Citi Miles Ahead Savings Offer

My wife received an interesting mailer for a Citi Miles Ahead Savings offer yesterday. It appears to be targeted towards Citi AAdvantage cardholders. The ToP offer is for 50,000 American Airlines miles, but I don't think that is truly the best option for this offer. I actually thing the low end of this savings account bonus is where the good stuff is at. Let's take a look at the different tiers of the offer and I'll share why I am focusing on the low end of this one.

Table of Contents

ToggleCiti Miles Ahead Savings Offer Details

The Citi Miles Ahead Savings offer is like a normal savings bonus except that you get American Airlines AAdvantage miles instead of a cash bonus. Some will prefer that and others won't. Even though you are getting miles instead of a cash bonus you will still likely get a 1099 sent to you for the value of the miles. If you were thinking that may be an advantage of getting miles that isn't the case here.

Different Offer Tiers

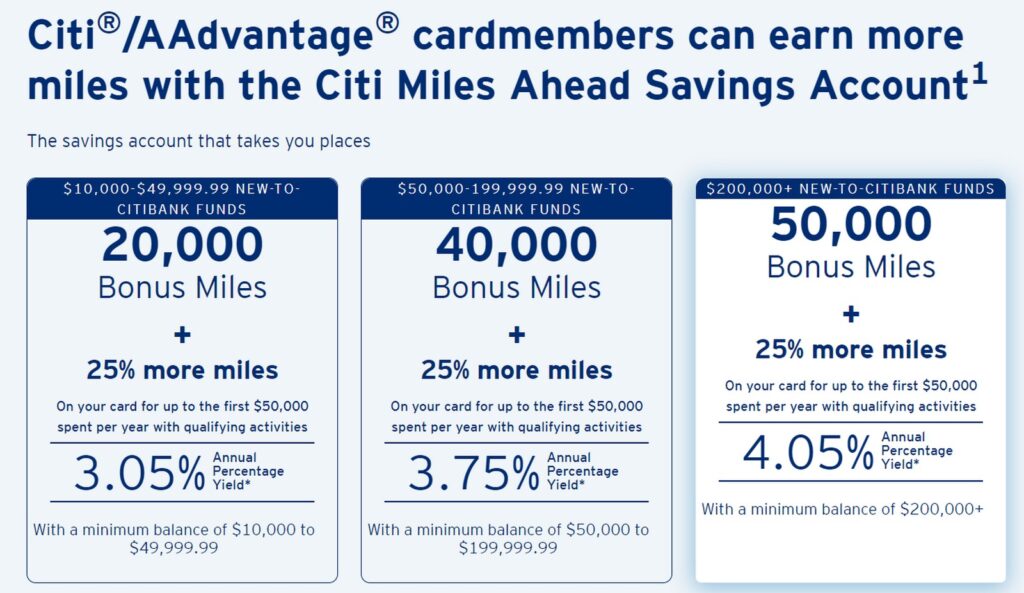

This is a tiered offer. Here is a graphic breaking down the different options.

- $10,000 – $49,999.99 in new funds deposited

- 20,000 AAdvantage miles bonus

- 25% more miles earning on your card on purchases of up to $50,000 spent per year.

- 3.05% APY on your money

- $50,000 – $199,999.99 in new funds deposited

- 40,000 AAdvantage miles bonus

- 25% more miles earning on your card on purchases of up to $50,000 spent per year.

- 3.75% APY on your money

- $200,000+ in new funds deposited

- 50,000 AAdvantage miles bonus

- 25% more miles earning on your card on purchases of up to $50,000 spent per year.

- 4.05% APY on your money

There are no monthly fees on the account which is nice. No annoying minimum balance to get the fee waived or anything like that.

Citi Savings Bonus Offer Terms

Here are some notable terms of the offer:

- The new money must be deposited within the first 20 days of account opening

- You must maintain the balance for an additional 60 days after the initial 20 day deposit period

- Bonus Miles will be paid within 90 calendar days from the date you complete all required activities

- Only select “Eligible Cardmembers” who have received a direct communication or advertisement (“Communication”) from Citibank inviting them to apply are eligible for a Citi Miles Ahead Savings account.

- Eligible Cardmembers who already own a Citi Miles Ahead Savings account cannot open another Citi Miles Ahead Savings account.

Why I Think $10,000 Is The Sweet Spot For This Offer

It is usually customary to go for the biggest bonus possible, but not with this offer. At least not in my opinion. If you look at this just in terms of the bonus the $10K deposit gives you the best bang for your buck:

- $10,000 gets 20,000 miles or a 2 to 1 ratio

- $50,000 gets 40,000 miles or a 0.8 to 1 ratio

- $200,000 gets 50,000 miles or a 0.25 to 1 ratio

You may be thinking, but what about the increased APY? That is true, but none of the rates are good enough to really worry about long term. I get over 4% right now from a regional bank and there is no extreme minimum in place. So, if we look at this as a pure savings bonus the $10,000 gives you the best return in terms of value.

The 25% Card Earning Bonus Is Intriguing

More than that though, it unlocks the same 25% bonus earning on the credit card as the other levels. If you spend on your American Airlines cards at all then this could be intriguing. Let's say you are chasing status etc., then getting more value for that spend could make it easier to justify.

I read through the terms and it looks like they just add 25% more miles at the end of the statement period. That means that it adds to all earnings, and not just the base 1x earning. The bonus gives you essentially 2.5 miles at restaurants and gas stations with the Citi AAdvantage Platinum Select card.

That could make it worth parking $10,000 in the account and giving up a percent or two of interest on the money if you are spending enough on the card. You would need to crunch the numbers and see if it makes sense compared to the rates you are currently earning on your savings though.

Link To Check If Targeted (Log Into Your Account)

Citi Miles Ahead Savings Offer: ToP Thoughts

If you are targeted for this Citi Miles Ahead Savings offer then I think it is worth considering. At least at the lower end of the offer that is. If you value American Airlines miles at 1.25 cents each, the 20,000 miles would be worth $250. That is like an additional 6% APY, when breaking that value out over the 5 months you need to leave it in the account, on ToP of the 3.05% the account earns on its own. Not too shabby.

The real value could be unlocking the bonus earning on your American Airlines credit card though. Depending on how much you spend on it each month that could add another couple percent worth of APY essentially. This could be a nice perk for people chasing American Airlines status via credit card spend.

Let me know if you were targeted for this Citi Miles Ahead Savings offer in the ToP Facebook Group. Even if you weren't let me know if you would take advantage of it or not.