Chase Pay Yourself Back Devalued

Well, this is not the way we wanted to start off the year, with some bad news. This bad news was somewhat expected though, with Chase leaking a few new Pay Yourself Back options in late December. I guess you could say this is a good news / bad news scenario. The good news is that the Chase Pay Yourself Back program has been extended into 2023. The bad news is that it comes at lower redemption levels. With Chase Pay Yourself back devalued, I'll take a look at the new changes and if the program is still worth using going forward.

Table of Contents

ToggleUpdate 3/19/23: The gas and annual fee categories have been extended until 6/30/23 on the Sapphire Reserve. I am not sure what is happening with the grocery section. And it doesn't anything has been done with the Ink Preferred / Ink Plus yet either. At least I don't see any updates on my account. Hopefully we get more info on those soon.

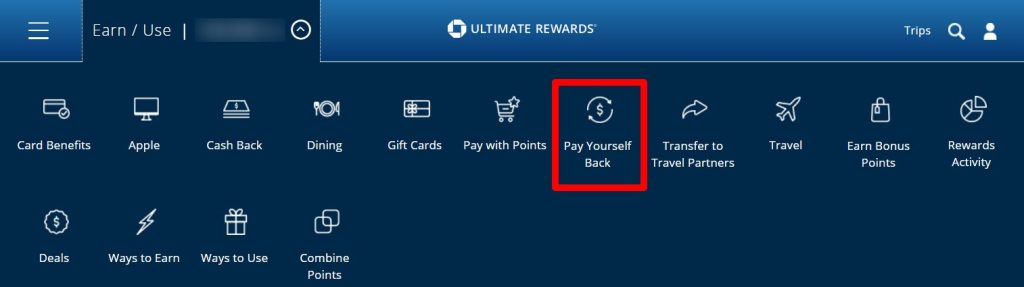

What Is Chase Pay Yourself Back?

Some of you may be wondering what Chase Pay Yourself Back is exactly. It is a program that was introduced during the pandemic as a way to “cash out” your Ultimate Rewards points. This was at an elevated level compared to the old cash out option for Ultimate Rewards. That let you redeem your points to your checking account at 1 cent each. How much better was the pay yourself back option versus the normal cash out option? Up to 50% better. But, it all depended on which cards you had. It essentially worked out that the higher the annual fee of your card, the better pay yourself back rates you would get. Here were the rates before today:

- Chase Sapphire Reserve – 1.5 cents per point

- Chase Sapphire Preferred – 1.25 cents per point

- Ink Preferred or Ink+ (no longer available) – 1.25 cents per point

- No Fee Cards like Chase Ink Cash & Freedom Flex – 1 cent per point outside of Charitable Contributions

- This offered no improvement versus the normal cash out option

Each card had unique options on what was available to cash out as well. The Chase Sapphire Reserve usually had the most options available to it, as it being the most expensive card. These categories would rotate every 3 months or so. They have included options like grocery stores, restaurants, airbnb and others along the way.

The New Chase Pay Yourself Back Options & Rates

Now that we have an understanding of what the program is, let's take a look at the program now with Chase Pay Yourself Back devalued. I'll go over the redemption options and the new, lowered rates.

- Chase Sapphire Reserve categories and redemption value, as of January 1, 2023:

- Points can be redeemed at 25% more value for purchase with

- gas stations (Extended till 6/30/23)

- groceries

- as well as towards the card’s annual fee (extended till 6/30/23)

- Points can be redeemed at 25% more value for purchase with

- Chase Sapphire Preferred categories and redemption value, as of January 1, 2023:

- Points can be redeemed at 1:1 value for purchase with gas stations and groceries through March 31, 2023

- Points can be redeemed at 25% more for qualifying charities through December 31, 2023

- Chase Ink Business Preferred and Ink Plus categories and redemption value, as of January 1, 2023:

- Cardmembers who utilize Pay Yourself Back can redeem points worth 25% more on business expenses related to the following until March 31, 2023:

- internet,

- cable,

- phone services

- shipping

- Cardmembers who utilize Pay Yourself Back can redeem points worth 25% more on business expenses related to the following until March 31, 2023:

- Chase Ink Business Cash and Chase Ink Business Unlimited categories and redemption value, as of January 1, 2023:

- Cardmembers who utilize Pay Yourself Back can redeem points worth 10% more on business expenses related to the following until March 31, 2023:

- internet,

- cable,

- phone services

- shipping

- Cardmembers who utilize Pay Yourself Back can redeem points worth 10% more on business expenses related to the following until March 31, 2023:

- Freedom (no longer available), Freedom Flex and Freedom Unlimited categories and redemption value, as of January 1, 2023:

- Points are worth 25% more when donating to select charitable organizations

How Bad Are These Changes?

These changes are pretty dire overall. While they added more useful categories to rack up large spend, Chase slashed the rates on the redemptions side of things. The only card(s) that wasn't really affected was the Chase Ink Business Preferred (and discontinued Ink+ card). This is now the Pay Yourself Back winner, in my opinion, since the rate is the same as using the Chase Travel Portal with the card, 1.25 cents per point.

The Chase Sapphire Preferred was nerfed in the program to the point that it is pretty much worthless as a pay yourself back option. At a 1 to 1 rate you might as well just cash out the points to your bank account at 1 cent each. You would be better off using the Chase travel portal too, and the 1.25 cents per point value they offer there.

The Chase Sapphire Reserve saw its rate slashed from 1.5 cents per point, down to 1.25 cents per point. That is below the 1.5 cents you can get using the Chase travel portal as well.

ToP Thoughts

You could usually get more value, even at the old pay yourself back rates, by transferring your Ultimate Rewards to travel partners. But, if you were in a cash pinch, or had more points than you needed, Pay Yourself Back was a nice option to have. Previously, the sting wasn't as bad because the program offered the same redemption rate as the Chase travel portal too. It was actually preferable for some people because it gave you the same rates without all of the hassles that come with booking via a travel portal.

The times that transferring points to travel partners brought you about the same value, pay yourself back was actually better. That is because you could book use the money you earned to book that same travel. This would allow you to earn more credit card rewards on the travel purchase, as well as, utilize cash back portals and earn loyalty points from the travel programs. This added increased value AND you would still get the same rate you would have got by transferring the points. A pretty great stacking opportunity many took advantage of.

That is no longer the case with these changes, unless you were already cashing out at 1.25 cents per point with the Ink Preferred anyway. If that is the case then it is business as usual going forward. You are the lone “winner” in this new world it appears.