Amex Benefit Credits Post After Card Closing

Almost all of us miles and points lovers found our way into this world by being a deal hunter first. That is bedrock of our foundation, maybe even our soul. It is what drives our love of all of this after all. Well, that and all of the amazing travel! This is just a long way to say that we still have that need to maximize everything. With that in mind, now walks in the situation when an annual fee posts on our credit card, but we still have a few benefits that we want to maximize before closing the account. Should we risk the 30 day window for getting a refund on the annual fee? Or, should we walk away from that $10, $25, $50 or $200 card perk? Forget the hand wringing, we can still do it all, since Amex benefit credits post after card closing.

Table of Contents

ToggleMy Personal Experience

I have dealt with this some in the past and knew that Amex benefit credits post after card closing. Things are always changing though, so I figured I would give everyone an update on the process.

I recently had my Hilton Business card come up for renewal, and I knew I wasn't going to keep it open after they recently destroyed the card's long term value. The problem was that I had a stay planned at the Conrad Orlando shortly before my 30 day annual fee refund window would be up. I knew the on property charges would be high there, so I wanted to use my quarterly credit to defray the high prices. I actually checked out with several Hilton cards, which felt cheap and embarrassing at the time if I am telling the truth. That shame quickly turned into a smirk when a near $300 pool bar tab was slashed to around $100 though.

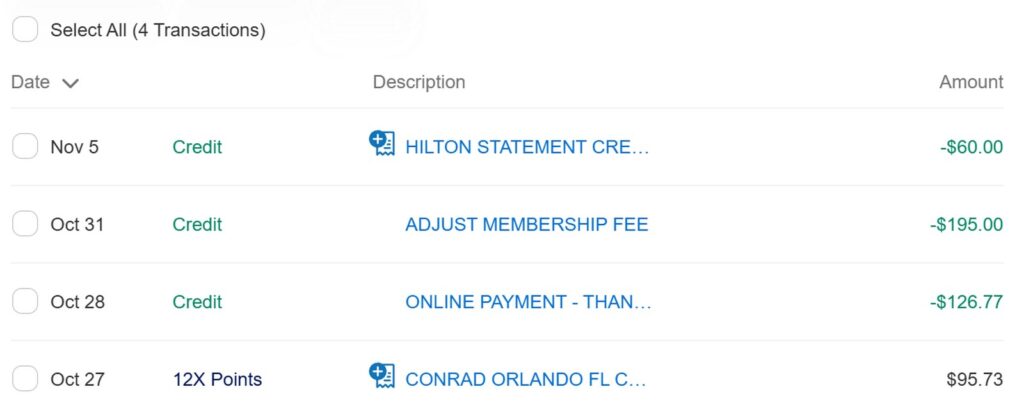

The portion of the hotel charge that was billed to this card settled on the 27th of October. I had a few days until the 30 day refund clock struck 0, but figured it wouldn't post in time. I decided to close the card on October 30th and the annual fee was refunded the next day. It wasn't until 5 days later that the statement credit came through for the quarterly property spend benefit. This still settled even though the American Express credit card had been closed.

I had been sure to leave a $60 balance on my Amex Hilton Business card at the time of closure so I didn't have a negative balance on my account when the credit came through. Although, taking care of a negative balance on your American Express account is pretty easy to handle overall.

Amex Benefit Credits Post After Card Closing: ToP Thoughts

If you are up against a wall with your American Express credit card annual fee, but still want to maximize one last perk, have no fear. You will still get the statement credit you deserve because Amex benefit credits post after card closing. It may take a few days, but they have always showed up for me.

Let me know your experience with card benefits posting properly after card closure over in the ToP Facebook Group.