Citi ThankYou Points are among the most valuable transferrable points currencies out there. Transferring TYPs to Citi's many airline and hotel partners gives you the most value for your points. Like other transferrable currencies, TYPs offer a lot of flexibility and outsized value through its many travel partners. Transferring TYPs is a pretty straightforward process, and this post will walk you through it.

Table of Contents

ToggleEarning TYPs Across Different Credit Cards

Citi offers plenty of card options to earn ThankYou Points. Starting off with the Citi Premier (review), this is the cornerstone of the ThankYou Points system. The Premier earns 3x points at restaurants, supermarkets, gas stations, air travel, and hotels, and 1x on all other purchases. No other credit card offers 3x point on these many categories.

Another great card is the Citi Double Cash Card (review) earns 2x points on every purchase (1x when you make the purchase, and another 1x when you pay your bill). This card has no annual fee. The Double Cash has a limited time offer to earn $200 cash back (or 20,000 TYPs) after spending $1,500 on purchases in the first 6 months of account opening.

The Citi Custom Cash Card (review) earns 5% cash back (or 5x TYPs) in your eligible top spending category per billing cycle, on up to $500 spent. The eligible categories are restaurants, gas stations, grocery stores, select travel, select transit, select streaming services, drugstores, home improvement stores, fitness clubs, and live entertainment. The Custom Cash has no annual fee. The Custom Cash currently offers 20,000 TYPs after spending only $750 in the first 3 months. This is similar to the Chase Freedom Flex, but the Custom Cash is easier to maximize because the categories don't rotate.

Lastly, there's the Citi Rewards+ Card (review), which earns earns 2x per dollar at supermarkets and gas stations on the first $6,000 per year (and then 1x thereafter). The Rewards+ card also automatically rounds up to the nearest 10 points on every purchase! This means that a pack of gum costing $1.50 earns you 10 TYPs just from rounding up.

If you have each of these Citi cards, you can earn between 2x, 3x, or 5x on every single purchase. Even better, you will only pay $95 in annual fees per year. Neither Chase nor Amex offer you this earning potential for so little in annual fees.

Unlike Amex, Citi does not automatically pool all of your TYPs together from your different cards. But you can call the number on the back of your card to link your accounts to have all your TYPs in one place.

Transferring TYPs to Travel Partners

Transferring TYPs is the same process whether you are transferring to an airline or hotel partner. If you ever want to check which partners you can transfer Citi TYPs to without logging into your account, check out ToP's Transfer Partner Tool.

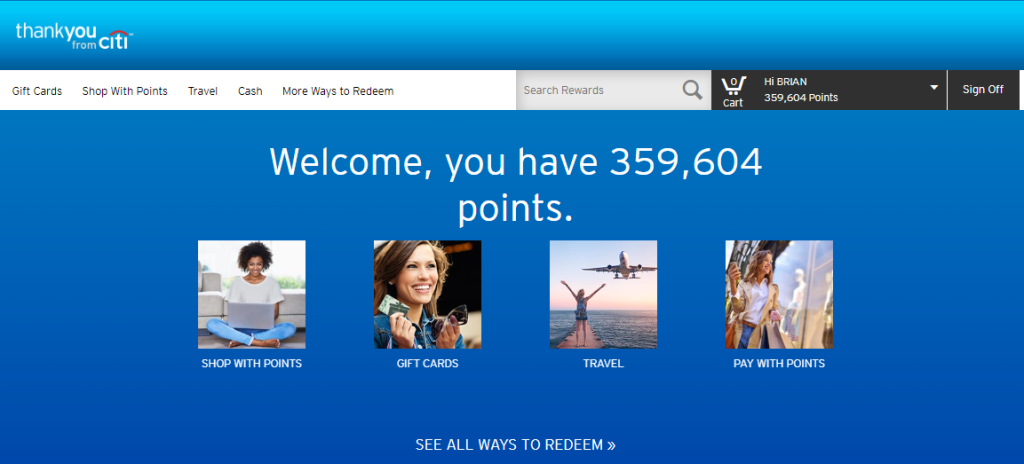

You can access the ThankYou Rewards portal either by logging into your Citi account or directly on www.thankyou.com. Your log in information here is the same as for your Citi account.

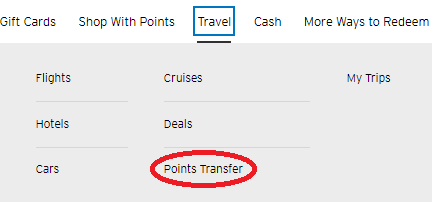

From the ThankYou homepage, you can select “Travel” from among the tabs at the top of the page, and click “Points Transfer.”

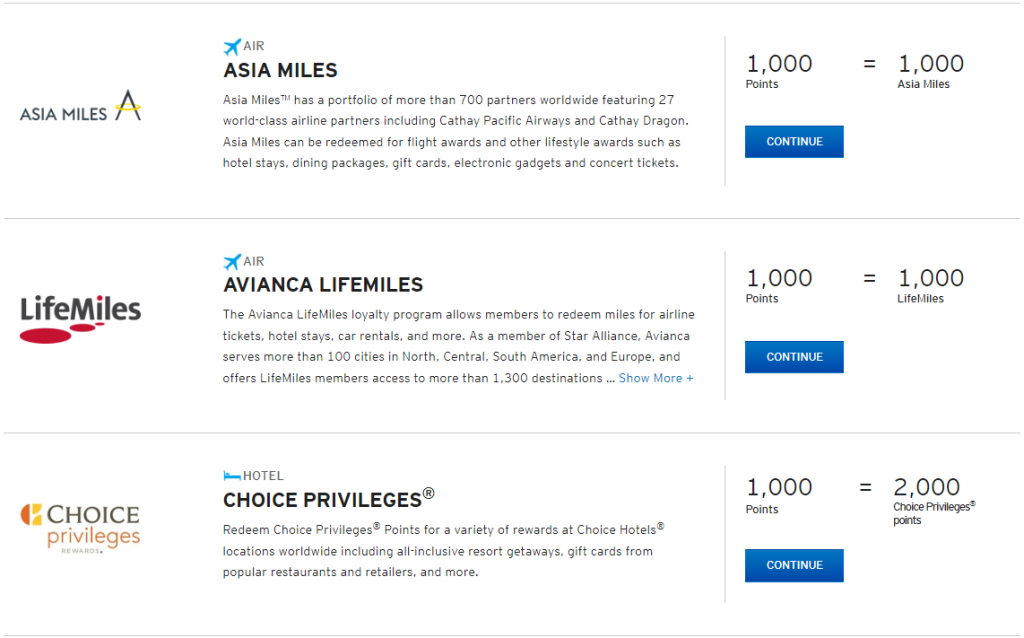

The next page will show you all of Citi's transfer partners. You can limit your view to just airlines or hotels if you wish. This page also shows you the transfer ratio for each of the partners. Most of them are 1:1, but some can be more favorable. Also, if there is a transfer bonus available, it will appear on this page.

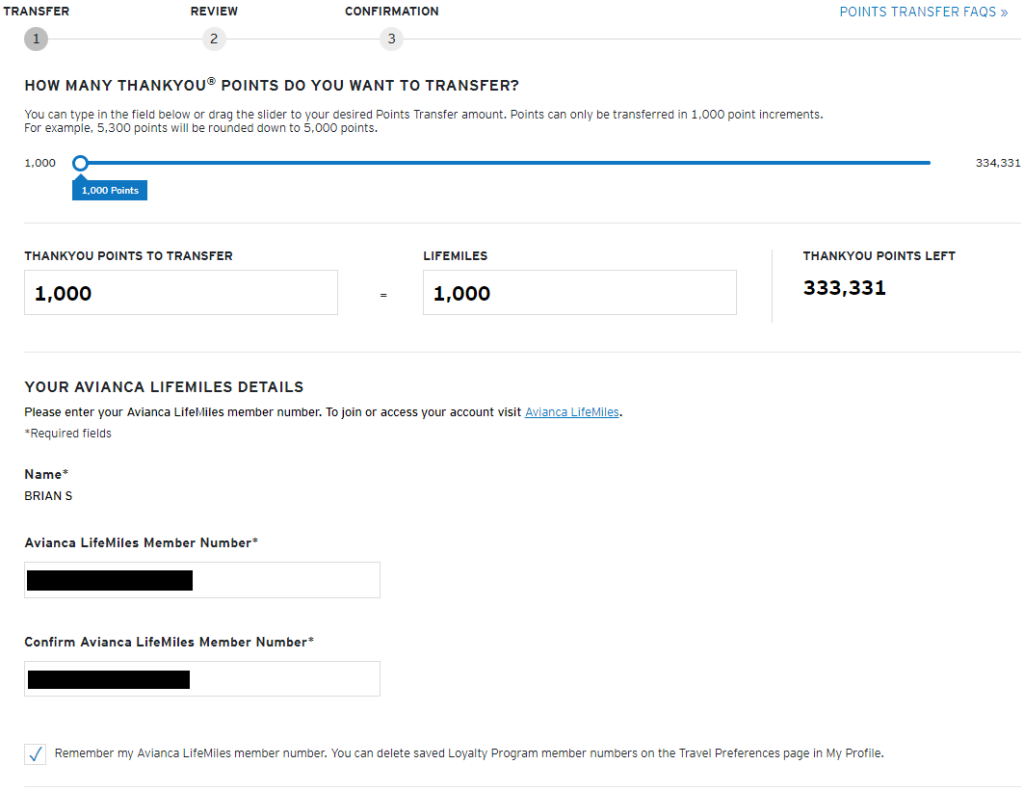

For today's example, let's transfer some points to Avianca LifeMiles. To begin the transfer process, click on the “Continue” button next to the partner you wish to transfer to. Once you click “Continue,” the next page asks how many points you want to transfer. You can type the number of points you want to transfer or you the scrolling button to set the transfer amount. Further down on the page you must insert your loyalty account number twice. To save time in the future, you can check the box to save your member number for future transfers. You can always delete that from your profile later if you changed your mind. After reviewing the terms and condition, check the box and click “Continue.”

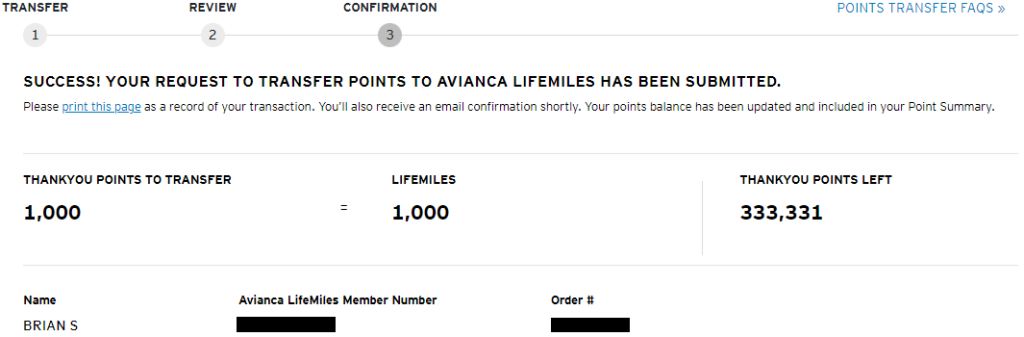

The next page is your chance to review the details of your transfer and make sure everything looks correct. If all looks good, click the “Transfer Now” button on the bottom right of the page to make your transfer.

Citi will then show you a confirmation of your transfer, which also includes an order number. Transfer times vary by partner. Transfers to LifeMiles are usually instant, and that was the case here too. Citi typically sends an email confirming that the transfer order has been placed, and another email confirming the transfer once it is concluded. Since this transfer was instant, I received both emails back to back. I also received a separate email directly from LifeMiles indicating that points from Citi were transferred into my LifeMiles account.

Transfer times do vary among partners. The ToP Partner Transfer Tool shows how long transfer times usually take for each partner. Transfers to brand new accounts can take longer than usual. This is why we recommend setting up loyalty accounts with airlines and hotels ahead of time.

Remember that all points transfers are final. And you cannot transfer points or miles for a hotel or airline program to Citi (or any of the other banks).

Final Thoughts

Redeeming TYPs through transfer partners can yield incredible value for your points. Citi has some great partners that should not be ignored.

Which are your favorite Citi transfer partners? Come share your thoughts in our Facebook group!