I am a big proponent of banking relationships. We preach this in the Travel on Point(s) Facebook group and any time we talk about about velocity and pace in this hobby. I rarely cancel cards if avoidable and try to maintain those positive relationships. Having signed up for a lot of new business cards in 2021 led me to have some decisions with cards in 2022. I had received several No Lifetime Language offers on business cards leading me to have a surplus of American Express Business Gold Cards(review). I took to Amex chat to cancel one of these cards as I usually do.

Table of Contents

ToggleThe Chat

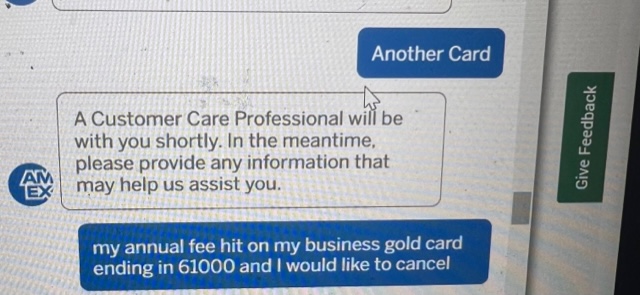

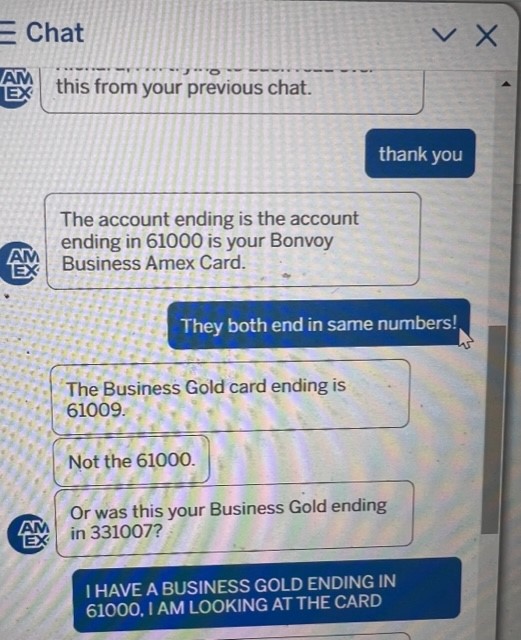

I actually made several attempts to chat. My plan was to cancel since I had already tried to get a retention offer on several occasions without any luck. I found myself too late in the day on a couple of occasions. Each time I was clear in my intention. I said things like “My annual fee hit on my Business Gold card ending in 61000 and I would like to cancel.”

Card Cancelled

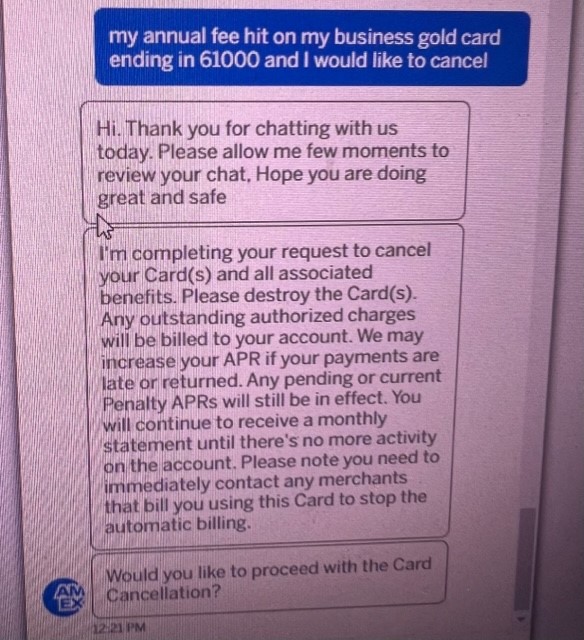

On my third attempt, I got through in time. Again, I used the same phrasing and found the rep quickly start the cancel process. As you can see in the screenshot, I specified the card and the last five digits. You'll also notice the Amex rep never identified the card, just the card number.

Once this was done, I felt confident everything was handled. The chat was fast and I went on with my day. Because I was working, I did not go into my Amex app until the next day, which is when the nightmare began.

Wrong Card Closed!

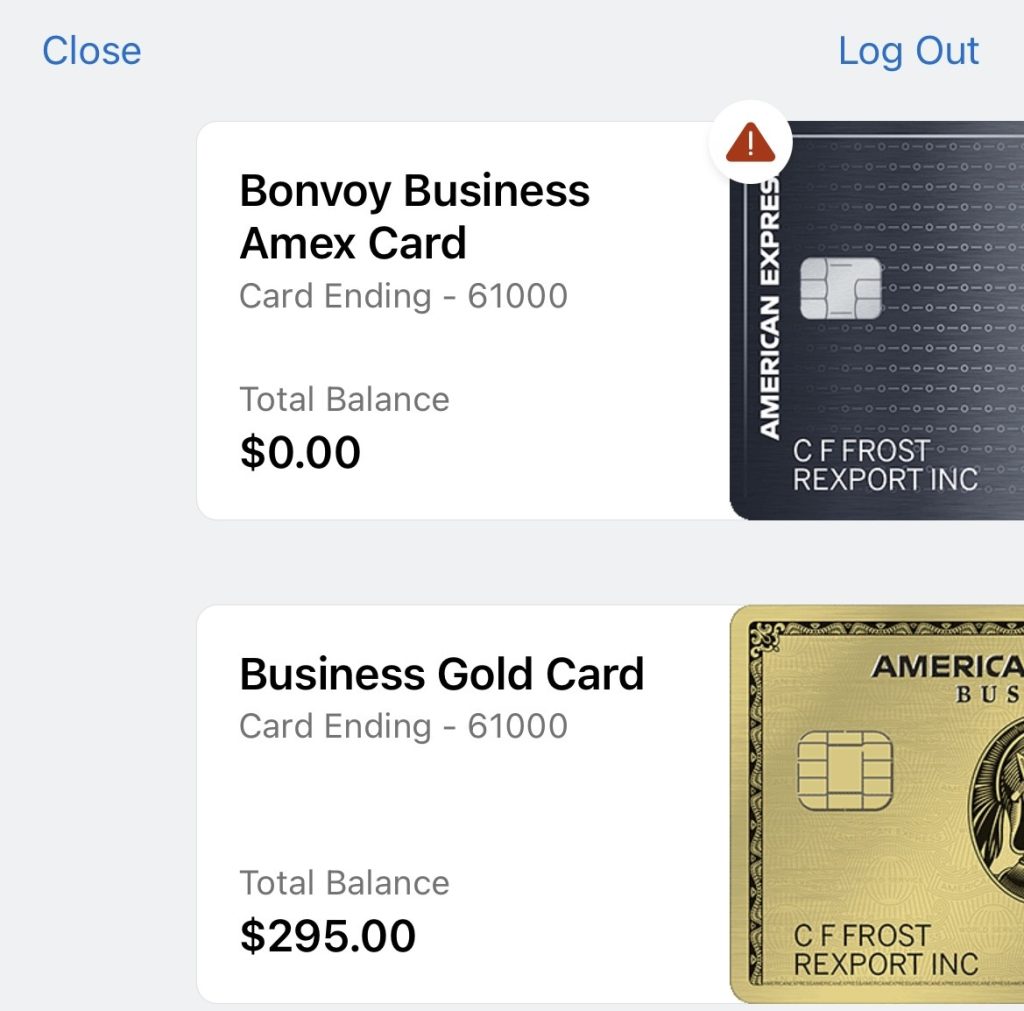

That next day, I opened my Amex app as I usually do several times a day. I noticed something alarming when I looked through my cards. Amex closed my wrong card! The Amex chat rep had closed my Marriott Bonvoy Business American Express Card(review), which also ended in 61000. While that card will be on the chopping block potentially too, I had just received the card in December. This meant by closing the card before year one was up, I would violate Amex's terms and conditions and risk losing that card's sign-up bonus. Closing a card in year one is one of the biggest mistakes in this hobby. I immediately started imagining a claw back, as well as the potential for an Amex pop-up jail. Pop-up jail is where Amex will not approve you based on your relationship with them, lack of spending, or ineligibility for a welcome offer.

Next Step

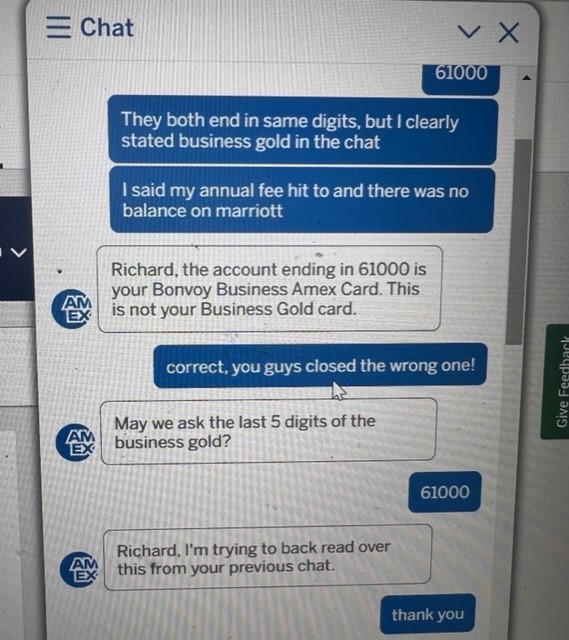

My first thought was to chat again. As I did, I could still see my entire chat history. This reaffirmed my belief that I had done everything correctly in my request.

This began what was serious of confusing and frustrating chats and phone discussions with American Express representatives. First up, they tried to say I did not have a Business Gold card ending in 61000.

This is a case where having too many American Express cards is an issue. They continued to insist I did not have the cards I did and I became frustrated. I gave up quickly on the chat feature this time and decided to call. At this point, I was able to get a representative to file what is called a “Request to reinstate.” I was told I would hear something in 7-10 days.

Follow-up

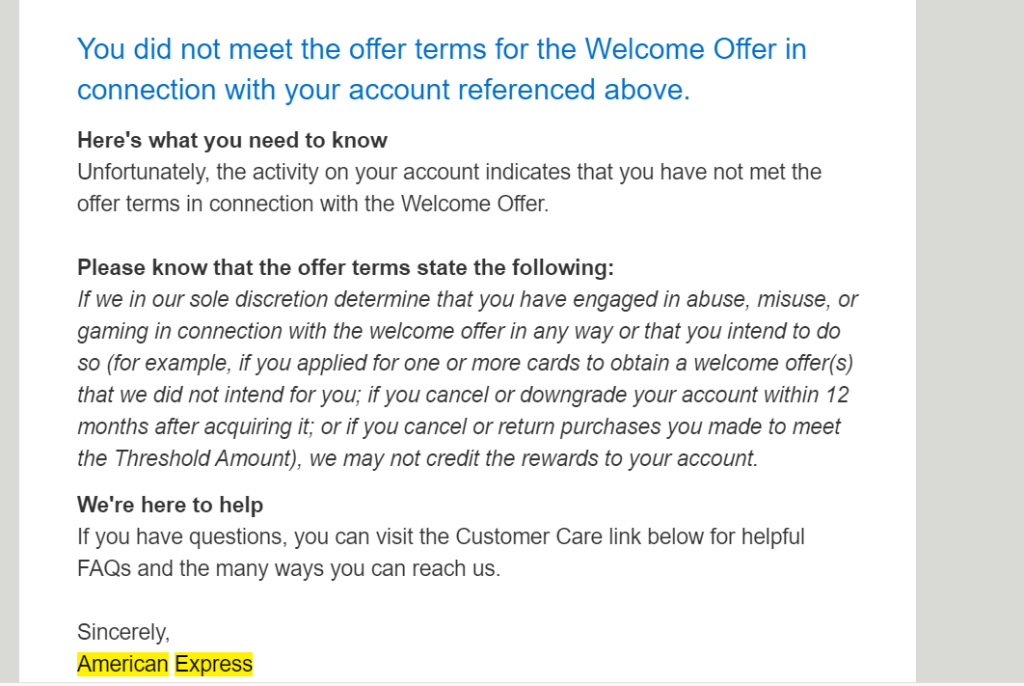

The wait was frustrating. It became apparent to me at this point that I would have to pay the annual fee and keep this particular Business Gold card. I did not want any other issues and keeping the card open would help make my case. Anger set in as I now received an email from American Express that I violated the terms of the Marriott Bonvoy welcome offer.

This made me upset and I had not heard anything, so I decided a phone call was in order. This phone call gave me no answers and further dug into my confusion for me. First, the rep wanted to initially do another request. Secondly, she could not tell me anything about the status of my previous request. The outcome was her giving me a “case number” and stating she was emailing it to the right department. With each call, the reps apologized to me several times. It was as if the reps knew this happened, but could not seem to give me information or speed up the process

The Letter

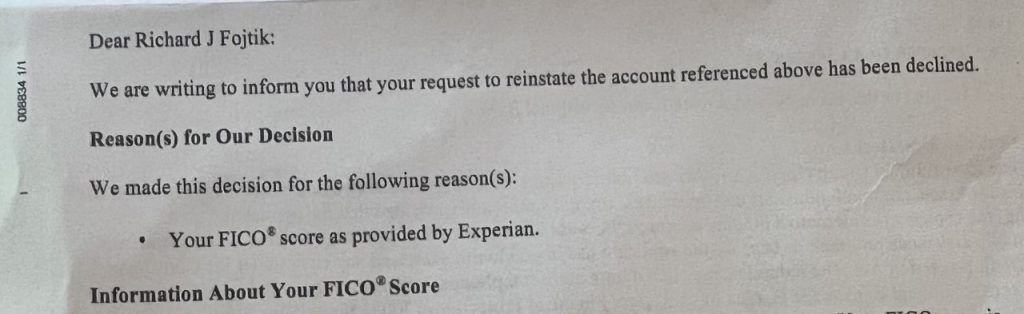

After this phone conversation, I happen to check and read my mail. Now I had received a denial letter on my request. The odd thing was it claimed credit score was the reason. This did not make any sense to me. Nor did it address the fact that remained, which was I never requested this card to be closed.

Now I was becoming angry. I got back on the phone but this time using the number on the letter. This seemed to stream me to another department. I relayed all the information as I had done with each chat and phone call. This is where I felt my luck begin to change, but not before more anger. This representative stated the first rep submitted the initial request incorrectly! When a “request to reinstate” is completed, the reps have options. The first rep used an option about me being unhappy, rather than using representative error. Yes, Amex has “representative error” as an actual choice, which says all you need to know. The rep told me he would not be able to update me further and I would only find out via a letter in the mail. Again, the rep apologized to me several times.

Final Outcome

Despite me receiving yet another denial letter, my Bonvoy Business card was reinstated. I noticed a few days later it had appeared in my app without the red cancelled warning. Due to the time all of this took, I did keep the Business Gold card, costing me the $295 annual fee. I still do not know the impact this will have on any future applications, if any. I am still mad and was already having a busy month without credit card relationship stress. Clearly, I was Bonvoyed by American Express.

Have you ever had a card cancelled like this? Come over to our Facebook group and let us know your thoughts.