Cash Out Membership Rewards Points With Charles Schwab Platinum

With the recent changes to The Platinum Card by American Express some are wondering which is the best personal platinum option to keep? Since you can cash out Membership Rewards points with Charles Schwab Platinum many will say that is the best option. But, how do you do it? Is it worth it? And, how is Amex trying to actually trick you here? Let's answer all of those questions.

Table of Contents

ToggleInvest With Rewards

The program that allows you to cash out Membership Rewards points with Charles Schwab Platinum is called “Invest With Rewards”. You need to have a Charles Schwab brokerage account to be able to get this version of the Platinum card. While you are at it be sure to grab their fee free checking account the refunds ALL ATM fees around the world. It is best in class for a traveler.

Once you have that account set up, and grab your Charles Schwab Platinum card, you are now able to Invest With Rewards. By doing this you are redeeming your Membership Rewards at 1.1 cents per point. This is then placed into your brokerage account for you to invest with. The fun thing is you don't really need to do that. You can move the money to your checking account and keep it there for international travel, or you can transfer it to your bank account of choice. This offers a much better cash out rate versus doing a statement credit (more on that in a bit) and it is the best option for cashing out Membership Rewards as a whole.

Don't Fall For Amex's Tomfoolery

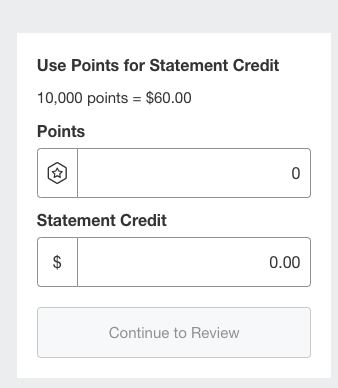

If we can Invest With Rewards and cash out our Membership Rewards at 1.1 cents per point what is this thing I see on my Charles Schwab Platinum login? Is it really that easy?

This is Amex trying to play gotcha with you. They are hoping people don't pay close attention and redeem their Membership Rewards as a statement credit thinking it is Invest With Rewards. If you don't pay close attention to the conversion rate you can be easily fooled. This is only giving you $0.006 per point versus the $0.011 you can get for your points with the same card. This option they put on your main account page is almost twice as bad!

How To Cash Out Membership Rewards Points With Charles Schwab Platinum

Here is the step by step process on how to cash out Membership Rewards points with your Charles Schwab personal Platinum card.

Invest With Rewards

First up you will want to log into your American Express account and head to your Charles Schwab Platinum page. Then you will want to go to your Membership Rewards points balance box on the right hand side of the page. Right under your balance should be a hyperlink labeled Invest With Rewards, click that.

Useless Landing Page

Clicking the Invest With Rewards will take you to a useless landing page telling you a little about the program. Click Get Started once here.

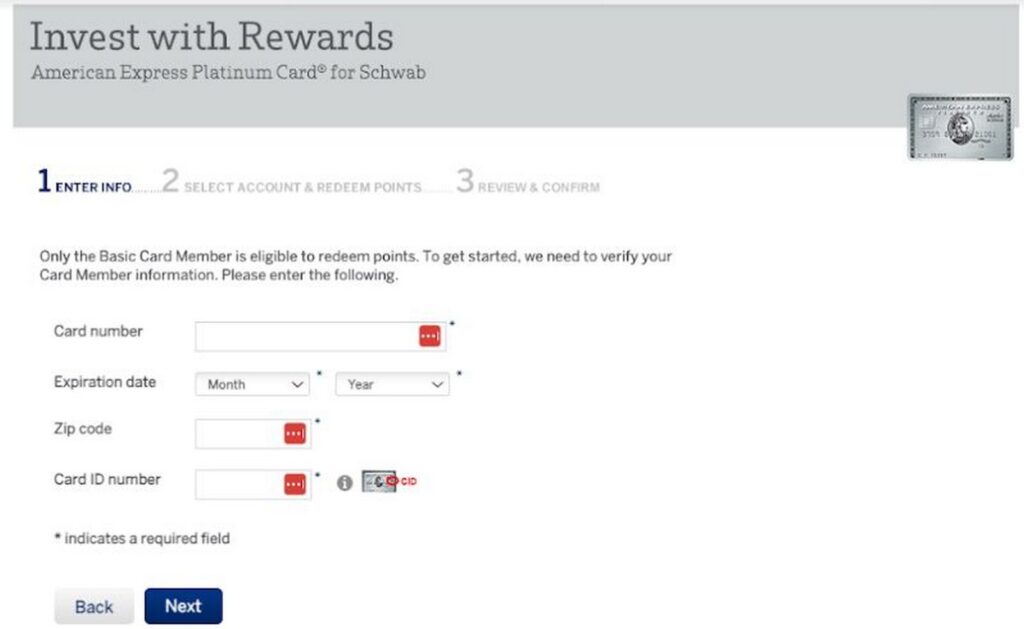

Enter Your Card Information

You will need to enter your Charles Schwab Platinum card information on the next screen to access the ability to “cash out” your points. You will need your card number, expiration date and CID number. The CID number is on the front of Amex cards. Every other issuer puts that number on the back of their card so it can be a bit tricky with Amex.

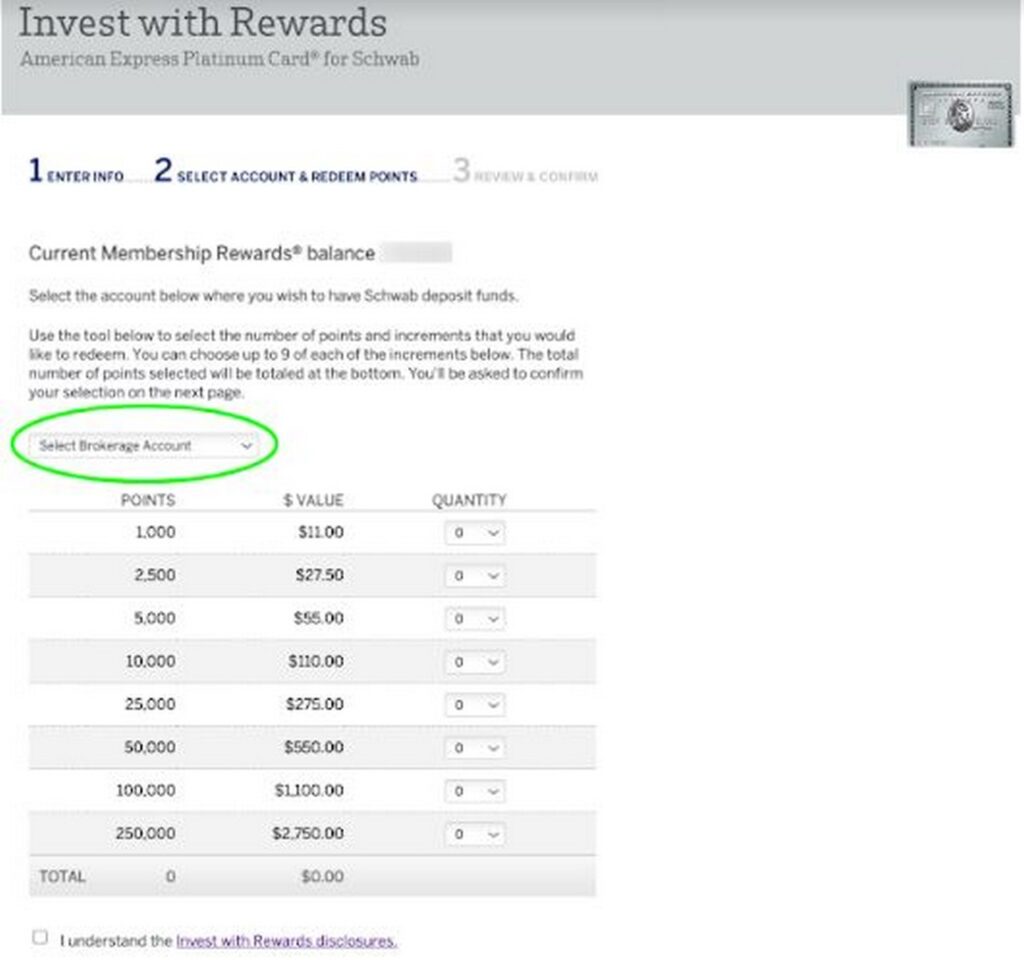

Select Your Quantity

On the final page you will need to do two things. First up, you need to select which brokerage account you want the points to deposit into. Next up, you need to select how many Membership Rewards points you want to “invest” with or “cash out”. This can only be done in multiples of 1,000 points. In true 1990's fashion, American Express has multiple point drop down boxes instead of letting you just enter a number.

Transfers Are Usually Quick

Every time that I have used the Invest With Rewards option on my Charles Schwab Platinum card the money has transfer quickly. It is usually in my brokerage account within a few minutes, if not instantly.

It should be noted that there are times that the service as a whole is down. This is normal and happens a handful of times each year.

Should You Cash Out Membership Rewards Points With Charles Schwab Platinum?

Now that we know how to cash out your Membership Rewards with your Charles Schwab Platinum card, the question is should you? The redemption is only at 1.1 cents per point after all. While that is a vast improvement over doing the statement credit we discussed above it still isn't maximizing your points.

Even if it is the best cash out option available, it is still well below the value you can get for travel with the same points. Cue the international business class flights can get you 3+ cents per point crowd! So why would someone do this? Simple, they are swimming in points.

The only truth in this game is that there will be devaluations. When that happens your points are worth less. That means the longer you sit on your points the more likely they are to drop in value. If you are earning more points than you can use on travel then this is something to consider and be aware of.

Another time that people may consider this option is if they are in a cash crunch. If you have an unexpected expense, or fall on hard times, then having a Membership Rewards safety net could come in handy. I think of our points as our emergency fund and will tap that before savings most of the time.

Cashing Out Membership Rewards Points: ToP Thoughts

Even if you never plan on using the Invest With Rewards program it is still good to be aware of it. You never know what the future holds after all. It could also be a way to offset those higher annual fees, especially if you are annual fee adverse. Grabbing a Amex Business Platinum, and redeeming some of the welcome offer points to offset the annual fee, could make sense for some. If it opens up more cards to you then that is a good thing overall.

Hopefully this guide on how to cash out Membership Rewards points with Charles Schwab Platinum makes the process easy. It should also help you stay away from that Amex tomfoolery!