The points and miles hobby has a big emphasis on the points you can earn from signing up for new credit cards. This emphasis is well-deserved because of the how much value you can earn from points and because of the large bonuses earned for a relatively small amount of money spent. But even without a credit card, there are still plenty of other ways you can earn money or points.

Table of Contents

ToggleBank Bonuses

One way to earn money which can be used to save on travel is by signing up for new bank accounts that are offering bonuses. Most will earn you between $200-$600. In fact, Doctor of Credit has an entire section dedicated to bank account sign-up bonuses.

To earn the bonus, you must open a bank account and meet the offer's terms. These usually include making a deposit, making direct deposits, or having a certain amount in your account for a minimum amount of time. Many bonus offers focus on direct deposits. This can be done easily if you can adjust your employer deposits. Often there are other creative ways to make deposits that will meet the direct deposit requirement, such as using a prepaid card to transfer money into the account. These creative ways can vary by bank.

Once you have earned the bonus, you need to decide whether you want to close the account or keep it. Usually, to keep an account fee free, you will need to meet certain requirements. For example, with US Bank, I simply need to make a direct deposit to my account to keep it active. My Wells Fargo account has the same requirements, so I've kept both open. And since someday I may want to open a credit card with either or both of those banks, I avoid closing my accounts with them, if possible.

Finally, keep in mind that bank bonuses apply to those with a business as well. Often, you can double dip by signing up for a personal account and a business account. As always, check the fine print.

Shopping Portals

Who has time to shop when you're busy traveling the world? If you're like us on the ToP team, most of your shopping happens online.

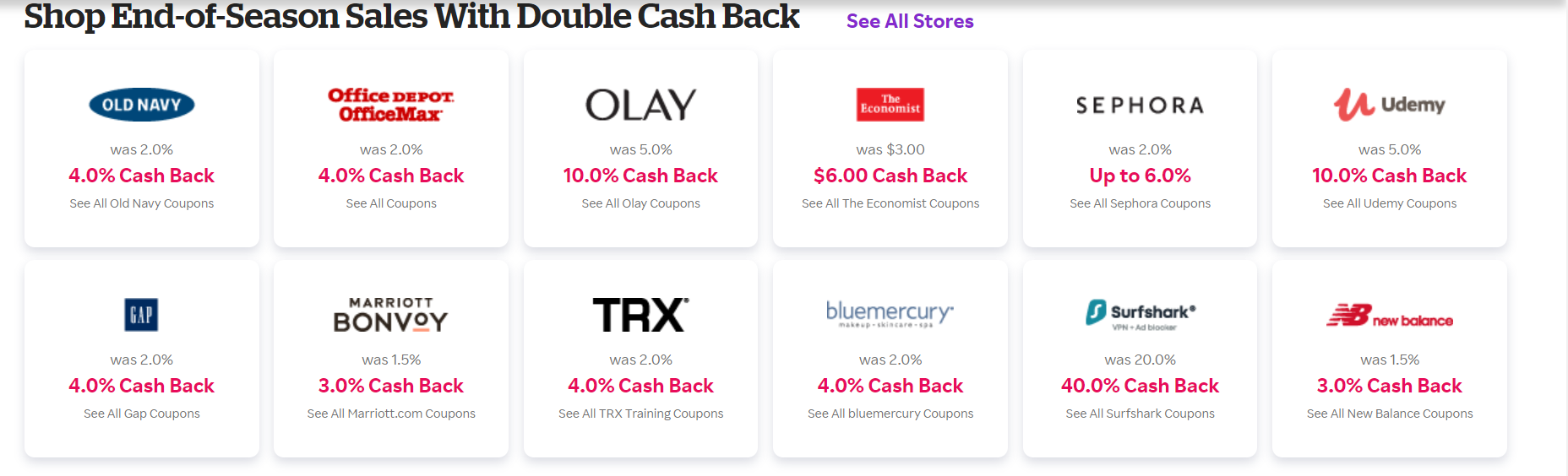

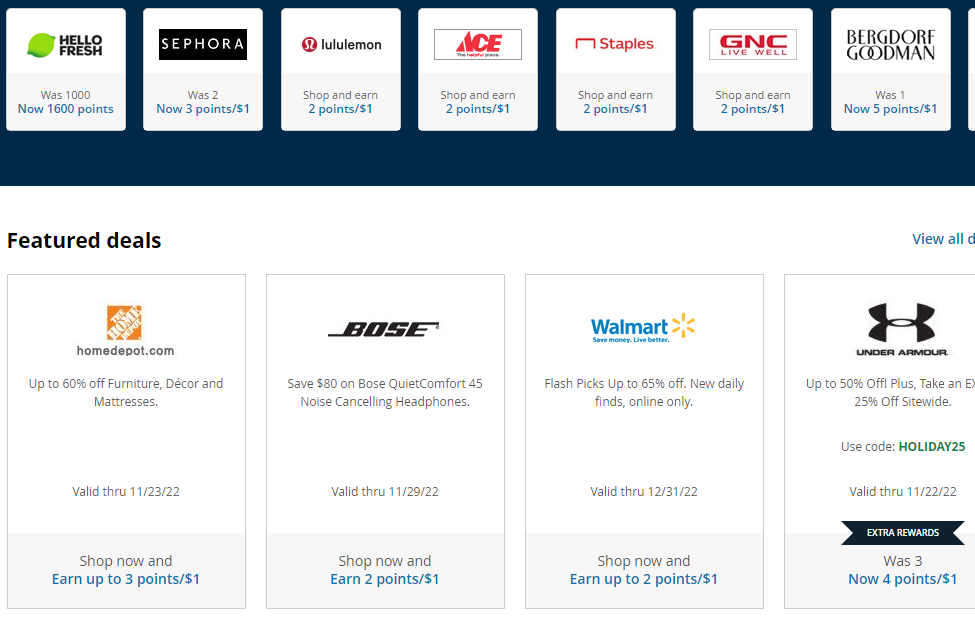

Many rewards programs have a shopping portal that offer extra rewards points for shopping through their site. Even better, there is no specific credit card necessary. Our favorite tool for shopping portals is Cashback Monitor. This site tells you what each portal offers for a particular site you're using, so you can decide which one to use to maximize your earnings.

There are cash back only portals like Rakuten that will pay you (once a quarter via check) for your purchases. Just sign up for an account, and before your next online shopping purchase, go to the Rakuten website first. They frequently run promotions with up to 15 cents back per dollar spent. You can read our Rakuten guide here.

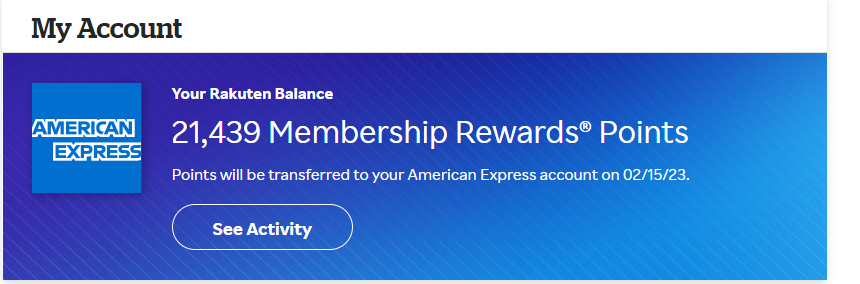

If you have an American Express card that earns Membership Rewards, you can sign up for a Rakuten account that will earn you Membership Rewards points instead of cash back, if you prefer. [Spoiler alert, we value Membership Rewards higher than 1 cent per point, so a Rakuten account that earns Membership Rewards could be more valuable].

Chase has its own shopping portal that you can use if you have any of their Ultimate Rewards earning cards to help you accumulate those points faster. There are also portals for the major airline loyalty programs, if you're trying to accumulate those miles with a specific redemption in mind. Keep in mind that, according to its terms, the Chase shopping portal will only award bonus points for purchases made with your Chase cards.

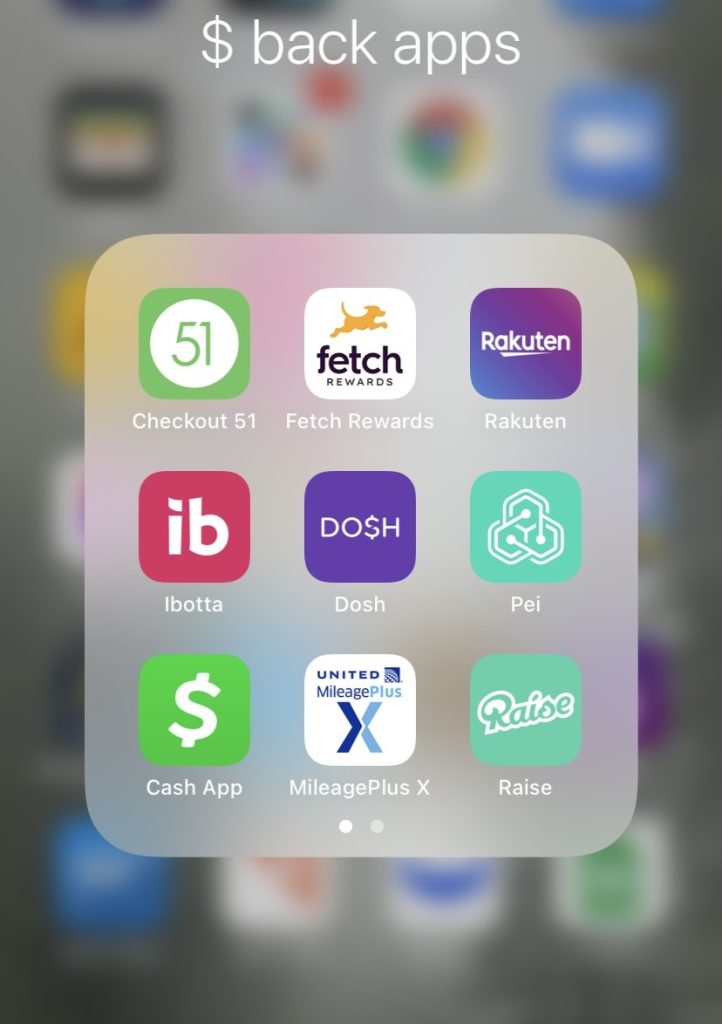

Rebate Apps

Another way to save is through rebate apps on your phone or computer. Each of these work somewhat differently, but give you cash back for your purchases.

Receipt Apps

Ibotta: While widely considered a grocery shopping app, Ibotta actually has many retailers available and even its own shopping portal. You simply add offers to your account and get cash back when you redeem them. Our full review is available here.

Upside: Claim offers in the app (note the limited time you have to redeem), complete your purchase, and upload a picture of your receipt to earn cash back through the app. Upside use may be regional and location specific, but growing. It can stack with Shell Fuel Rewards to earn you even more cash back on your purchases at Shell.

Fetch: Fetch is a receipt scanning app that only requires a picture of your receipt – no scanning of UPC codes or anything additional. At a minimum you will earn 25 points for each receipt. You can earn up to thousands in additional points by buying special items at the store. You can also link Fetch to your Amazon account to earn on Amazon purchases. One of my favorite Fetch deals is when they offer points for Safeway/Albertsons purchases of a certain dollar amount. This means you can even earn points for buying a gift card. You can then redeem these points for gift cards at various retailers at a typical rate of 1,000 points:$1. You can read our full review of Fetch here.

Portal/Credit Card Linked

Do$h: Download the app, link your credit cards and earn cash back for in-store and online purchases. The app tells you which offers are available, but you don't have to choose or add them in advance. Read our full review here.

Payce: Similar to Dosh, this app has offers that can be activated monthly. You link your credit card(s) to the app to earn cash back. Payce is one of the slowest to pay out, but again, free money. Read our full review here.

TopCashBack: Another cash back portal similar to Rakuten. Some of the payouts can seem a bit slow but I have had no issues otherwise. They also cover Amazon devices.

Other Apps

Groupon: Groupon is available online or on the app. You can also link to a Chase-earning card to earn Groupon bucks. Read our full review here.

Mileage Plus X (MPX app): This is the United app for earning extra miles for simply making a purchase (technically of a gift card) via the app. This can work in a couple ways. One example, is Starbucks. You can buy a gift card and then turn around and load it to your app. Secondly, you can pay for a purchase in person at a store or online by simply entering the amount, which automatically purchases a gift card in that amount. You then enter or scan that digital gift card right at the register.

Fluz: A fantastic app and website. You can buy gift cards for various merchants and earn cash back. There are also lots of other uses, including gift cards that code for various categories. Sign up here.

Stacking

Stacking is when you combine one or more offers to earn more points or save more money. Here are a couple examples of stacks I completed.

I ordered meal delivery kits from Green Chef. When I signed up for the service, I went through Rakuten, which earned me cash back and a discount on my first three orders. In addition, I used a Chase offer for 20% off. I saved via Rakuten and then used Chase offers to save an additional $6.59, making my first week only $25 for three meals with two portions each.

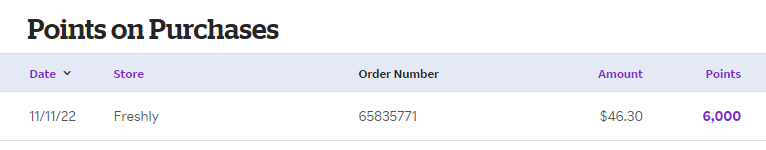

American Express Offers are another way to stack. Recently, I did a different meal delivery service. I received $10 off my order of $50 or more with an Amex offer. I also shopped via Rakuten, which earned me $60. However as we mentioned, since you can have your account link to a Membership rewards earning card, this earned me 6,000 MRs. Sometimes these meal deals will net you almost no cost or many points in return.

I can also buy gift cards at a grocery store, which now puts me in the grocery category where I have cards that earn more. I earn 4x with my American Express Gold Card(review) or sometimes Chase cards have a temporary grocery bonus as well. Next, I go through Rakuten to earn points or cash back on my purchase and pay with the gift cards I purchased at the grocery store. Many times, even when using a gift card, the portal will track the full amount. For example, when making a $100 purchase with a $50 gift card, the portal will still credit you for a $100 purchase. As we like to say, your mileage may vary (YMMV). Either way, I come out ahead points-wise.

There is no right way or wrong way to do this. Extra savings and points earnings is what it's all about. Typically you can add a card linked program plus a portal and perhaps even a credit card offer like Amex or Chase offers.

Gas Saving Programs

Many gas stations and grocery stores have points programs that allow you to earn credits towards your fuel purchases. One of my favorites is Fuel Rewards, which are redeemable at Shell stations around the country. You can earn savings directly through Fuel Rewards, or you can link other rewards programs to redeem your points through Fuel Rewards on gas at Shell. Some of us in the ToP team have linked our Giant card to Fuel Rewards and have seen the savings pile up.

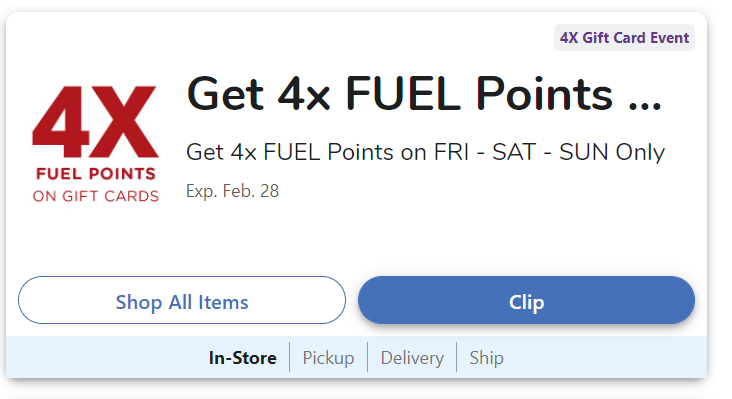

Grocery store gas points programs can also be a source of great savings on their own. Many have bonus gas points promotions, including on buying gift cards (which you can then use to cover other ordinary expenses). Check the weekly circular (available on the store's website) or the mobile app to add digital coupons. Keep in mind that some of these programs like, the Albertson brands and affiliates, let you use these points for gas or groceries discounts.

Final Thoughts

You might be reading lots of information on points, miles, and sign-up bonuses. However, by overlooking some of the methods we have mentioned above you could be leaving free money on the table. That free money could be to the tune of hundreds of dollars a year, if not more. All for simply doing one or two bank accounts per year or scanning some receipts for a few seconds after each shopping trip. Making one extra click before online shopping can be the most valuable of them all. Just like investing, I like to diversify, and this is no different.

As a reminder here are all of our sign-up links:

Are you earning cash back via apps? Come over to our Facebook group and let us know your thoughts.

Travel on Point(s) has partnered with CardRatings for our coverage of credit card products. Travel on Point(s) and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.