Amex Charles Schwab Limits

We've had lots of negative news in the points & miles world lately. We reported that there was a seemingly minor adjustment to terms and conditions that could majorly affect Amex authorized user bonuses, Choice Hotels just devalued its program, and many more. Now we have another major devaluation: Amex has instituted Charles Schwab cash out limits at reasonable rates.

Table of Contents

ToggleThe Backstory

American Express issues various “flavors” of its premium Platinum card. The Platinum Card, the Platinum Card for Morgan Stanley, and the Platinum Card for Charles Schwab. Recently, Amex instituted a “family rule” for these cards and you can only earn one welcome offer per lifetime for any of these. The Platinum Card for Charles Schwab is a favorite of many, including Derrick, due to its ability to cash out Membership Rewards directly to a Charles Schwab account. Historically, say prior to 2022, that cash-out value was 1.25 cents per point. In late 2021, this cash-out value was lowered to 1.1 cents each, which stug quite a bit. Hindsight 20/20, however, 1.1 cents was still a decent rate for turning credit card points into cash.

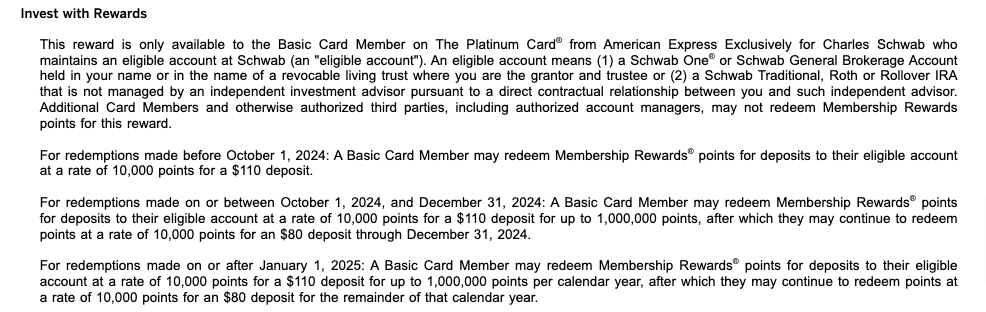

Amex Charles Schwab Limits

We learned today that a major devaluation of the Amex Platinum for Charles Schwab card is in the works. Beginning October 1, 2024, cardholders are limited to cashing out up to 1 million Amex Membership Rewards for 1.1 cents each per year. This cap is for the period of 10/1/24 to 12/31/24 and then for all subsequent calendar years. After 1 million cap, the rate goes down more than 27%, to only 0.8 cents per point. If you choose to continue cashing out points, you can do so at 0.8 cents per point. There is a limit of 4 million Membership Rewards cashed out to Charles Schwab per 7 days, so a theoretical total annual cap of 208 million Membership Rewards cashed out to Charles Schwab.

New Charles Schwab Cash Out Limits: ToP Thoughts

The good news here is 1) this likely does not affect most folks, 2) Amex gave us 3 months to prepare for this devaluation, and 2) the annual limit is still 1 million Membership Rewards at 1.1 cents each (i.e. $11,000). But that is where the good news ends and the bad news begins. If you were earning enough Amex Membership Rewards to cash out millions of Membership Rewards per year, this devaluation likely hurts. For many, it hurts more than the 2021 devaluation from 1.25 cents per point to 1.1 cents per point. It will surely cause some to reconsider the $695 annual fee on the Platinum Card for Charles Schwab. Further, it will likely lead to a flurry of cash outs between now and September 30, 2024.

Does this affect you? If so, come over to our Facebook group and let us know.

H/T: DDG