Capital One Refer A Friend

I wanted to share my recent experience with a Capital One refer a friend bonus offer. It is yet another annoyance I ran into with Capital One. First, it was their travel portal rules and unwillingness to work with me on something that was out of my control, and now their referral program. I'll go over how to find Capital One refer a friend links yourself and why they can be good. I will also go over how Capital One is short sighted in their implementation and how they played “gotcha” with me.

Table of Contents

ToggleWhere To Locate Capital One Refer A Friend Offers

Many credit card issuers will offer current members some bonus points for referring a friend or family member. It is a way to reward your loyalty and giving you a thank you for spreading the word. This is a big part of the miles & points game when in a two player household (spouse or significant other). It allows you to boost your earnings on new welcome offers, as well as, sometimes getting you a better offer overall.

Capital One doesn't seem to promote this fact as much as their competitors American Express and Chase does. Here is how to locate your personal Capital One refer a friend offers.

On A Computer

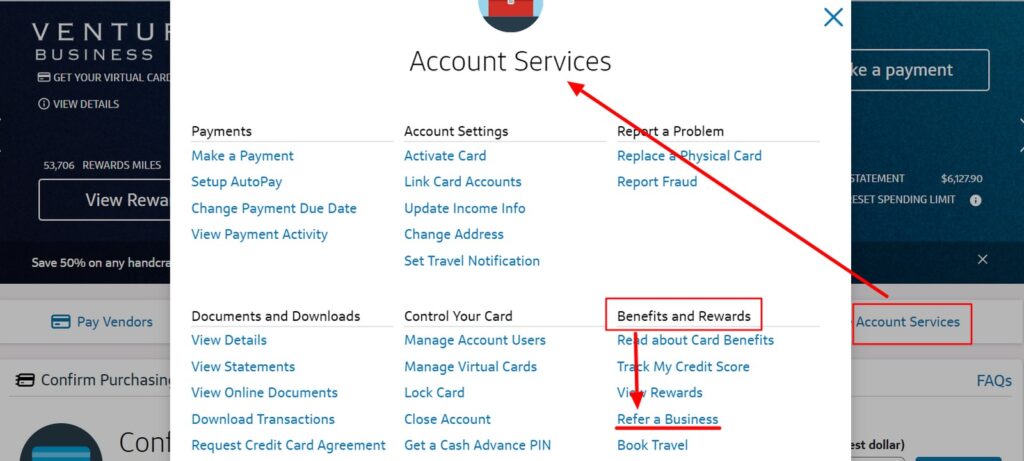

Above is a screenshot of where to find your Capital One refer a friend link.

- You first need to login to your Capital One account and select the credit card you want to refer

- Once there click Account Services in the upper right of the screen

- Once that box opens, find Benefits and Rewards on the lower right hand side of the box

- Select Refer a Business for business cards or Friend for personal cards

- This will take you to a page with your personal link to share for your card's offer

On Your Phone / In The App

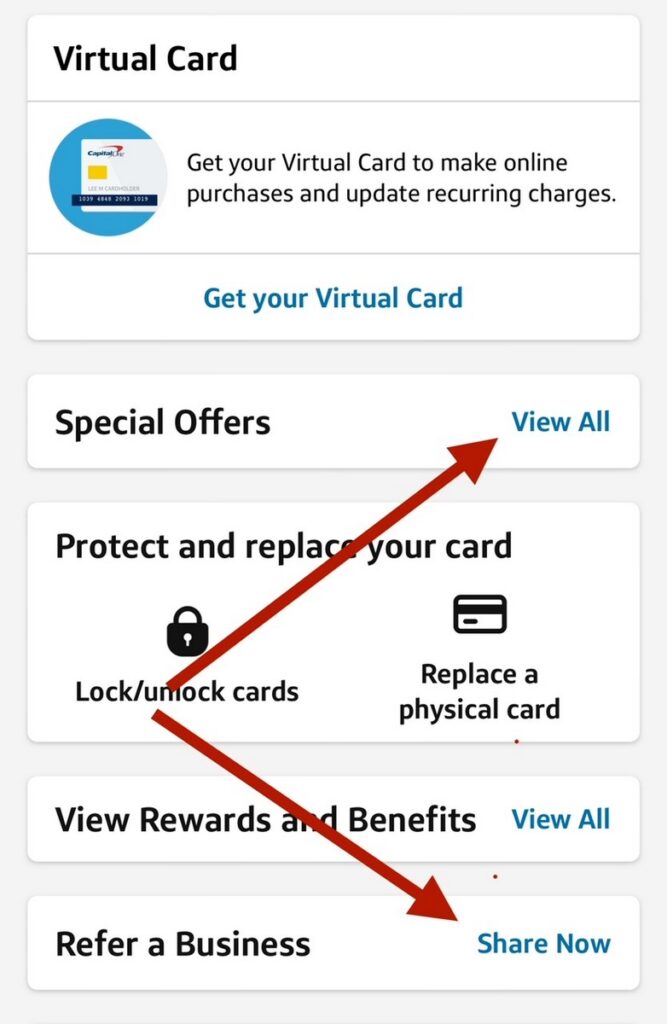

If you like doing everything on your phone / in the app, then we have you covered for that too.

- Open your Capital One app and locate the card you want to refer

- Once you have the card scroll down until you see the refer a friend / business option.

- You can also find the links in your special offers section

Not Everyone Gets Capital One Refer A Friend Links

It should be noted that not everyone gets Capital One refer a friend links. I don't know why this is the case, but you are not losing your mind if you can not find your links via either option listed above. Hopefully you will see the option added to your account soon if you don't have it already.

Why Refer A Friend Offers Can Be Good

There are a few reasons to love refer a friend bonuses. First off, they can be a nice source of bonus points or cash. The referrals can offer anywhere from $150 up to $1,500. Yes, you read that right, some are targeted for up to $1,500 referral offers! You can see the same levels in terms of points too. If you are in a two player system then that can mean an extra 20,000 or 30,000 points for each card you sign up for etc.

The other interesting thing with referral offers is that they sometimes give you a better welcome offer. Look at the current Venture X referral offer, which is 15,000 points better than the public offer. Chase has done similar things, like with the Freedom Flex card right now. At times these can offer you a bonus for referring the card, plus give the cardmember a better offer. A true win, win situation.

There are other times where it works the other way too. Times when the refer a friend offer is worse than the public offer. That is like the Chase Freedom Unlimited right now. At that point you need to decide what to do with your friend or spouse etc. If in a two person household then the referral may more than cover the difference, since all points stay in house. If you are sharing with a friend then you need to be up front with them and likely send them the public link instead. That is unless you work something else out to cover their loss.

The “Gotcha” In The Capital One Refer A Friend System

I recently referred a friend to the large Venture X Business card offer. He has some end of the year licensing fees that he needs to cover at his business which will make hitting the large minimum spend required easy. It would also net me 25,000 Capital One points for the referral, or at least it should of. He was denied for the Venture X Business but Capital One offered him another card he would approved for, the Spark 2x Miles card. This will often happen with Capital One, they will offer another option if you are not approved for the high end card but are eligible for a lower end option. Think applying for the Venture card and getting offered the Quicksilver on denial.

He went ahead with the Spark 2x Miles card and was approved. I sat back and waited for my points to post. I didn't need to wait long since Capital One referral points normally post lickety-split, within a day or two. The problem was, my referral points never came. I figured this may happen since he wasn't approved for the card I sent to him. I decided to call the number on the back of my card to inquire about this and see if there was a way to get credited for my referral. That is when I was informed that I would not be getting any referral points even with the approval. I would have received the 25,000 points only if he was approved for the Venture X Business or the Spark Cash+ card. A weird distinction, but that is what I was told.

Why This Feels Like A Gotcha

I find this to be a bit annoying, and pretty cheap overall. I brought Capital One a new cardholder and a valuable business with a lot of spend. What did I get for my effort, or troubles? Nada. Nothing. Zip! Even though the application ended in approval they give me nothing as a thank you. This feels so short sided. Why potentially upset a current cardholder, who may poison your new cardholder, over 25,000 points. Giving me the referral bonus would have been a heck of a lot cheaper than paying marketing to get someone similar to sign up. What is cheaper than giving some points though? Giving no points at all. I guess they got me there.

This especially rubs me the wrong way because their competition is way more lenient on the same thing. American Express let's you refer to almost any card they offer, outside of co-branded cards. You get the same referral bonus no matter which card they choose to apply for. Chase is a little more restrictive, only allowing you to refer to any card in the same card family, but they are still more generous than Capital One.

If Capital One is going to offer more options on a referral sign up to gain a new cardholder, then they should pay the refer a friend bonus upon approval for any card.

How To Use Capital One Refer A Friend: ToP Thoughts

Hopefully you found this how to use Capital One refer a friend guide useful. Especially if you are looking to score some extra points on your next application. Whether you do it via your computer, or the Capital One app, this should give you the tools to make it happen easily. I am also glad that I was able to share a potential downfall of the program with you. I was always curious on how it would play out if a referee signed up for a different card than what they were referred to. Well, now we now. It is likely that you will end up with a big old goose egg. It seems awfully short sighted on Capital One's part, and probably just downright cheap, but it is what it is.

Let me know if you have experienced something similar with Capital One over in the ToP Facebook Group.