Cardmatch Tool, What Is It Exactly?

As anyone who has been a follower of Travel on Point(s), or ToP, for a quick minute already knows miles & points open up a lot of travel opportunities. Options that we wouldn't have otherwise without them. A big key to the secret sauce is maximizing your spend with lucrative welcome offers. Having said that, there is nothing worse than grabbing a new card and then immediately seeing a larger welcome offer roll out. Missing out on that 10, 20 or even 30 thousand points hurts, it hurts real bad. While it isn't the end of the world, there is a tool that can help you have a better shot at these higher offers. That is where the Cardmatch tool comes in. In this write up I'll go over exactly what the Cardmatch Tool is, how it can help you in your miles and points quest and I'll show you some of the increased offers it can give you.

Table of Contents

ToggleWhat Is Cardmatch Exactly & Why Should You Use It?

Cardmatch is a tool that lets you check to see if you are eligible for some of these increased targeted offers out there. Instead of waiting for a mailer, email or pop-up in your account, you can now take the fight to the targeted offers so to speak. At least it feels that way, like you have a little bit of power within your grasp because of the Cardmatch tool.

What Cardmatch does is ask you for some general information that you would fill out for pretty much any application. It then uses this information to perform a soft pull. The soft pull gives the Cardmatch system a peek at your credit score without having to perform a hard pull that affects your credit report. This is exactly the same thing that some employers and landlords do for new applicants. Even banks will routinely do if you hold a credit card with them to make sure you still fall within safe lending perameters.

Cardmatch will then use this information to pair you up to credit card offers that you are more likely to be approved for. Depending on your credit profile, and what it sees available, it can pull offers that are much higher than the public offer too.

Cardmatch Increases Your Chances At A Higher Offer, But There Are No Guarantees

There is no guarantee that you will receive one of these elevated offers, but since there is no affect to your credit score / report there is no harm in checking. You could actually check it every few weeks / months, since the offers are constantly changing and more people are targeted all the time.

Check For Higher Welcome Offers With Cardmatch

What Credit Cards & Banks Work With Cardmatch?

Quite a few of the larger banks work with Cardmatch, which means the tool has access to some of the best cards. Here is a list of many of the banks the Cardmatch tool works with:

- American Express / Amex

- Bank of America

- Capital One

- Chase

- Citi

- Wells Fargo

- Plus other smaller lenders

That is almost every major credit card issuer you could want. I like that smaller banks come up too, since they can sometimes throw things in there that you may have never seen / heard of before. It should also be noted that Cardmatch will only pull up personal credit card offers. Unfortunately, it does not work with business card accounts.

What Higher Offers Have Been Seen?

Here are some of the higher offers that people have seen when using the Cardmatch tool. This is by no means an exhaustive list, and there are no guarantees that you receive these offers.

- The Platinum Card® From American Express card (120K – 175K offer)

- American Express® Gold Card (75K – 90K offer)

- Blue Cash Preferred® Card ($300 offer)

- Blue Cash Everyday® Card ($250 offer)

These Offers Do Not Get Around Other Application Rules

It should be noted that the Cardmatch tool offers are not no lifetime language offers. That means that the offers will work within the standard application rules for each bank. That would include the American Express family rules, so be sure you have a plan before using the tool in case a targeted offer appears.

Check For Higher Welcome Offers With Cardmatch

How To Use The Cardmatch Tool

Let's get into the good stuff now, how to actually use the Cardmatch tool. It is a pretty simple process and it should take a minute or two to fill out all of the required information. I'll go through it step by step, with screenshots below, so you know everything that will be asked of you ahead of time. Remember that there is no hard credit pull and using the Cardmatch tool will not affect your credit. That is unless you get an offer that interests you and then you apply for the card. You can check Cardmatch before every single application if you want to see if a better offer pops up.

Step 1: Go To Cardmatch

The first step is an easy one, go to the Cardmatch site.

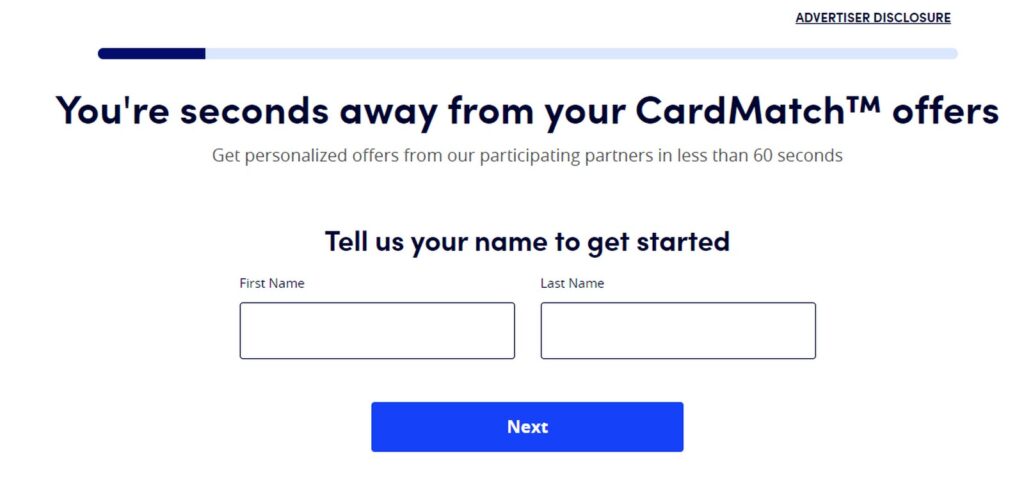

Step 2: Enter Your Name

Once you land on the Cardmatch Tool page you will be asked to fill in your name, and then hit next.

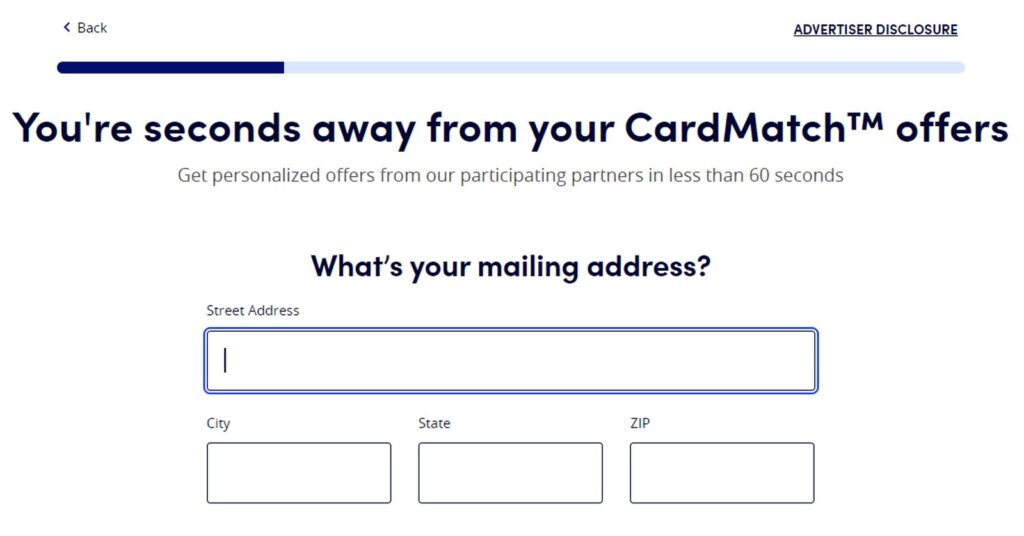

Step 3: Fill In Your Address

On the next screen you will need to enter your mailing address.

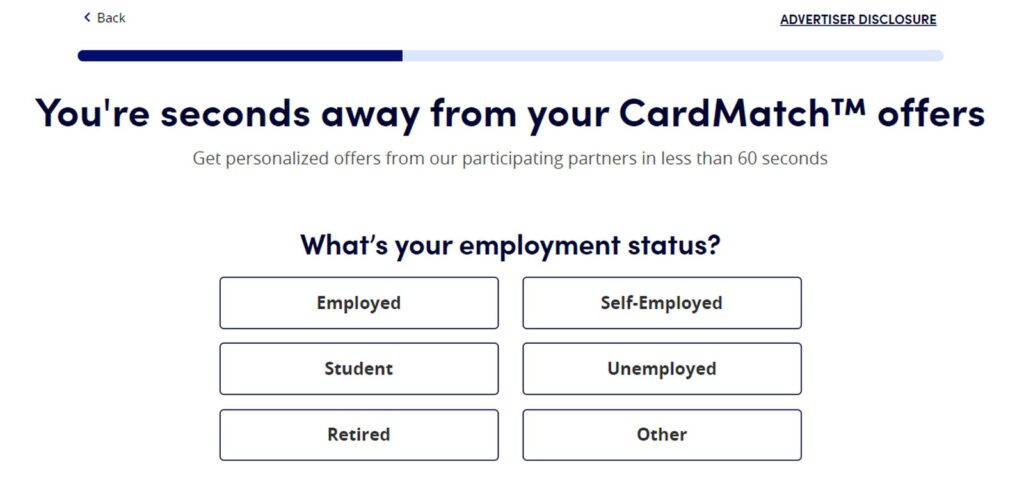

Step 4: Your Employment Info

I am sure you could have guessed that the next step is asking you about your employment status.

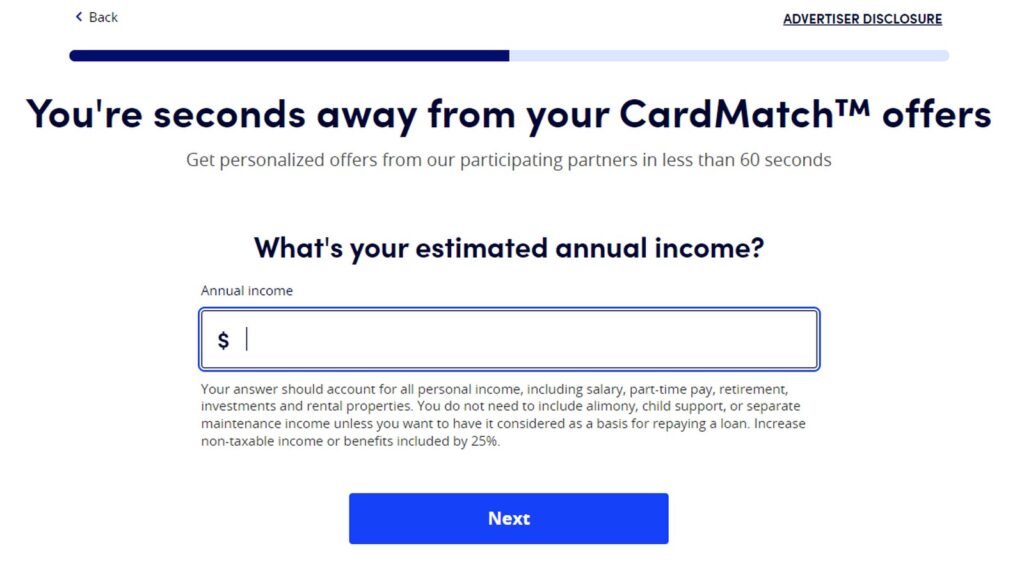

Step 5: Your Household Income

After you tell them whether you have a job or not they are going to ask how much that job pays you.

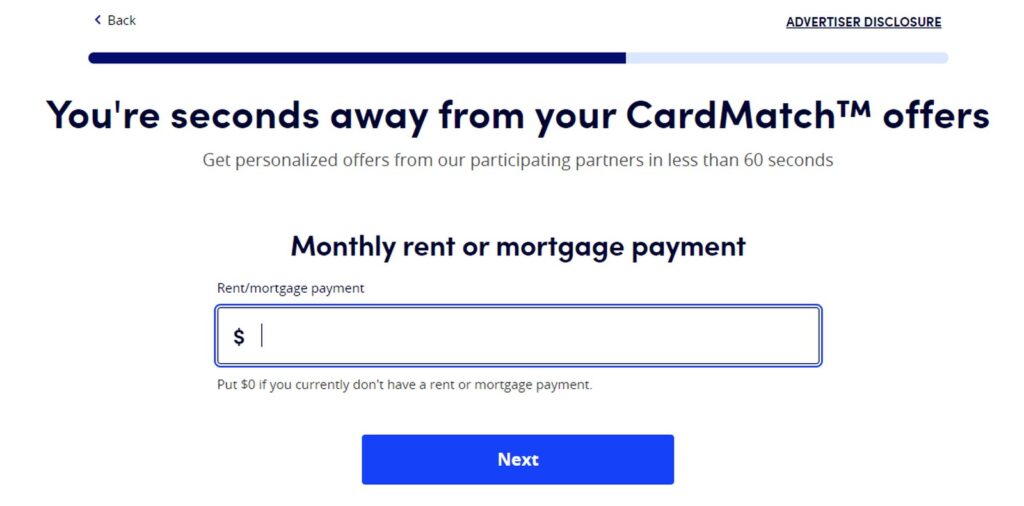

Step 6: Your Monthly Rent Or Mortgage Payment

The next question will cover how much you pay for your mortgage or rent each month.

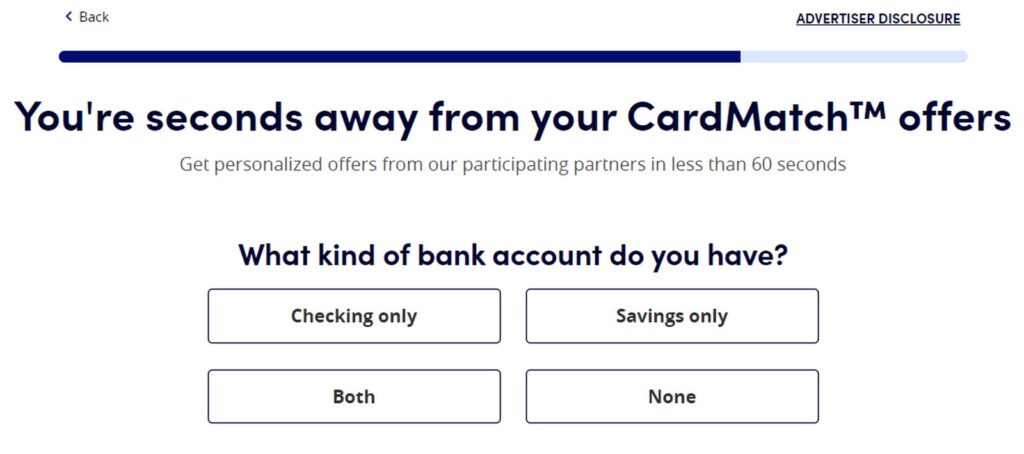

Step 7: What Kind Of Bank Accounts Do You Own

Another very common question for financial products is next up, wondering what kind of bank accounts you have available to you.

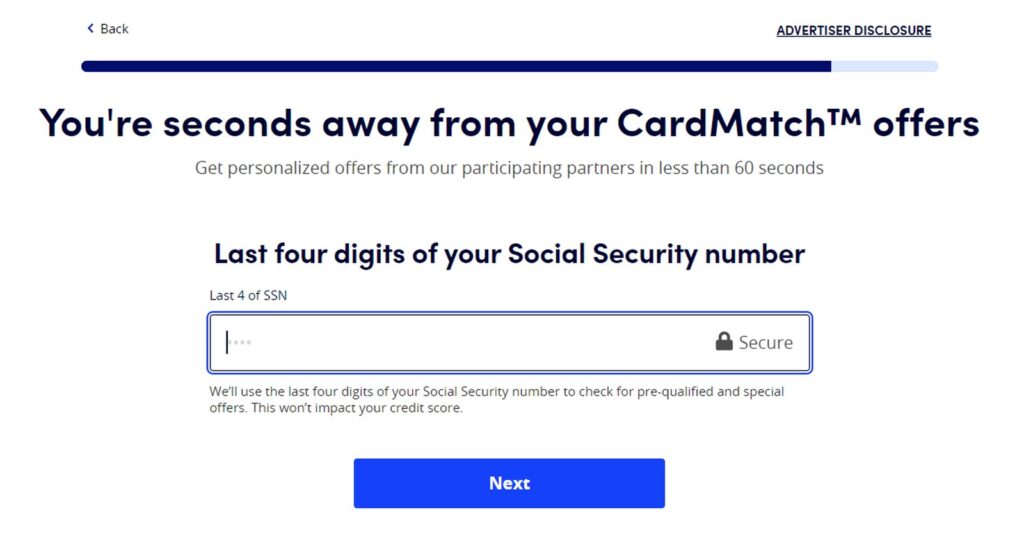

Step 8: Last Four Of Your Social Security Number

I love that the Cardmatch Tool only asks for the last four digits of your social security number since many people are uneasy sharing the full number online.

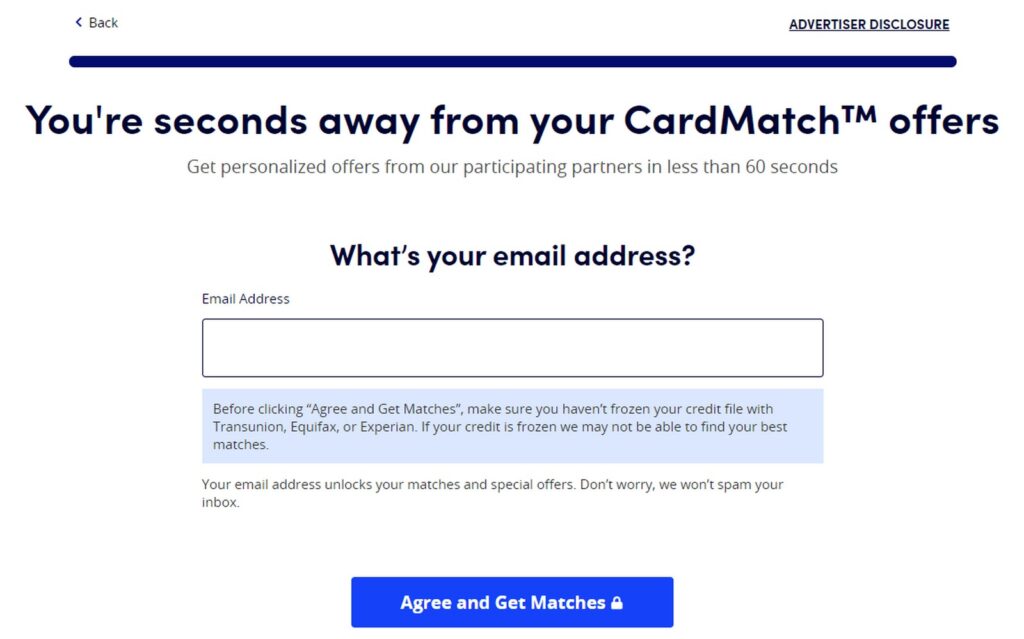

Step 9: Enter Your Email Address

The last step is entering your email address. You should be able to use a secondary / spam email address here. I will say I haven't noticed any email blasts etc. after using the Cardmatch Tool.

Check Your Cardmatch Options

After you jump through those screens you will be offered up your matches. Which issuers you get, and the cards offered, will be different from person to person. It can also be different from week to week, or month to month. I love that the info requested is about what you would expect for setting up a store rewards account. It took me a minute or two to jump through the steps and see my matches as well. The fact that there is no hard pull for doing it is the real icing on the cake though.

Check For Higher Welcome Offers With Cardmatch

Get Better Offers With The Cardmatch Tool: ToP Thoughts

Hopefully you now know exactly what the Cardmatch Tool is, and how it can help you get better welcome offers than what is publicly available. It is a targeted system, so there are no guarantees, but it is worth a try before submitting any new applications. The fact that it won't hurt your credit in anyway is why it can be such a powerful tool. I remember using the Cardmatch Tool to get my very first American Express Platinum card at the enviable 100K welcome offer level. Well, it used to be enviable. Now Cardmatch is pulling up to 175K offers – nuts!

Let me know if you give the Cardmatch tool a try and what offers you get over in the ToP Facebook Group.