How Are Credit Scores Calculated?

One of the first questions people ask when learning about award travel is whether opening many credit cards hurts your credit score. The answer is NO. In fact, opening additional credits can even help your credit score! To understand why, we need to understand how credit scores are calculated.

Table of Contents

ToggleWhat Is a Credit Score?

Many different forms of credit scores exist, but most banks rely on a consumer’s FICO credit score or some near variation of that score. As such, we will focus on FICO credit scores. The three main credit reporting agencies–Equifax, Experian, and TransUnion–each report your credit score, and they each calculate credit scores slightly different from the other.

We will show how credit scores are calculated further below, but first, what is a good or a bad credit score? Here’s how credit scores are typically broken down by quality:

800-850: Exceptional

740-799: Very Good

670-739: Good

580-669: Fair

300-579: Very Poor

Folks in the “Very Good” range with a score between 740 and 799 should have no trouble getting approved for credit cards, especially those on the higher end of that score. This of course is subject to any given bank's application rules and policies.

Breaking Down How Credit Card Scores Are Calculated

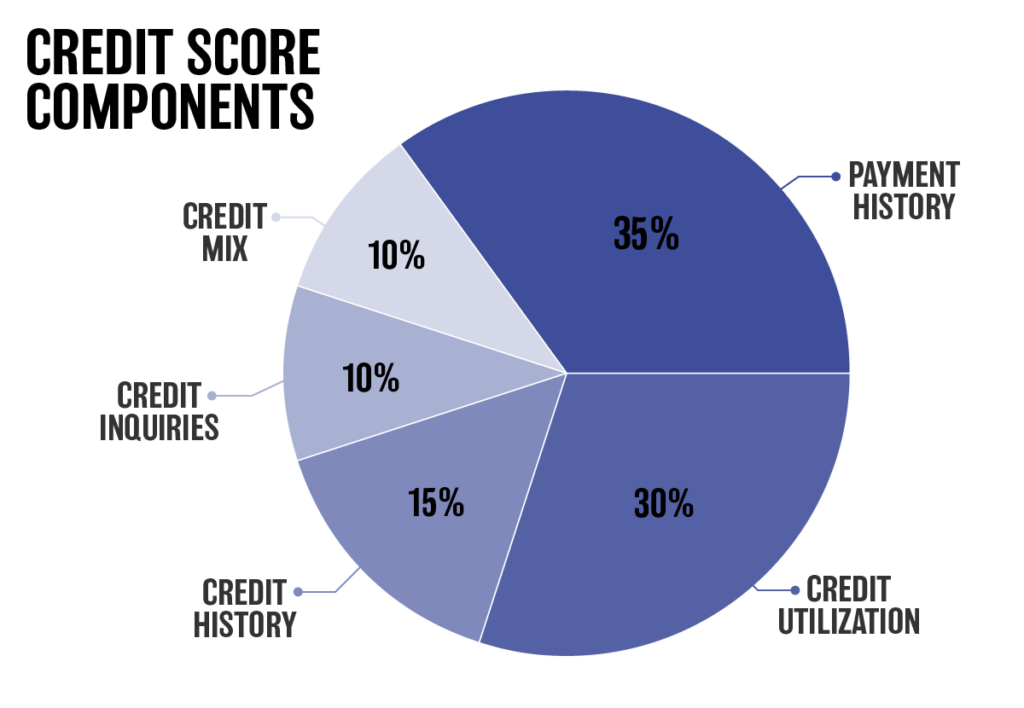

Many factors go into calculating your credit score, with some factors playing a bigger role. Here are the main factors that contribute to your credit score:

Payment History

Failing to make a loan payment, such as on a car loan or credit card bill, shows up on your credit. At 35% of your credit score make-up, one missed payment can drop your credit score by dozens of points. This is one of the many reasons why paying your credit cards in full and on time every month is the most important rule in award travel. It is also the most important part of how credit scores are calculated.

The longer and more recent the delinquency, the greater the negative impact on your credit score. Even if you get up to date on your payments the following month, that delinquency will remain on your credit for about seven years.

Making a payment on time only requires you to make the minimum payment due. However, you should always avoid carrying a balance on your credit cards because you will still be charged interest, even if you make the minimum payment.

Credit Utilization

Credit use or utilization is the relative size of your current debt. (This is also known as your debt-to-credit ratio.) This is the total amount of your debt divided by the total amount of credit that is available to you across all of your accounts. There is no magic number for what your debt-to-credit ratio should be, but you don’t want it to be high. A high credit utilization suggests that you are close to spending more than you can afford, or that if an unexpected financial emergency happened, you might fall behind on your existing bills.

Balance alerts can help you keep your credit utilization low. A balance alerts will notify you if you’re close to maxing out your credit line on any one credit card.

Unlike with payment history, credit utilization is easier to fix. Once you pay a high balance that frees up your credit line, the card-issuing bank will report that payment to the credit bureaus. Once the card-issuer reports that payment, the effect disappears from your credit score.

Credit History

This is the average length of all accounts on your credit history, including credit cards, student loans, car loans, mortgages, etc. This becomes a significant factor for those who have very little credit history, such as young adults or someone who just recently moved to the US. It can also be a factor for people who open and close accounts within a very short period of time. Old accounts show lenders that they can count on you as a reliable long-term customer.

One way to take advantage of how credit scores are calculated is to become an authorized user on someone else’s credit card. Doing so will reflect that you have had a credit card open since the primary cardholder first opened their card. For example, say one of your parents has had a credit card since 1997 and they added you as an authorized user in 2024. Your credit score will now show that you have had a card opened since 1997, even though you are only an authorized user.

Credit Mix

This relates to the different types of credit accounts you have, such as mortgages, car loans, credit cards, and student loans. Having a greater mix of types of loans is better than having fewer. But we are not recommending that you take out unnecessary loans just to boost your credit score.

Credit Inquiries

Credit inquires relate to when lenders pull your credit to decide whether to grant you a new account or a loan request, such as a car loan or mortgage. Your credit score can drop a few points each time someone pulls your credit, but it recovers quickly within a month or two.

Having too many inquiries all close to each other can also affect your credit a bit. But credit inquiries play such a small role in your overall score that this is not a cause for concern usually. It does not play a major role in how credit scores are calculated though.

The good news here is that checking your own credit score does not affect your credit score.

How Can Opening Credit Cards Actually Improve My Credit Score?

Over two-thirds of how your credit score is calculated is based on your payment history and credit utilization, as shown above. Opening a new credit card does not affect your payment history, but it does contribute to your credit utilization because it increases the amount of credit available to you.

Meanwhile, opening new credit cards can help broaden your credit mix, especially if you haven’t had many cards in the past. New cards can contribute to a lower average credit history, but older accounts should help offset those new cards. When you apply for a new credit card, you undergo a credit inquiry. This is when a bank pulls your credit to determine whether they will approve you for that credit card. This credit inquiry will drop very few points from your credit score temporarily, though that recovers quickly.

Let's walk through an example of how this works.

A Real Life Example

Say your monthly expenses are $5,000 and you have one credit card with a $5,000 credit limit. Each month, you put all your expenses on that card and pay it off in full. Your payment history is excellent because you never miss a payment. But your credit utilization is not very good at all because you are using 100% of your credit each month. In the eyes of a lender, you won't be able to meet an unexpected expense, such as a car repair, medical bill, etc., because you're using all of your credit every month.

But say you open a second credit card that also has a $5,000 credit limit. If you continue to only spend $5,000 per month between your two cards, your credit utilization will decrease to 50% ($5,000 out of $10,000). So now a lender sees you can manage unexpected expenses of up to $5,000.

And what if you open a third credit card? Or a fourth? And you're still only spending $5,000 and making all your payments on time. Now, your credit score looks a lot better because you have a lower credit utilization. Lenders see that you can manage bigger unexpected expenses due to how much credit you have at your disposal. The way that credit card scores are calculated is a flawed system but this is how you work within their perameters.

Therefore, if you open a new credit card but your expenses remain the same, lenders will now see you spending a smaller percentage of the credit that is available to you.

Monitoring Your Credit Score

Now that we learned how credit scores are calculated, let's look at how to monitor your credit score and why it’s important to do so.

Since the first step to traveling on points is earning points and miles through credit card welcome offer, we need good credit scores to open those new cards. Credit scores are the primary factor that banks, like other lenders, use in determining whether to grant us credit. That is why we must make sure our credit scores are healthy and our credit reports are accurate.

Several resources are available to check and monitor your credit score for free.

Banks

Many banks offer cardholders free access to their credit scores. American Express allows users to view their credit scores as calculated by Experian and TransUnion. Chase and Capital One allow cardholders to view their scores as calculated by TransUnion. Meanwhile, Citi is the only bank that offers card holders access to their Equifax score, for holders of such cards as the Citi Prestige, Citi Dividend, and Citi Double Cash cards. In addition, Discover offers anyone, not just their customers, free FICO scores through their Credit Scorecard.

Non-Banks

Credit Karma allows users to see both their Equifax and TransUnion credit scores for free by setting up a free account. You can also see new credit accounts opened. However, Credit Karma shows you your VantageScore, which uses a different formula than FICO score. This information differs from your FICO score, which is what banks actually use when deciding whether to approve credit card applications.

Credit.com allows anyone to set up an account to view their Experian credit score every 14 days.

Obtaining Your Credit Report

In addition to monitoring your credit score, it is also wise to monitor your credit report. Both things play a role in how credit scores are calculated. Credit reports provide your credit history, such as opened and closed accounts. Federal law entitles everyone to a free credit report every 12 months directly from each of the three big credit bureaus (Experian, TransUnion, and Equifax) by using AnnualCreditReport.com. This means you can access your credit report three times a year for free, once from each bureau. Instead of looking at all three reports at once, it is wise to spread this over 12 months and obtain your credit report every four months or so.

How Are Credit Scores Calculated?: ToP Thoughts

Understanding how credit scores are calculated is crucial to succeeding in award travel. The key to maintaining a healthy score is understanding how credit scores work. The higher your credit score, the higher your chances of being approved for new credit cards. Take the time to get your financial house in order and assess what you need to do to improve your credit score and keep it strong going forward.