Like all of you, 2020 has been frustrating, disappointing, and downright scary for Sarah and me. As we spent more and more time in our home from March through June, we realized we were not happy in our current house. At the same time, we began canceling trip after trip and our points balances began growing by leaps and bounds. By late summer, we had more points and miles than we could possibly use for travel in 2021. Almost simultaneously, we decided that we were ready to sell our house and move elsewhere. So what's the correlation between selling your home and vast sums of points and miles? I'll explain below!

Table of Contents

ToggleOur Home

Sarah and I moved into our current home almost six years ago. While we absolutely love our community and our neighbors (they're all in our Facebook group and our travel buddies!!!), we grew to love our house less and less. While we had completed many exterior upgrades over the years, including a fenced backyard, a new driveway, and new energy-efficient windows, we hadn't done much to the interior or other exterior repairs that were increasingly necessary for a 30+-year-old house.

As we began considering selling our home, we solicited bids for numerous upgrades. We realized we should spend $7,500 to $15,000 to get our house in tip-top shape to list it on the market. Now that we had a budget, we sprung into action to save as much money as possible.

The Plan

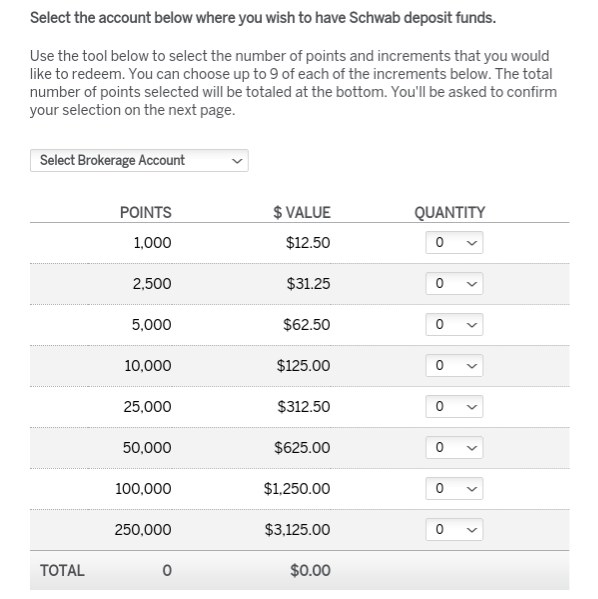

As I wrote about earlier this year, I added an American Express Platinum for Charles Schwab card to my portfolio. While I was ready for a new card, and I loved the additional perks added for 2020, I was most interested in the ability to cash out Membership Rewards at 1.25 cents per point. As I mentioned previously, there is no annual or lifetime cap on the number of Membership Rewards you can cash out. If you have Membership Rewards in your balance and you hold the Platinum for Charles Schwab, you can redeem those points for cash!

With this in mind, Sarah and I planned to aggressively cash out my Membership Rewards, while preserving enough MRs to book travel for 12-18 months, if needed. Note that while we do not usually encourage or recommend cashing out your points or miles, Sarah and I had a specific need for cash AND we had more than enough other points and miles to make all our travel dreams come true, once travel returns to pre-2020 levels.

The Execution

Over the course of 4 to 6 weeks in late summer, I cashed out 600,000 Membership Rewards for $7,500.00 in my Charles Schwab account.

Beginning in September, the home remodeling began. Our contractor is also a loyal ToP Reader and benefits from points and miles in his business! We've assisted him with maximizing his business spend, dining spend for himself and his employees, and hotel rewards when he is on the road with his crew for days or weeks.

By late October, our home was ready! A new kitchen floor, new paint, many upgrades to our basement, new shutters, new gutters, and a nice exterior refresh. We listed our home on October 29, 2020.

Believe it or not (sarcasm font), our Realtor is also a loyal ToP reader and a good friend! Do you see a theme here? Within 3 weeks, we accepted an offer and the closing is scheduled for early December!

Final Calculations

In total, we did just shy of $11,000 in necessary repairs and other upgrades to beautify our aging house. Overall, we were very, very pleased with the work on our house. Even better, the work cost us only $3,500 out of pocket, after applying the $7,500.00 we cashed out via my Platinum for Charles Schwab. We considered cashing out even more Membership Rewards to cover the entire cost, but ultimately decided against it. Instead, we opted to grab a new credit card and hit another sign-up bonus via Plastiq. If you've never used Plastiq, create your account and use referral code:607465. You'll get fee-free dollars to pay your bills via credit card (mortgage, car payments, student loans, and small businesses), even at merchants that don't otherwise take credit card payments!

Other Options

The Platinum for Charles Schwab was not the only card we could have used for this plan. We chose this card because I had plenty of Membership Rewards. Instead of Membership Rewards, we could have also used Chase Ultimate Rewards through Chase “Pay Yourself Back” at a value of 1.5 cents per point with the Chase Sapphire Reserve (or 1.25 cents per point with the Chase Sapphire Preferred). However, Pay Yourself Back is limited to actual credit card spend instead of actually cashing points out. So that would have required buying some gift cards at stores that qualify for Pay Yourself Back. Also, Chase does offer the opportunity to cash out Ultimate Rewards at 1.0 cent per point. But at this rate, the Platinum for Charles Schwab is a better option, unless you're swimming in Chase points.

In addition to Chase, we could have cashed out Citi ThankYou Points via cash back at 0.5 cents per point. The Citi route is definitely the least appealing, given the low redemption value. Citi's cash back feature involves either them mailing you a check or a statement credit on your credit card bill. Neither of these are particularly efficient.

Conclusion

While Sarah & I had never really considered cashing out points or miles before, 2020 made sense. We've now cancelled over a dozen trips, including 5 weeks of international trips. Those points alone are enough to book a full vacation schedule for 2021. With those refunds, in addition to aggressively earning points and miles in 2020, it was the perfect storm to offset out-of-pocket costs with credit card rewards! So tell us, are you using credit card rewards for cash during 2020? Have you switched your credit card earnings to cash back cards? Head over to our Facebook group and let us know your current strategy.