Freezing Your Credit Report

Capital One can be one of the more fickle banks in terms of approvals. We hear lots of different theories in the Capital One approval lore. Between applying on the third Thursday of every month and all of the other crazy techniques we have heard, there is one that actually seems to work. That technique involves freezing one of your credit scores. Further, Capital One has little to no reconsideration process, so this technique can be helpful for ensuring you get approved. In this article we will walk you through a tried and true method of freezing your credit report before a Capital One application.

Table of Contents

ToggleWhy The Freeze?

Of all of the banks, Capital One appears to be particularly inquiry sensitive. This means that Capital One does not like to see applicants have a ton of inquiries on their credit report. This can be tricky, since the longer you have been in this hobby the more inquiries you are likely to acquire. As you apply for more cards, naturally you pick up more inquiries. Because of this roadblock, many folks in the points and miles space will tell you to start with Capital One. This advice is at odds with the 5/24 rule, which states you should focus on Chase cards while starting out. However, by freezing your credit report you can improve your odds of a Capital One approval. This means that there is little reason to start with Capital One, since there is still hope past 5/24.

Why Freezing Your Credit Report Helps With Capital One Applications

As we mentioned, Capital One can be inquiry sensitive. How can freezing your credit report help with that though? After all, Capital One does need to see your credit score in order to approve you. The opportunity lies within the way that Capital One processes credit card applications.

Capital One pulls all three credit reports for all applicants of credit cards. Despite pulling all three, Capital One will approve you with just two available to them. This provides the opportunity for you to freeze one of your credit reports to improve your odds. There is a side bonus that only two credit reports are pulled this way instead of three.

Most banks do not pull all three reports, this means that more likely than not, one of your credit reports has more inquiries than the others. What bureau each bank pulls can vary based on the state you are in, so we will walk you through how to check which one you should freeze.

Capital One Cards this Works With

This technique works with all Capital One credit cards. Some of the most common cards we have seen this technique used for are the Capital One Venture X Business card and the Capital One Venture X card.

How to Complete the Capital One Freeze

There are a couple of steps in order to complete the Capital One freeze. We will walk you through all of the steps and considerations needed to help you receive a Capital One approval.

Step 1: Reviewing Credit Karma

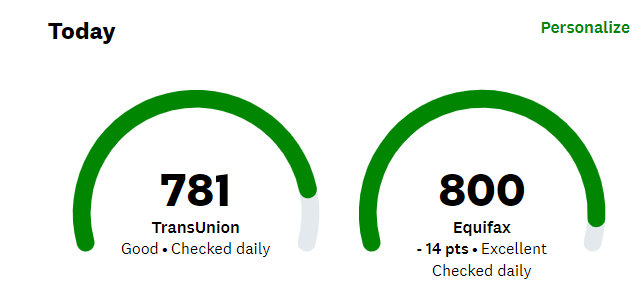

The first step to competing this process is to determine which of your credit reports has the most inquiries. Again, this will vary by person so you should confirm which has more for you. If you log into Credit Karma you can retrieve how many pulls you heave on either TransUnion or Equifax.

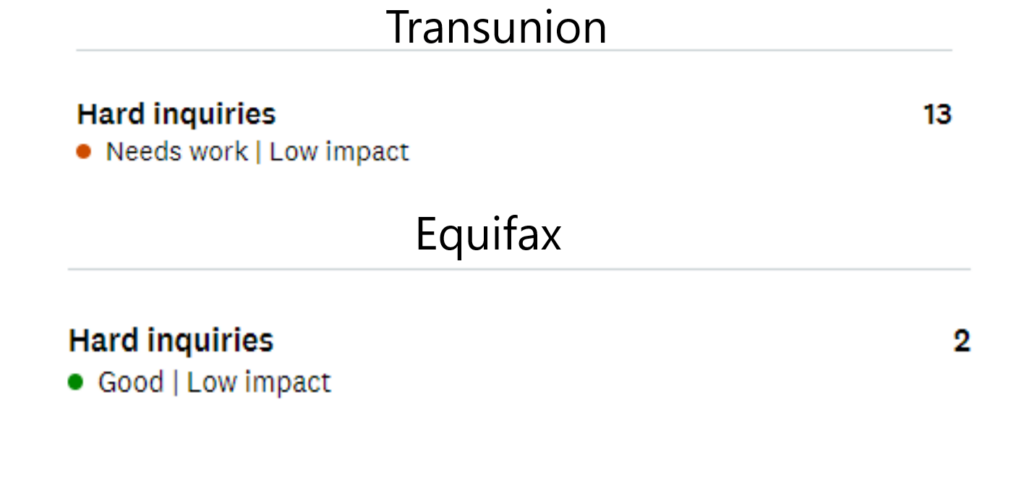

Step 2: Reviewing Which Score to Freeze

Once you are logged into Credit Karma you will see both of your scores. The score isn't what we are looking for, though: it is the inquiries. If you click into each score you will see a tally of how many inquiries each has. As you can see below, for myself, TransUnion has the majority of my inquiries. I have 13 inquiries with TransUnion but only 2 with Equifax. This would mean the correct method for me would be to freeze my TransUnion credit report since it has more inquiries.

Step 3: Freezing Your Credit Report

Once you have determined which score you would like to freeze, the next step is to freeze that credit report. You can do so by reaching the bureau directly or creating an online account. See below instructions for either bureau. Remember, the idea is to freeze one or the other, and not both. So you should follow either step 3a or 3b but not both.

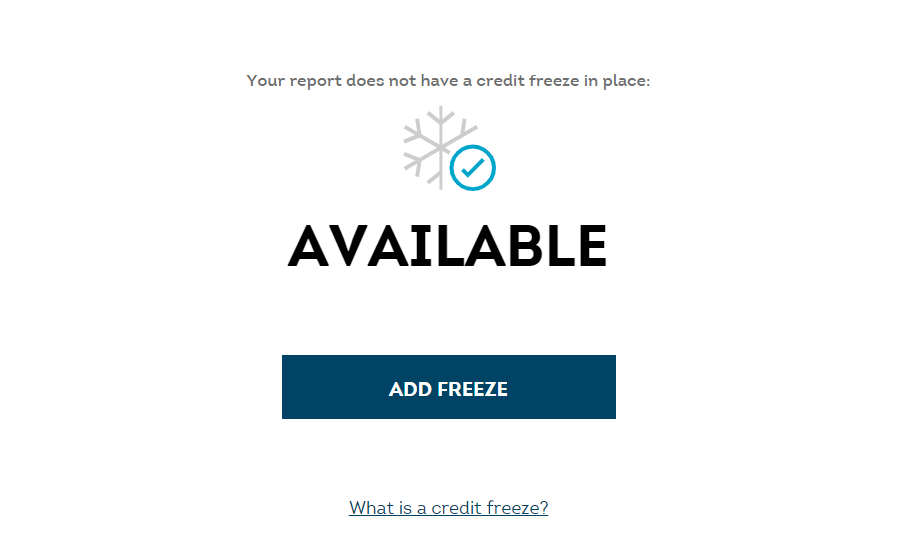

Step 3a: Freezing your TransUnion Report

If TransUnion is the bureau you would like to freeze then you can head on over to their website and freeze your score there. Alternatively, you can call TransUnion at 1-800-916-8800 to complete a freeze over the phone. By far the easiest way to complete the freeze is on their website though. You can freeze and unfreeze by the click of a button.

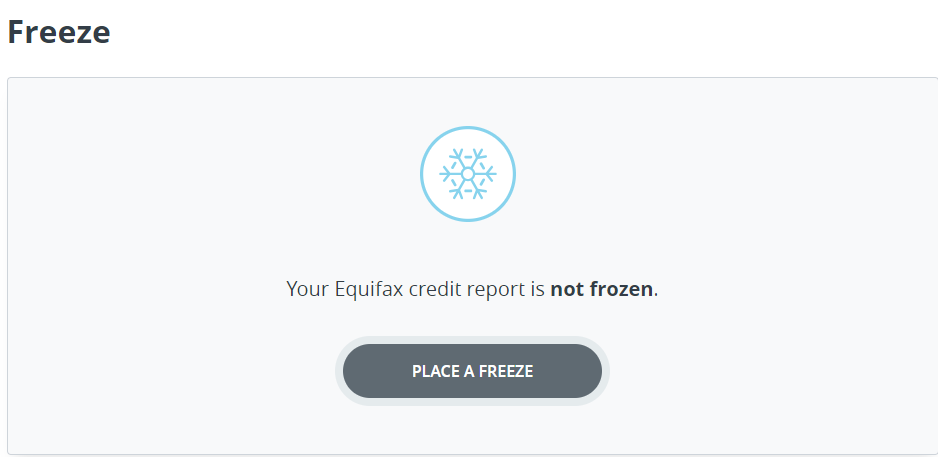

Step 3b: Freeze your Equifax Report

Similarly, if Equifax is the bureau you would like to freeze then you can head on over to their website and freeze your score there. Alternatively, you can call Equifax at 1-888-298-0045 to complete a freeze over the phone.

Step 4: Completing your Capital One Application

The last and final step is to go ahead and complete your credit card application. Now that one of your reports is frozen, Capital One should only be seeing the two (of the three) reports with fewer inquiries. Hopefully, this will increase your chances of approval and save an extra hard pull.

Capital One Application Process: ToP Thoughts

There is a plethora of application rules and preferences out there in the Travel on Point(s) realm. By knowing about Capital One's preference for applicants with fewer inquiries, you now know how freezing your credit report can help with applications. If you are just starting out, then this is your next step after working through the 5/24 rule.

Have you had success getting an approval with this technique? Let us know about it over in the ToP Facebook group!