Chase Pay Yourself Back Categories

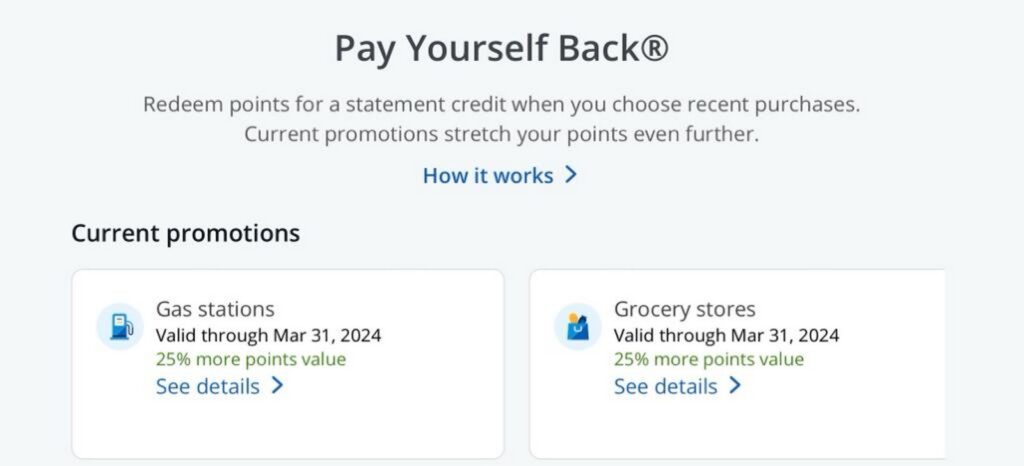

We had been waiting to see how the Chase Pay Yourself Back categories would shake out for the 2nd quarter of 2024 since we never quite know what will or will not be extended. Chase has decided to keep much of it the same with a few tweaks versus the first quarter of 2024. This isn't too surprising since Chase took the legs out from the program in the middle of 2023 anyway. The once great program doesn't have much left in the tank, but can still be useful for some.

Table of Contents

ToggleUpdated with new categories 4/8/24

Chase Pay Yourself Back Categories For Each Card

Let's break it down for each one of the Ultimate Rewards earning cards.

Ink Preferred or Ink Plus Chase Pay Yourself Back Categories

You can redeem Ultimate Rewards points in the following categories at 1.25 cents each through at least June 30, 2024.

- Select charities

Removed In 2023:

- Internet

- Cable

- Cell service

- Shipping

Sapphire Reserve Chase Pay Yourself Back Categories

You can redeem Ultimate Rewards points in the following categories at 1.25 cents each until at least June 30, 2024

- Pet Supplies Stores & Services

- Wholesale Clubs

- Gas stations

- Annual Fee

- Select charities (1.5 cents per point)

Removed in 2024 (1.25 cents per point)

- Grocery Stores

Ink Cash Chase Pay Yourself Back Categories

You can redeem Ultimate Rewards points in the following categories until at least June 30, 2024

- Select charities (1.25 cents per point)

Removed in 2023 (1.1 cents per point)

- Internet

- Cable

- Cell service

- Shipping

Ink Unlimited Chase Pay Yourself Back Categories

You can redeem Ultimate Rewards points in the following categories until at least June 30, 2024:

- Select charities (1.25 cents per point)

Removed in 2023 (1.1 cents per point)

- Internet

- Cable

- Cell service

- Shipping

Sapphire Preferred Chase Pay Yourself Back Categories

You can redeem Ultimate Rewards points at 1.25 cents for select charities until at least June 30, 2024.

Freedom Cards Chase Pay Yourself Back Categories

You can redeem Ultimate Rewards points at 1.25 cents for select charities until at least June 30, 2024.

What Are The Select Charities?

Here is a list of the select charities from the Chase Pay Yourself Back categories page:

- American Red Cross

- Equal Justice Initiative

- Feeding America

- GLSEN

- Habitat for Humanity

- International Medical Corps

- International Rescue Committee

- Leadership Conference Education Fund

- NAACP Legal Defense and Education Fund

- National Urban League

- Out & Equal Workplace Advocates

- SAGE

- Thurgood Marshall College Fund

- United Negro College Fund

- UNICEF USA

- United Way

- World Central Kitchen.

Please donate directly to the charity’s parent organization. Local chapters may not be eligible for Pay Yourself Back.

Thoughts On These Options

With the gutting of the Ink Plus and Ink Preferred Chase yourself back categories, the only real show in town is the Sapphire Reserve. The nice thing about having it on the Ink cards was that it was in areas of bonus earning plus you got the 1.25 cents per point. That was the same as the Reserve but for a fraction of the annual fee and the Reserve's categories don't earn bonus points on the purchase. As of now, it remains the only decent “cash out” option though.

Actually the Aeroplan card is now the best option, but more on that below.

Non Ultimate Rewards Earning Chase Pay Yourself Back Cards

The Chase Pay Yourself Back categories don't end with the Ultimate Rewards earning cards. There are a few options among the co-branded airline cards. I have said that I think the Chase Aeroplan card is the best overall, since all points transferred in count (even from other banks), and that the Southwest Airlines option shouldn't be touched with a 10 foot pole. The only other option, which I don't think we have discussed before, is on the United cards.

Chase Aeroplan

You can redeem any points in your Aeroplan account at 1.25 cents per point to pay yourself back for anything that codes as travel. This is now capped at 50,000 points per year, after being uncapped in 2023. The travel category has been extended until at least 12/31/24

Southwest Credit Cards

You can pay yourself back with your Rapids Rewards points at 1 cent per point towards the annual fee or dining for $0.80 cents per point. There is a $200 redemption cap for the dining option. This should be AVOIDED at all costs.

Chase United

You can pay yourself back with United Miles at 1.5 cents per miles towards your annual fee. This is actually a pretty decent option if you get value from the card long term.

Chase Pay Yourself Back Categories: ToP Thoughts

Those are the Chase Pay Yourself Back categories for the third quarter of 2023. Chase decided to suck a little more blood from this Pay Yourself Back stone and took what little we had left of value. This makes the Chase Aeroplan card the most attractive option since you don't need to use Ultimate Rewards points to take advantage of it. Just be careful to not go overboard with it.

Happy redeeming!