Despite a lot of (well deserved) negative press over the last few years, United Airlines continues to offer tremendous value to award travelers. As we highlighted last fall, the value in United Airlines is usually flying its Star Alliance partners. Today, we discuss the best ways to accrue United Airlines miles. Should you use this card or that card?

Table of Contents

ToggleUnited MileagePlus Credit Cards

All United MileagePlus credit cards are co-branded cards issued by Chase. The available cards are:

- United Gateway℠ Card

- United ℠ Explorer Card

- United Quest ℠ Card

- United Club℠ Infinite Card

- United℠ Business Card

Of these cards, the United Gateway℠ card earns 2x on United purchases, gas stations, and local transit & commuting and 1x on all other purchases. This card is a great option to downgrade to but is not one to apply for outright. The United ℠ Explorer Card earns 2x on United purchases, restaurants and hotels and 1x everywhere else. The United Quest ℠ Card earns 3x on United purchases, 2x on all other travel, dining, and select streaming services as well as 1x on all other purchases. The ClubSM Infinite earns 4x on United purchases, including seat selection, wifi, and in-flight service; 2x on dining and all other travel; and, 1x everywhere else. The United℠ Business Card earns 2x on all United purchases (like Infinite) and at gas stations, office supply stores, restaurants, and local transit/commuting.

For the cards that offer the benefit, you must pay for your United flight with your United card to receive free bags and/or 25% discount on in-flight purchases.

Other Options

United Airlines is a transfer partner of Chase Ultimate Rewards (UR). You can transfer your URs to United Airlines MileagePlus at a 1:1 ratio and there is no limit to the number of URs you can transfer. You can also use your UR in the Chase Travel Portal to purchase United Airlines flights (at either 1.25 or 1.5 cents per point), although this requires a telephone call and it not available online.

As a reminder, these cards earn Chase Ultimate Rewards:

- Chase Sapphire Preferred® Card;

- Chase Sapphire Reserve®;

- Chase Ink Business Preferred® Credit Card;

- *Chase Freedom Flex;

- *Chase Freedom;

- *Chase Freedom Unlimited;

- *Chase Ink Business Cash® Credit Card; and

- *Chase Ink Business Unlimited® Credit Card;

*these cards earn UR when paired with a Sapphire Preferred or Reserve or a Ink Business Preferred. Otherwise, these cards earn cash back.

Of these cards, CSR and CIBP both earn 3x on travel, including United Airlines purchases, hotels and rental cars and the CSP earns 2x. The CIBP earns 3x on social media and search engine advertising, shipping, and internet/cable/phone purchases (on up to $150,000 in combined purchases per year). The CFU or CIU both earn 1.5x on all other spend. On a quarterly rotating basis, the Freedom card earns 5x on up to $1,500 spend. Lastly, CSR (3x) and CSP (3x) have category bonuses for restaurants.

This or That to Earn United MileagePlus Miles?

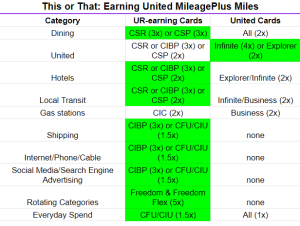

Based on the categories listed above, here is our breakdown:

There's a clear winner here: unless you are using the Infinite card to purchase United flights (and/or you need free bags while flying United and use the Explorer card), a UR-earning card is better than ANY United credit card to earn United miles. Crazy, right?! Also remember, while United-earning cards are only useful in the United MileagePlus program, Ultimate Rewards are transferable to more than a dozen hotel & airline partners or can be used like cash to purchase travel in the Chase Travel Portal.

Bottom Line

Unless you are using an Infinite card to make United Airlines purchases, or you need free bags on an upcoming United flight and use your Explorer card, it is ALWAYS better to forgo this (United) cards and choose that (UR-earning) cards! Come join our Facebook group to let us know which way you prefer to earn United miles!