Chase Business Verification Documents

Chase has been sending out letters to folks with recently-opened business credit cards asking for some information in order to keep the card account open. While these letters may seem scary at first, there is nothing to worry about, so long as you timely respond to the request. In this post, we explain how to handle if you receive a request for Chase business verification documents.

Table of Contents

ToggleWhat Information is Chase Requesting?

In the vast majority of cases, Chase is simply requesting two things:

- Proof of the legal name of your business

- Proof of the physical address of your business (e.g., utility bill)

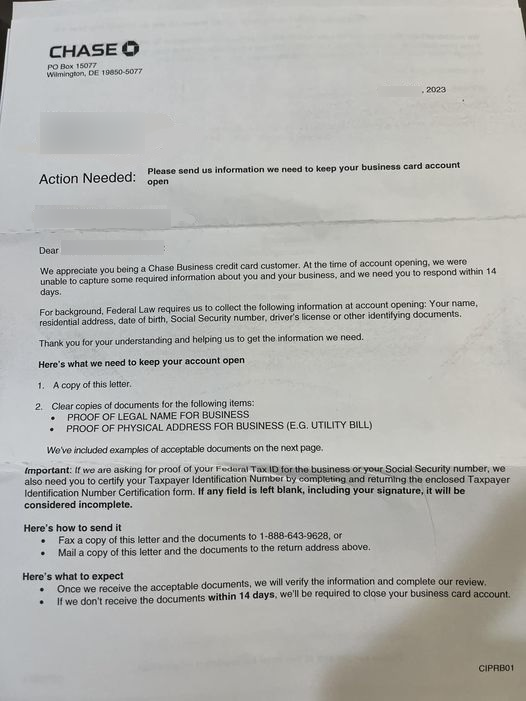

These are very easy to satisfy no matter what business you have. Here is an example of the letter:

What to Provide to Chase

In the back of the letter, Chase provides a list of acceptable documents you can submit.

If your business is a sole proprietorship, meaning you do not have an entity created like an LLC, you can comply by providing a copy of your driver's license. When opening a business card as a sole proprietor, the name of the business is just your legal name. So your driver's license will show both your legal name and your address (which is the address of your business).

If your business is an LLC or other entity and has an Employer Identification Number (EIN), the response is just as easy. You can simply provide a copy of the letter you received from the IRS with your EIN when you applied for one. That letter will show the legal name of your business and its physical address (as well as the EIN, of course). Other documentation that could work here includes any incorporation documents (to prove the legal name of your business) and any utility bills with your business name on them.

Why is Chase Requesting this Information?

If you receive this Chase business verification documents letter, it does not mean you're in trouble with Chase. Like any other bank, Chase is required by law to collect certain information about its customers (known as “Know Your Customer”). A lot of this information is what you would expect to provide when establishing any relationship with a bank, be it a checking account, a loan, or a credit card (whether personal or business).

Next Steps After Submitting Documentation

We have seen data points that if the documentation you submit passes muster, Chase will reply with another letter within a couple of weeks saying that Chase has verified your information and your account remains open.

We also have one data point that if your account is closed for failure to submit the documentation in time, there is still hope. In this instance, the person did not meet the deadline because they were traveling and didn't see Chase's letter in time. They submitted the proper documentation as soon as they got home and called Chase. The Chase agent confirmed receipt of the documentation and stated the account would be reopened within 24 to 48 hours.

Chase Business Verification Documents: ToP Thoughts

There is no need to worry if you receive a letter with a Chase request for information. Simply provide the documentation suggested above in a timely manner. Once provided, you can follow-up within a few days to make sure no further action is required.