How Do Amex Offers Work?

The American Express Amex Offers program is a great benefit that can save you some money on your next purchase. Amex regularly offers bonus points or cash back for using your Amex card at many different retailers. In this guide we will answer the questions, how do Amex Offers work, what they are and where to find them on your account. These can add up to hundreds of dollars in savings each and every cardmember year.

Table of Contents

ToggleWhat Are Amex Offers?

Before we answer the question, how do Amex Offers work, we should discuss what Amex Offers actually are. The simplest way to think of Amex Offers is that they are a coupon that you can attach to your American Express card. These coupons come in the form of statement credits or bonus Membership Rewards points for making purchases with select retailers. The types of retailers cover many industries, such as restaurants, shopping, and travel. Nearly all US-issued Amex cards have access to Amex Offers.

Different Amex cards have have access to different offers. It's pretty common for some offers to only be available on business cards but not on personal cards, and vice versa. Also, sometimes an offer can be available on some personal cards but not others. These are all targeted offers and some will show on your accounts and others will not.

Amex Offer Rules

The number one rule of Amex Offers is that you can only add an offer once across all of your cards. This is the main difference between Amex Offers and Chase Offers. I should also note that this rule applies regardless of whether you added the offer to a business or personal card. When you add an Amex Offer to one of your cards, that offer cannot be added to any other cards that share your Amex log-in.

You can add the offer to your card and to a player two's card though (spouse, child or significant other). This includes authorized user cards on your account that are attached to another person.

Where To Find Amex Offers & How To Add Them

Here are some step by step instructions on how Amex Offers work. We will go over where you can find them on your American Express account and how you go about adding them to a specific Amex card.

Step 1: Find The Amex Offers Section On Your Account

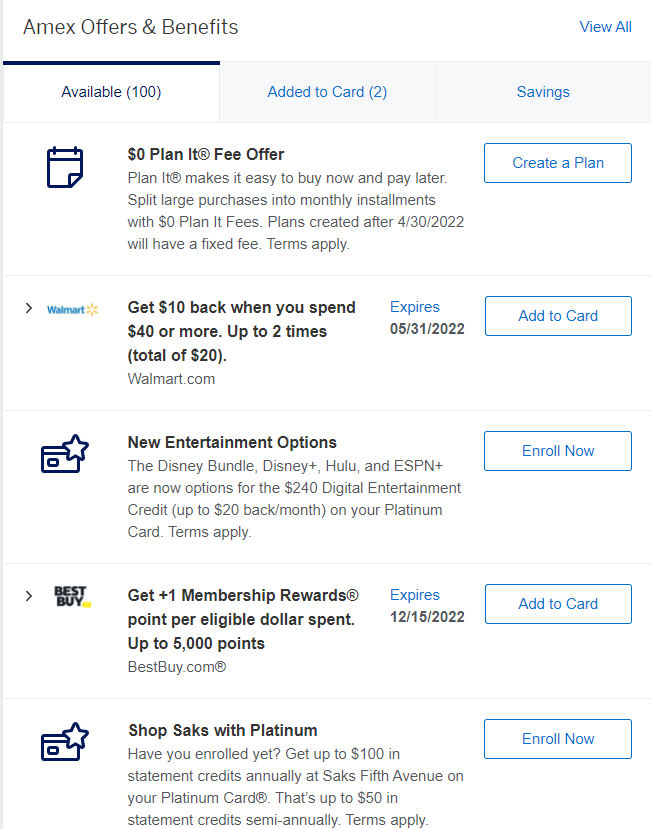

Amex Offers appears right on your home screen when you log into your Amex account. Just scroll down past your recent transactions and you will see the heading “Amex Offers & Benefits.”

In addition to Amex Offers, the list includes card benefits, such as the $240 digital entertainment credit available on the Amex Platinum card.

Step 2: Select View All To Access Up To 100 Offers

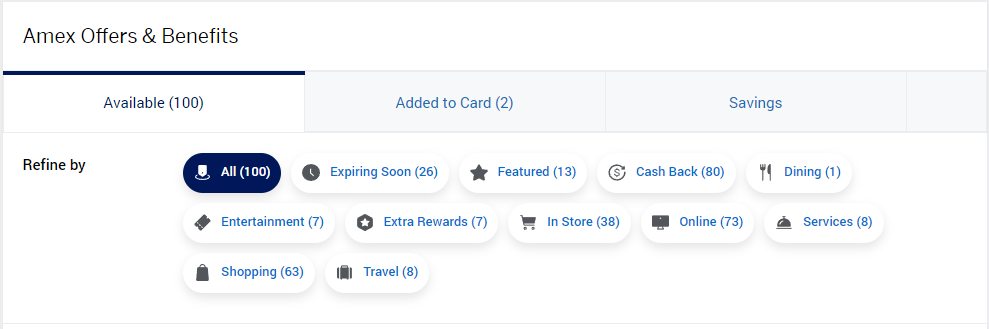

Amex displays only a few offers at first, but you can click “View All” to display all 100 offers available on your card. Clicking to “View All” takes you to a separate page listing the maximum of 100 offers. You may want to add offers you don't plan to use to a sock drawer card so that Amex will backfill your offers back up to 100. There could be offers you are missing out on because you are already at your 100 offer cap.

On this page, you can refine the available offers by categories. These include offers expiring soon, offers involving cash back or extra MRs, online or in-store offers, and by merchant category.

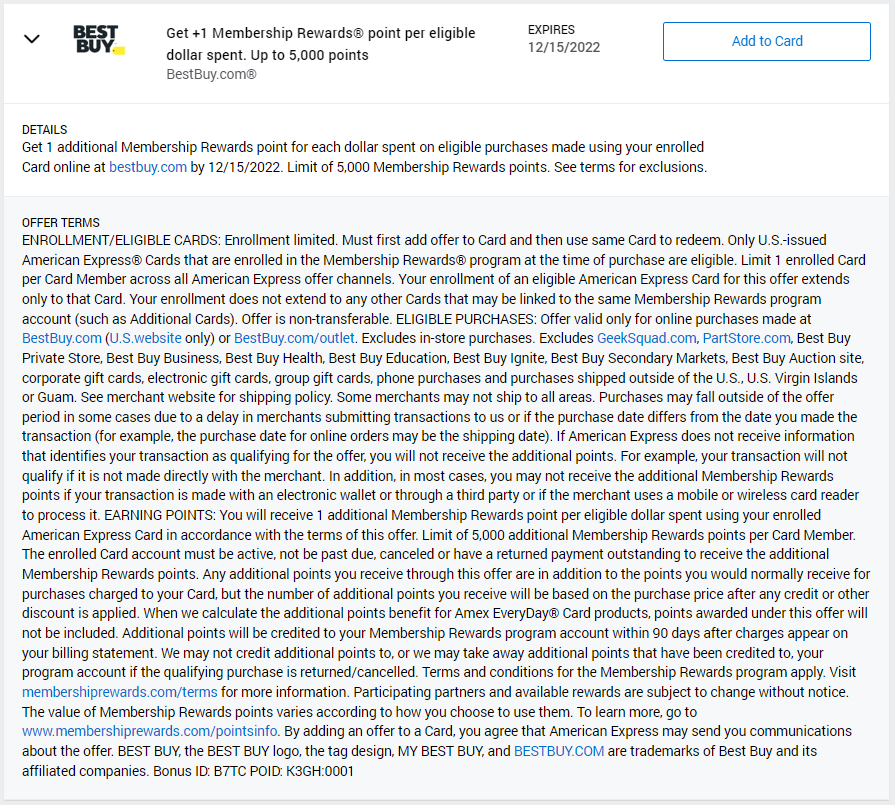

Step 3: Check The Amex Offer's Terms & Conditions

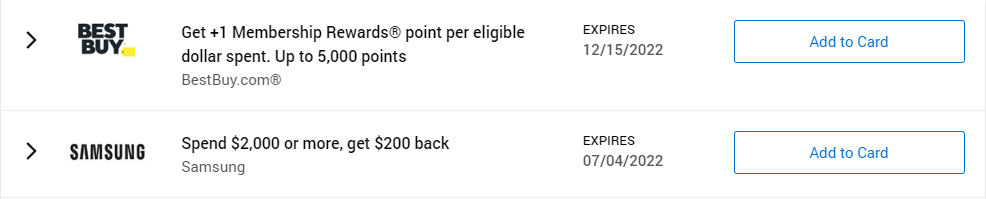

When figuring out how individual Amex Offers work, it is important to check the fine print. Each offer has its own terms and conditions. The initial display provides basic information, such as the name of the retailer, the general terms of the offer, and the expiration date. This screenshot shows two different types of offers, one for extra MRs, and one for a statement credit:

To read each offer's fine print, simply click on the offer. We highly recommend reading the offer's terms and conditions to make sure you trigger the offer properly. Reading the fine print can help avoid silly mistakes like making an online purchase for an offer that requires the purchase to be in-store.

Step 4: Add The Amex Offer To Your Card

To add an offer to your card, simply click the “Add to Card” button next to the offer. As mentioned above, once you add an offer to one of your cards, that offer will disappear from the other cards in that same log-in.

However, authorized users with their own log-in have access to their own Amex Offers. Adding an offer to one of your cards does not preclude your authorized users from adding that same offer to their cards.

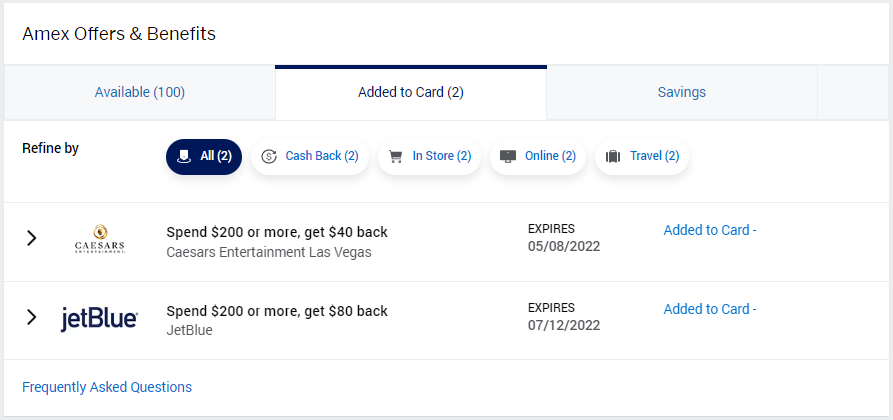

Step 5: How To Quickly Find Added Amex Offers

Once you add an offer to your card, you can view it among other added offers by select the “Added to Card” tab at the top of the page. This is helpful for double checking which card you added an offer to, or for confirming offer details in the fine print.

Choosing Which Card to Add an Offer

One of the keys to understanding how Amex Offers work is deciding the right card to add the offer to. Here are some factors to consider:

- Minimum spend:

- I usually prioritize meeting minimum spend, so I try to add offers to whatever card I am working on meeting minimum spend. The same goes for cards with a retention offer that requires meeting some amount of spend to earn the retention bonus.

- Bonused spend:

- Matching an offer with a card that earns bonus points for that retailer is a great way to double dip. Think adding restaurant offers to an Amex Gold card, which earns 4x at restaurants worldwide, or an airline offer to a personal Amex Platinum card, which earns 5x on flights purchased directly from airlines. For hotel offers, I like to use a co-branded credit card for that hotel brand or the Amex Green card, which earns 3x on hotels.

- Stack with card benefits:

- Some offers can involve an existing card benefit. For example, a Grub Hub offer would be a good way to double dip on the monthly $10 dining credit that the Amex Gold offers, which can be used with Grub Hub, among other merchants. The same goes for offers from Dell, which can be paired with the Amex Business Platinum card's $400 annual Dell credits.

How To Use (& Stack) Amex Offers For Huge Savings

Now that you know how Amex Offers work and how to add them to your card, you just need to use your card to make a qualifying purchase with the retailer. You do not need to click through anything on Amex's website to make the purchase. You also do not need to go back to Amex to confirm that you have made a purchase.

One of the beauties of the Amex Offers program is the opportunity to stack. Generally, you can stack Amex Offers with shopping portals like Rakuten and cashback apps like Dosh. Retailer-specific coupons and promo codes usually work as well, but make sure to check the fine print. You can also stack them with other card benefits, like using a Dell Amex Offer while using your Business Platinum Dell credit.

The terms and conditions usually state that returns or order cancellations may lead to the offer credit being reversed, which is no surprise.

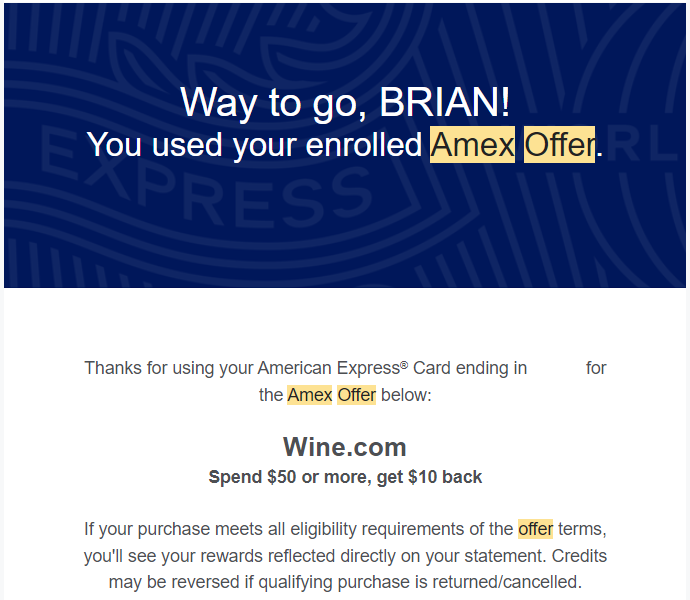

If your purchase triggers the offer, you will likely receive a confirmation email from Amex. These emails can show up in a matter of seconds, but can take a little longer too. On occasion, you might not even receive an email confirmation even though the the bonus MRs or statement credit show up on your account properly.

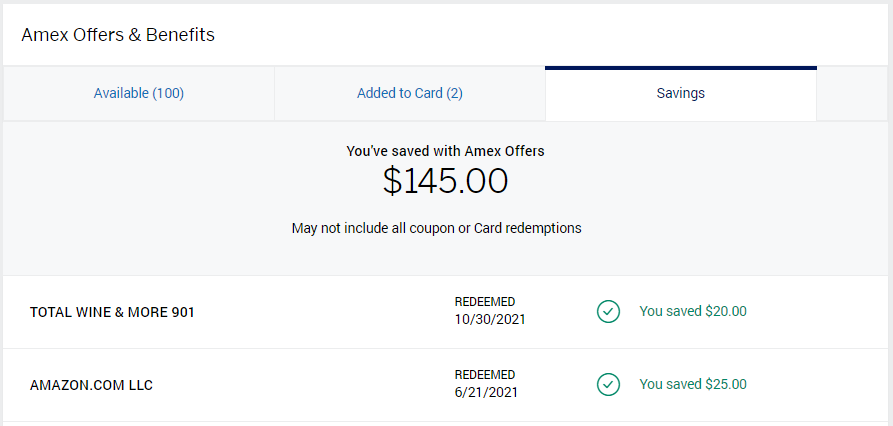

How To Check Your Amex Offer Savings

If you like keeping track of how much you've saved through Amex Offers, there's an easy way to do that. You can click on the “Savings” tab to see a list of redeemed offers.

General Amex Offer Tips

Here are some general tips when using Amex Offers.

Don't Delay

When you see an offer that you like, make sure to register for it quickly. In some cases, there is a cap on how many people can register for an offer. There's no reason to wait to add the offer until you're ready to redeem. That is one of the biggest keys on how Amex Offers work. Act fast, or risk missing out!

Getting Around The 100 Amex Offer Cap

As stated above, if you want to see more than 100 Amex Offers for a card, add a few existing offers to your card. After you log out and log back in, your total available offers should be back at 100 with some new offers replacing the ones you added. I always add the offers I don't intend to use to a card I rarely have in my wallet so it doesn't clutter up my other card's offers.

How Do Amex Offers Work: Choose Points Over Cash

When given the option to choose between receiving Membership Rewards or cash back, Membership Rewards usually make more sense. Sometimes you might see an offer on one card for bonus Membership Rewards, and the exact same offer will appear on another card offering a statement credit instead. In these cases, Amex is valuing Membership Rewards at 1 cent per point. We at ToP value Membership Rewards much more than that, and you can consistently redeem Membership Rewards for way more than 1 cent per point.

The Kind Of Point Offered Matters

Similarly, pay attention to whether an offer is offering bonus Membership Rewards or bonus Marriott Bonvoy points on a Marriott card or bonus Hilton Honors points on a Hilton card. Not all points are created equal. We usually recommend taking MRs over Marriott or Hilton points when given a choice.

How To Best Use Amex Offers

Purchasing gift cards from the retailer often works for triggering an Amex Offer. But you should still check the offer's terms and conditions to make sure it does not exclude gift cards.

How Do Amex Offers Work: ToP Thoughts

Amex Offers are a great way to save some cash or earn extra Membership Rewards on purchases you were already going to make. Checking each of your cards regularly for new offers can be quite rewarding. There's something very satisfying about hitting minimum spend on a new Amex card knowing that you're scoring some additional points on ToP of that nice sign-up bonus. Hopefully after this guide you have a better understanding of how Amex Offers work

What have been some of your favorite Amex Offers? Come over to our ToP Facebook group and share your experience!