only 4,000 points. You can earn enough points from one signup bonus to fly 20 such flights (or more)!!!

- Annual fees on credit cards aren’t worth it. TRUE & FALSE. For some cards, this may be true. For others, the annual fee is worth it and more. We’ll dive into this subject very soon, but a quick teaser is that we have a $450 annual fee card where the bank actually PAYS money to the cardholder, rather than the other way around. When used correctly, the cardholder can earn well over $700 per year in benefits, not including any points earned or a signup bonus. How does $250+ plus in FREE benefits sound? Depending on your travel & spending patterns, a card with an annual fee almost always gives you higher returns than a no annual fee card.

Conclusion

Despite many (most?) people initially believing any or all of the four most common misconceptions about credit cards, once you understand that these are myths, you're ready to begin your credit card rewards journey! Soon enough, you'll have a stockpile of points and miles and be ready to book that dream vacation. Come join our Facebook group to learn more.

Travel on Point(s) has partnered with CardRatings for our coverage of credit card products. Travel on Point(s) and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.