Amex Authorized User Bonus Offers

It looks like a new batch of Amex authorized user bonus offers went out over the last few days. I saw them on 3 different cards across our two accounts, and other ToP team members had them as well. I'll go over what American Express authorized user bonuses are, why they are so great, where to find them, how to keep them fee free and the list of current offers. If you see one on your accounts that isn't listed please let me know and I'll add it in to our Amex AU bonus database.

Table of Contents

ToggleRELATED: Frequently Asked Questions About Authorized Users

Update 6/27/24:

I was alerted to a new Business Platinum offer and added it below. If you are having issues activating the offer people have had luck removing the card from their online bank account, setting it up in a new one and then activating the offer. You can then move the card back to the old login once you have them active. Some annoying hoops to jump through for sure but an option if you are having issues with the offer.

What Are Authorized User (AU) Bonus Offers?

In case you didn't know, AU bonuses are the bees knees. They are like little welcome offers on accounts that you already have. Credit card companies love when you spend money and they want to do whatever they can to get you to spend more of it. What is one way they can do that? By having you add someone else to your account so they can rack up spend too. Genius!

They will offer these authorized user bonus offers to ensure that you do just that. They work pretty much just like new card welcome offers. Once you add an authorized user they need to spend a certain amount of money in a specified time frame to earn a points bonus. Most credit card issuers offer these AU offers but no one does it bigger, and better, than Amex.

How To Keep Authorized User Cards Fee Free

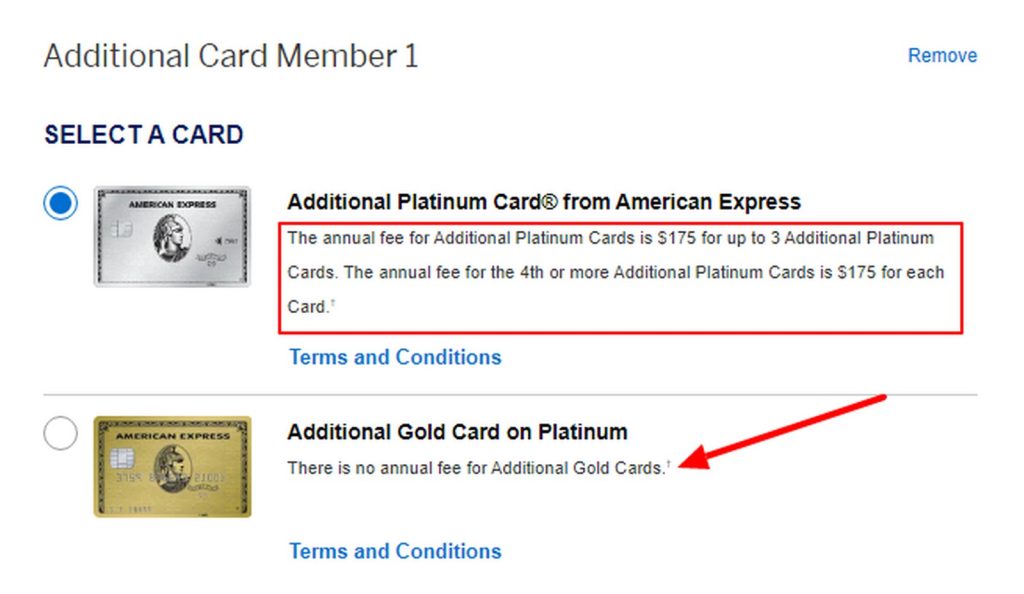

You may be thinking, wouldn't adding an authorized user cost you an annual fee and wipe out the value of the points? It can, but it doesn't have to. Most cards offer authorized users free of charge. Some cards, like the Amex Platinum, charge for their AU cards. But, that is only if the authorized user gets the Platinum version, which comes with some perks. If they get the Gold version instead it is fee free. Same with the Amex Business Platinum, grab the Green version for your AU and that new card will be fee free.

No matter what color the authorized user card is it will earn at the rates of the main cardholder. So, if you have a Gold authorized user attached to an Amex Platinum the AU card will earn at the same rates as the Platinum. It will not earn at the same rates that the Amex Gold earns. That can be a bit confusing to people at first.

Potential Pitfalls With Authorized User Card Offers

One caveat with these offers is it can be hairy with Chase 5/24. While you can usually work around AU cards on your account, or close the authorized user card before applying for a Chase card, it will pop up on Chase's screen as a new sign up. That is when you have to inform the retention department rep that it is an authorized user card and that you are not responsible for debt obligation. This is not an issue with business card AU bonuses though, since most business cards do not get reported for Chase 5/24.

You should also be aware that if you add an authorized user that you will ultimately be responsible for whatever is spent on the card. Only do it for someone you trust like a spouse, parent or child. Some will just add themselves with a middle initial etc. as the authorized user. Yes, that actually works.

Where Do You Find Authorized User Bonuses?

Authorized user offers can come in a variety of ways. I have received them via email, USPS and in the Amex Offers section of my cards. The offers that I saw today were found in the Amex Offers section.

All you need to do to check Amex Offers is scroll to the bottom of your American Express log in. You will see a variety of offers down there for all kinds of things. Then you can cycle through all of your Amex cards one by one to see if there are any offers.

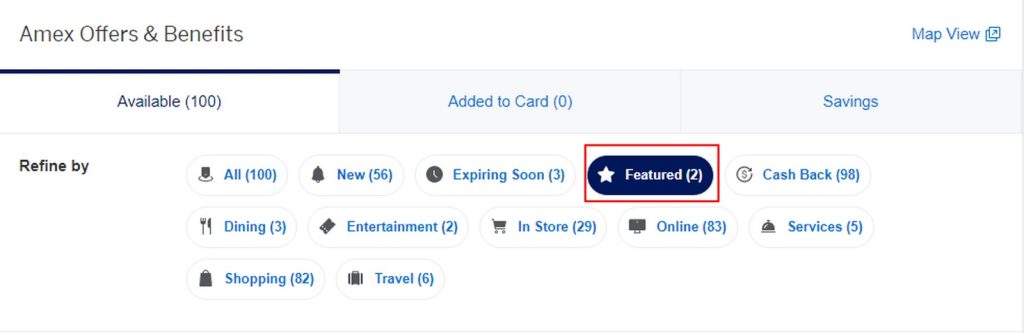

To do this quickly, select Featured Offers in the Amex Offers section like pictured above. I do this on my computer because it is a bit quicker than going through the Amex App. At least for an old timer like me!

Current Amex Authorized User Bonuses

Here are the current offers that we saw on our cards. Be sure to share any new ones you get over time and I will continue to update this post with new offers. Sometimes it is possible to get offers on your Amex business cards by calling in too. It is worth a try if you are not targeted in your Amex Offers section.

Personal Cards

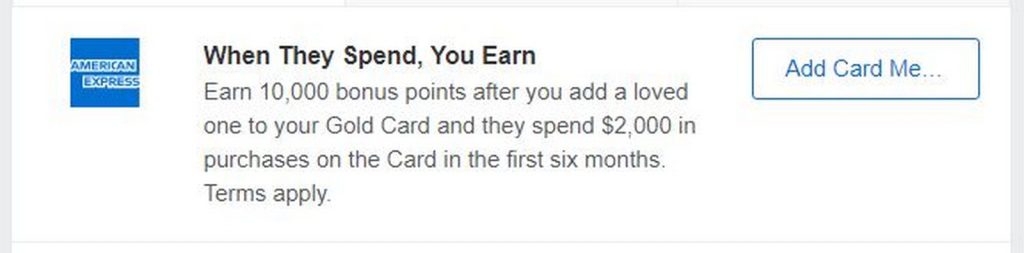

- Amex Gold Card

- Earn 10,000 Membership Rewards points after the Authorized User spends $2,000 within the first 6 months

- Earn 5,000 Membership Rewards points after the Authorized User spends $2,000 within the first 6 months

- Amex Platinum Card

- Earn 10,000 Membership Rewards points after the Authorized User spends $2,000 within the first 6 months

- Blue Cash Preferred

- Earn a $50 statement credit after the Authorized User spends $1,000 within the first 6 months

- Earn a $25 statement credit after the Authorized User spends $1,000 within the first 6 months

- Hilton Surpass / Aspire

- Earn 5,000 Hilton Honors points after spending $1,000 within 6 months, up to 20K in points (4 authorized users)

- Delta Gold / Platinum / Reserve

- Earn 2,500 bonus miles after they spend $500 in eligible purchases on their Card in the first six months of Card Membership.

- You can earn this offer up to four times for a maximum of 10,000 bonus miles.

- Earn 10,000 bonus miles after they spend $500 in eligible purchases on their Card in the first six months of Card Membership.

- You can earn this offer up to four times for a maximum of 40,000 bonus miles.

- Earn 2,500 bonus miles after they spend $500 in eligible purchases on their Card in the first six months of Card Membership.

Business Cards

- Hilton Honors Business

- Earn 5,000 Hilton Honors points after spending $1,000 within 6 months, up to 20K in points (4 authorized users)

- Blue Business Plus

- Earn a $50 statement credit after the Authorized User spends $1,000 within the first 6 months (5 authorized users)

- Earn 5,000 Membership Rewards after the Authorized User spends $2,000 within the first 6 months. (Up to 5 authorized users)

- Business Gold

- Earn 20,000 Membership Rewards after they spend $4,000 in eligible purchases on their new Card in their first six months of Card Membership

- You can earn this up to 5 times for a total bonus of up to 100,000 points.

- Earn 5,000 Membership Rewards after the Authorized User spends $2,000 within the first 6 months. (Up to 5 authorized users)

- Earn 20,000 Membership Rewards after they spend $4,000 in eligible purchases on their new Card in their first six months of Card Membership

- Business Platinum

- Earn 5,000 Membership Rewards points after they spend $2,000 in eligible purchases on their new Card in their first six months of Card Membership

- You can earn this up to 5 times for a total bonus of up to 25,000 points.

- Earn 7,000 Membership Rewards points after they spend $4,000 in eligible purchases on their new Card in their first six months of Card Membership

- You can earn this up to 5 times for a total bonus of up to 35,000 points.

- Earn 20,000 Membership Rewards after they spend $4,000 in eligible purchases on their new Card in their first six months of Card Membership

- You can earn this up to 5 times for a total bonus of up to 100,000 points.

- Earn 20,000 Membership Rewards after they spend $2,000 in eligible purchases on their new Card in their first six months of Card Membership

- Earn 5,000 Membership Rewards points after they spend $2,000 in eligible purchases on their new Card in their first six months of Card Membership

Thoughts On My Offers

I am particularly excited for the Amex Gold authorized user bonus offer since my $25K yearly U.S. supermarkets cap just reset. If we spent the full $2,000 in the U.S. supermarkets category that would be like earning 9X on that spend for 18,000 points. That is a great return right there! I should get a similar return on the Blue Cash Preferred offer since the card earns 6% at U.S. supermarkets and that $6K yearly cap just reset too. That would equate to an 11% return on that $1,000 in spend.

RELATED: How Long Do Amex Authorized User Bonuses Take To Post

Amex Authorized User Bonus Offers: ToP Thoughts

Hopefully this article gets you as excited about Amex AU bonus offers as I am! I love the kind of returns they can bring you on a card you already have. That is especially true if can complete the spending requirements on these offers in bonus earning categories on the card. Please keep us informed of any new authorized user offers you see so we can keep this Amex authorized user bonus offers guide up to date and as useful as possible.