One of the first things we recommend to “newbies” is to figure out your 5/24 status. As a reminder, your 5/24 status is a rule from Chase in that they will not approve you for a new credit card (personal or business) if you have opened 5 cards in the last 24 months. All cards that show up on your credit report count towards 5/24. The easiest method of checking for this is to use Credit Karma.

1. Go to www.creditkarma.com and you will see this page:

2. If you don’t already have an account, click “Sign Up for free” in the top right corner

3. Go through the necessary steps to create an account and then login to your account

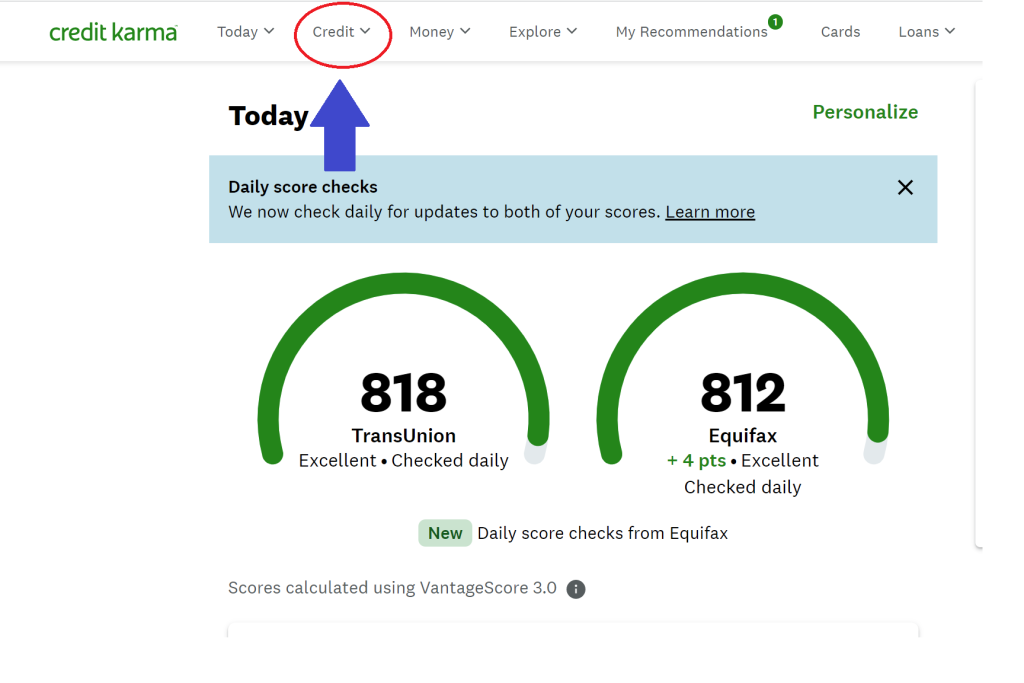

4. Click on “Credit”. Note: this is a good time to remind you to never trust the credit scores you receive from Credit Karma. My actual score according to FICO is higher according to more accurate sources such as AmEx and Discover.

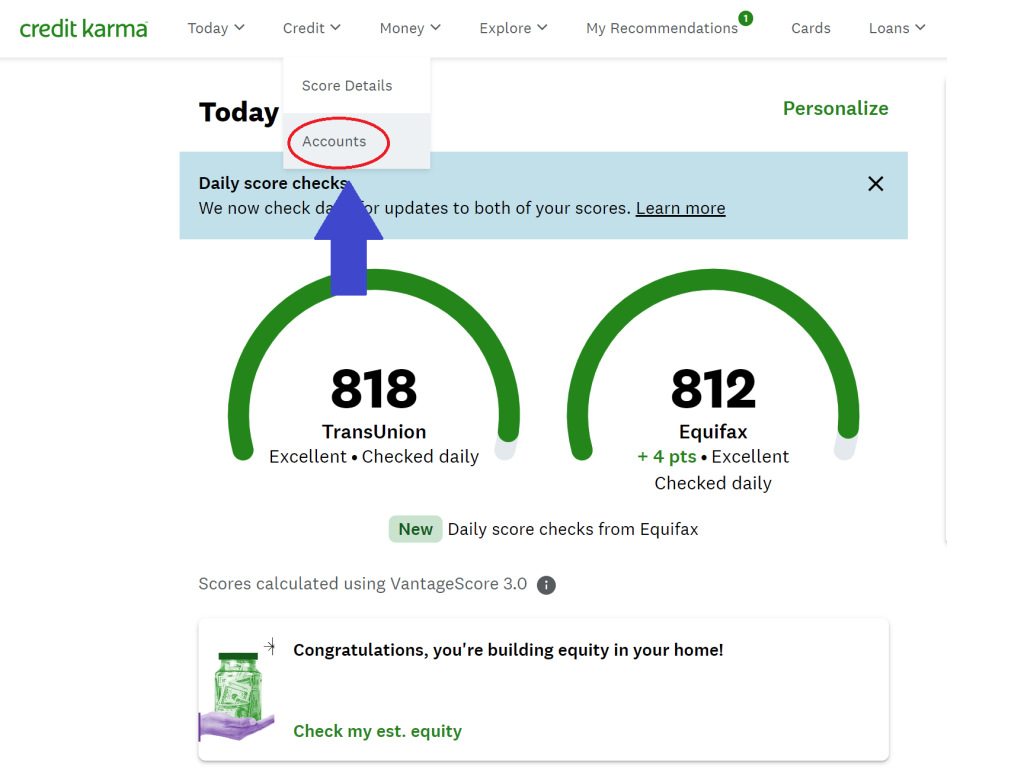

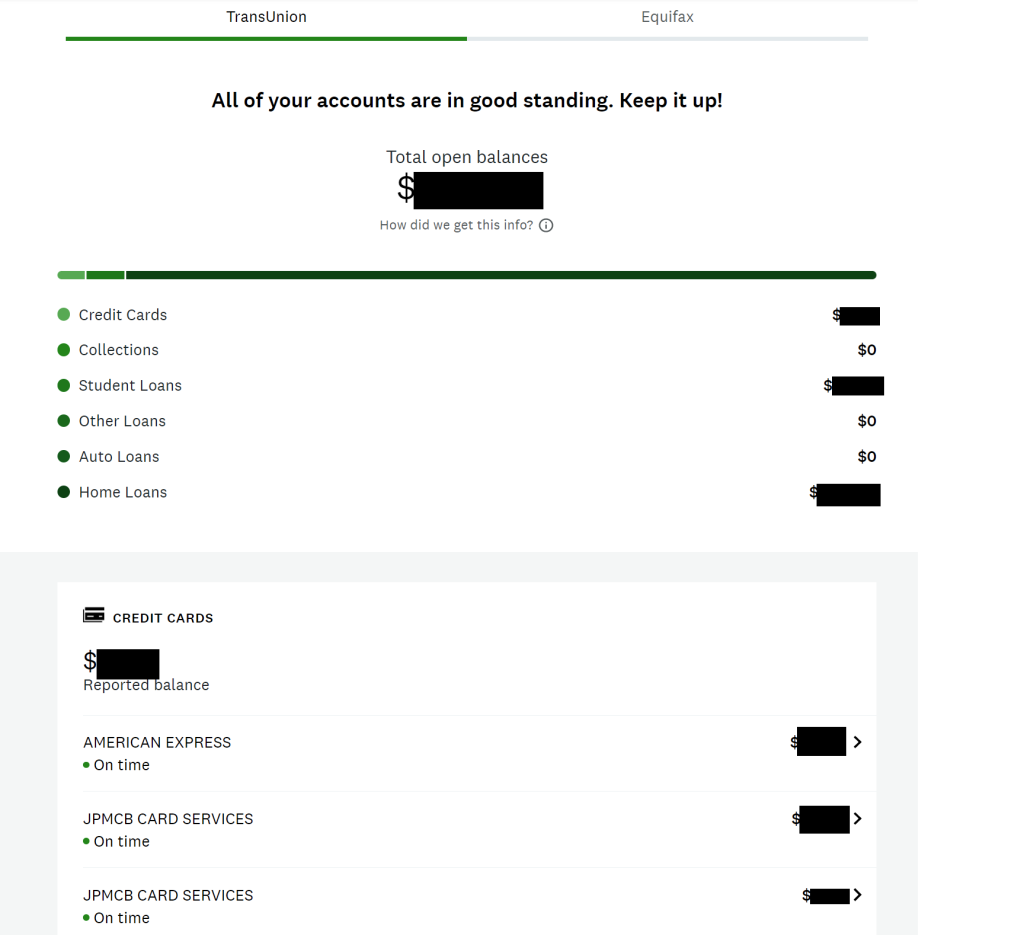

a. Then click on “Accounts”

5. From here, you can see all of your accounts.

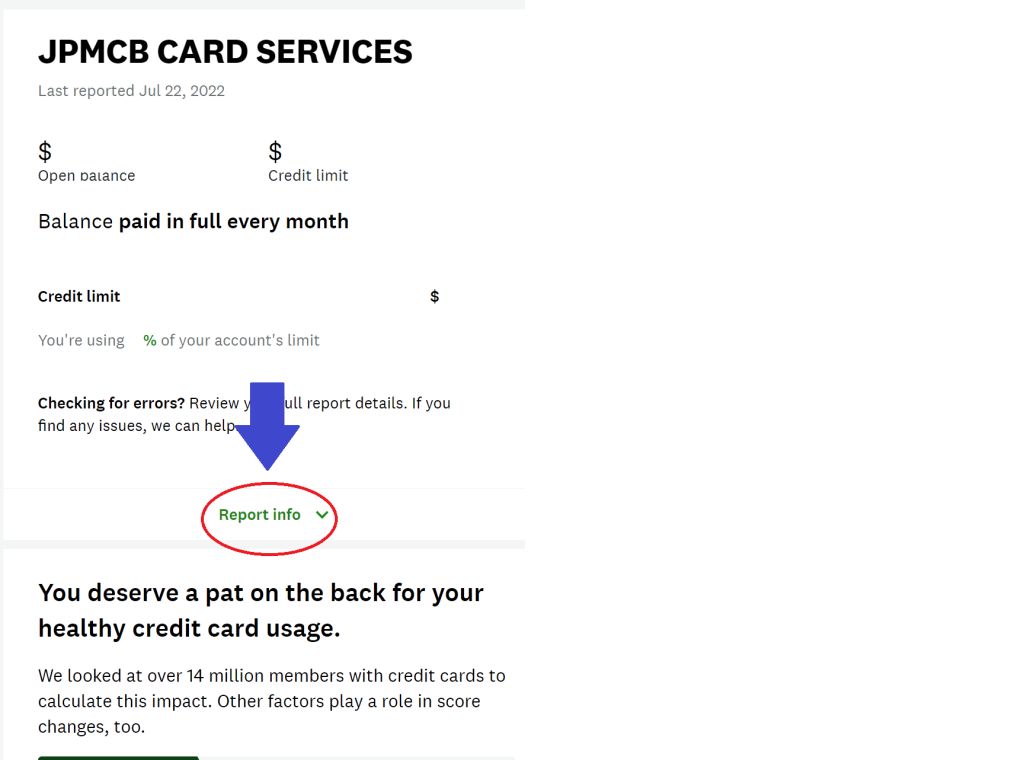

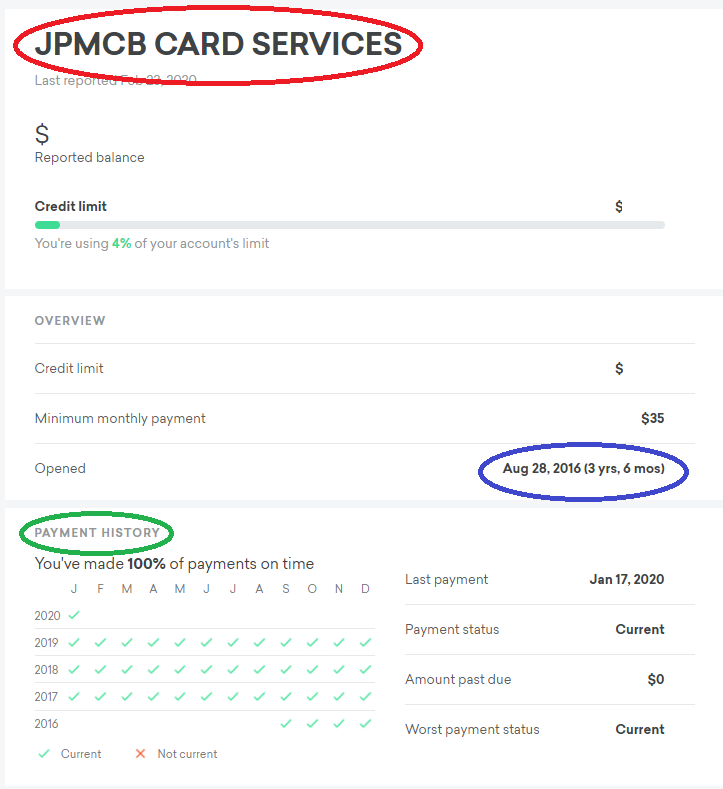

6. Click on each account individually to look at the information. This is a great time to enter your information into a spreadsheet help you track your credit cards. Please feel free to use ours (https://travel-on-points.com/trackersheet) or to create your own. You are going to want to look at a few pieces of information.

a. Cluck on “Report Info” to get to the information you need

b. Since Credit Karma tells you the bank (in this case, Chase) but not which credit card it might be, I use the credit line to help me figure that out.

c. Look at “Opened” for the date you were approved for the card. If this date is within the last 24 months, it counts towards your 5/24.

d. Look at payment history. Make certain it is accurate. We cannot say this enough but you always want it to be 100% on time as this is how to benefit from this hobby.

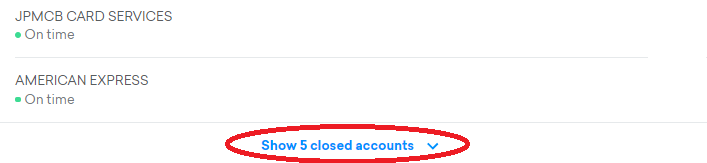

7. One other item to check is to look at your closed accounts. This is important for a bank such as Citi where their rules will not give you a card if you have opened or closed it within the last 24 months. To get there scroll down and click on “Show Closed Accounts”

Then click on the accounts the same as you did earlier. Here are the pieces of information you should be looking for

8. Go back and repeat this for all of your accounts to determine what accounts you have.

Thoughts? Questions? Join our Facebook group to learn more.

Special thanks to Shira Sliffman for writing this post.