Like Amex, Chase regularly features offers for certain merchants on its credit cards. These offers can save you money on purchases you were already planning to make. Unlike Amex Offers, Chase Offers come only in the form of cash back. This ToP guide to Chase Offers will walk you through the basics about Chase Offers and how to maximize them.

Table of Contents

ToggleWhat Are Chase Offers?

Chase cards can receive statement credits for cash back for making purchases with certain merchants. Like with Amex offers, the types of retailers cover many industries, such as restaurants, shopping, and travel.

Offers will vary among Chase cards. So make sure to check each of your cards for different offers. If the same offer appears across multiple cards, you can add it for each of those cards. This is a nice difference from Amex Offers, where you can only add one offer across all of your cards.

How to Access and Add Chase Offers

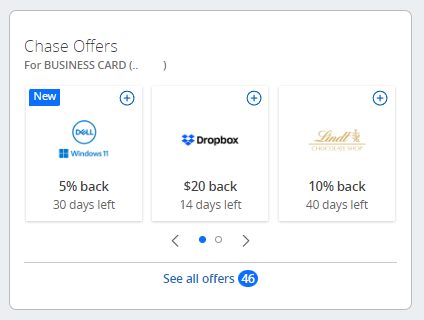

Chase Offers appears right on your home screen when you log into your Chase account. You can also access them via the Chase mobile app.

Chase displays only a few offers at first, but you can click “See all offers” to display all offers available on your card. In the screenshot above, Chase displays some of the offers available for one of my business cards.

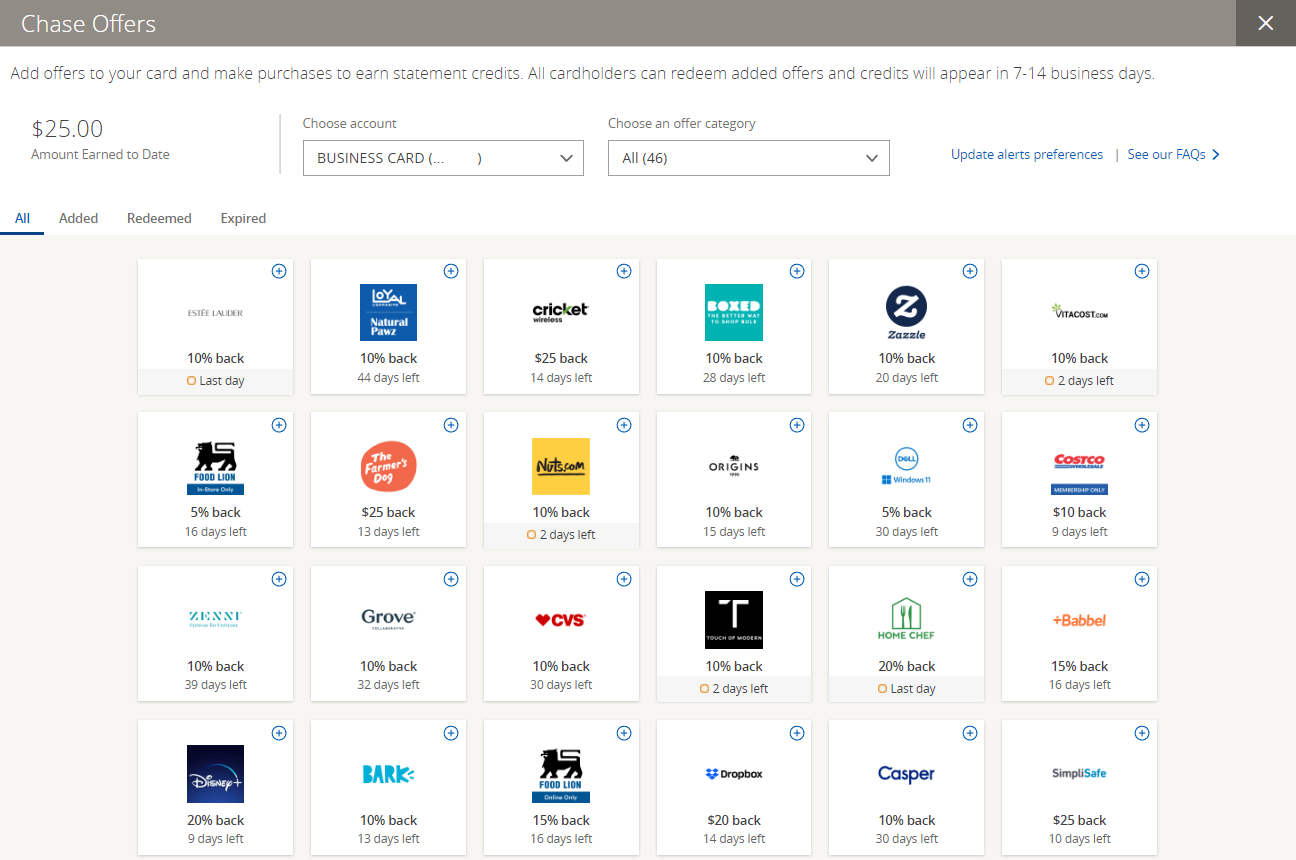

Once you click “See all offers,” the next page displays a lot of information about Chase offers. This page will have everything you need, so let's break this down. First, here is a screenshot of what the full page looks like:

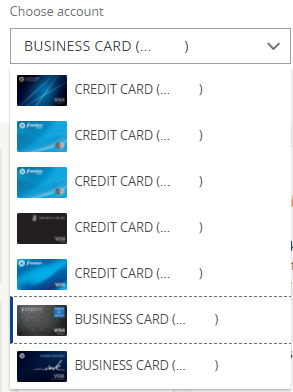

First, you can select which of your Chase cards you want to view offers for. Just click on the dropdown under “Choose account”:

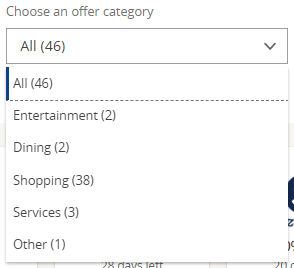

Next to that, you can sort your offers by categories. These include entertainment, dining, shopping, services, and other.

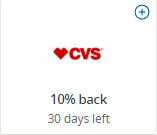

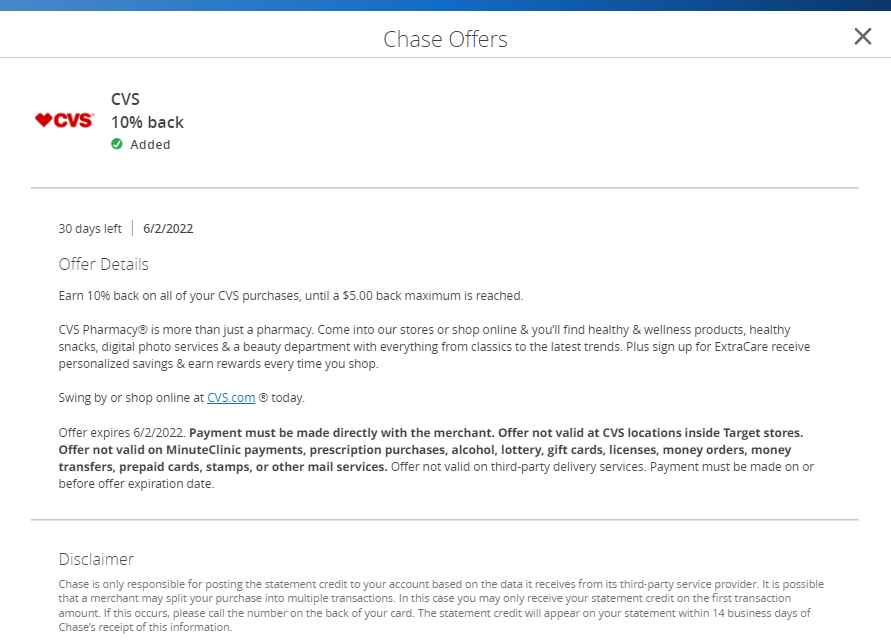

Each offer has its own terms and conditions. The thumbnails on the main page just show how much cash back you can receive. But they don't show you the amount of spend required. For example, this screenshot shows I can earn 10% back at CVS. But it doesn't say how much I need to spend, whether there is a cap on that 10%, and whether the offer applies in-store or online.

To read the offer's fine print, simply click on the offer. Keep in mind that by clicking on the offer, you are adding it to that card. Thankfully, you can add the same offer to multiple Chase cards if they are available for other cards. This is different from Amex. We highly recommend reading the offer's terms and conditions to make sure you trigger the offer properly. Reading the fine print can help avoid silly mistakes like making an online purchase for an offer that requires the purchase to be in-store.

To add an offer to your card, simply click on the offer thumbnail. As mentioned above, you can add the same offer to multiple cards, as long as that offer is available on your other cards. For example, you can add the same CVS 10% offer to your Chase Freedom Flex and to your Chase Sapphire Preferred if the offer is available on each of those cards.

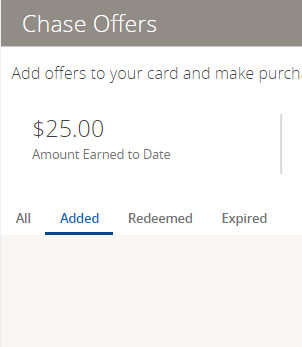

Once you add an offer to your card, you can view it among other added offers by select the “Added” tab at the top of the page. This is helpful for double checking which card you added an offer to, or for confirming offer details in the fine print.

You can also see which offers you have redeemed or have expired by clicking on the relevant tab.

Choosing Which Card to Use a Chase Offer

If a Chase Offer is available on more than one card, how do you decide which card to use it? If available across multiple cards, you can try to use the offer with each of them. But if you can only use a Chase offer with one card, you should consider a couple of factors.

First, consider using a card for which you need to meet minimum spend. Meeting minimum spend is the fastest way to earn points. Getting some cash back while meeting minimum is just icing on the cake.

In addition, try combining an offer with a card that earns bonus points for the offer's retailer. For restaurants, I like to use my Chase Sapphire Preferred (review), which earns 3.1x at restaurants. The Chase Sapphire Reserve (review) is also a good option for restaurants, since it earns 3x. For pharmacies, like CVS and Walgreens, I prioritize the Chase Freedom Flex (review), where it earns 3x.

Using (and Stacking) Chase Offers

Once you've added an offer to your card, you just need to use your card to make a qualifying purchase with the merchant. There is no need to click through anything on Chase's website to make the purchase (but you can certainly click through the Chase shopping portal for some extra points, as described below). You also do not need to go back to Chase to confirm that you have made a purchase.

Chase Offers are a opportunity to stack some deals. Generally, you can stack Chase Offers with shopping portals like Chase's shopping portal and Rakuten, and cashback apps like Dosh. Retailer-specific coupons and promo codes usually work as well, but make sure to check the Chase offer's fine print. Of course, you'll still earn valuable points through your Chase card as with any other purchase.

You should expect returns or order cancellations to result in the cash back credit being reversed.

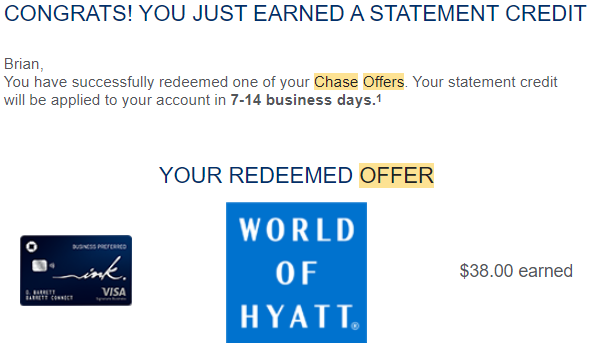

If your purchase triggers the offer, you should receive a confirmation email from Chase. Email confirmations usually arrive quickly, but sometimes they may take a while. Statement credits post within 7-14 business days. Chase tracks whether an offer is used based on the transaction date, rather than when the transaction posts.

Keeping track of how much you've saved through Chase Offers is simple. Chase shows the amounts saved to date on the upper left corner of the screen. The amount shown applies to whichever card you are viewing offers at that time.

General Tips

When you see an offer that you like, go ahead and add it. There is no limit to the number of offers you may add, nor is there a penalty for not using an offer.

Remember that you can add the same offer across multiple cards if that offer is available. For instance, if an offer is available for both your CSP and your Freedom Flex, you can add it to both cards. This is a good opportunity to save twice as much if the merchant allows you to split payments.

Only the primary cardholder can see and add offers. But purchases by authorized users can also trigger a Chase Offer. So keep the spending habits of your authorized users in mind when browsing Chase Offers.

According to Chase, the offers you receive are based on how you use your credit card. If you recently opened your account or rarely use your card, you may see fewer offers until you begin to use your card more often. Indeed, the number of offers available across my Chase varies from several dozen offers to as few as 6 offers. My cards with the heaviest spend, like my Chase Sapphire Preferred (review) and Chase World of Hyatt Business card (review), have the most offers available.

Lastly, Chase has a helpful FAQ on the top righthand corner of the Chase Offers page. Just click “See our FAQs” to learn more about Chase Offers and how they work.

Final Thoughts

Chase Offers are a great way to save some cash while still earning points. Checking each of your cards regularly for new offers can be quite rewarding. Remember that Chase Offers are an excellent opportunity for some serious stacking where you can own lots of points while still saving money.

How do you maximize Chase Offers? Come over to our Facebook group and share your thoughts!