Amex Credit Balance Refund

I don't often end up with a negative balance on my credit card accounts, but when I do, it seems to always be with American Express. This is probably because of all of the credits (err coupons) their cards offer as perks. That, plus a slew of other things like Amex Offers and merchant refunds and I assume most will end up with a negative number showing a time or two. Because of that we can all be in the need of an Amex credit balance refund from time to time.

Table of Contents

ToggleHow do we go about doing it, though? American Express offers a plethora of ways to get that negative balance money back in your pocket. It is your money after all! Let's go through each of them and see which one works best for you.

What Is A Credit Balance Or Negative Balance & How Do You End Up With One?

Before we get into how you can get your money back with an Amex credit balance refund, we should discuss how you end up with one in the first place. I discussed some of the ways it can happen above, but it is basically when you gave the card issuer more money than you owed. That means the issuer, American Express in this case, actually owes you money. Usually this isn't a whoopsie mistake where someone added a 0 to their payment check. It is often a bit more nuanced than that. Here are some examples of how I have ended up with a credit balance in the past:

- Credit from a merchant because of a returned item or refund from them after I had already paid my statement off.

- Paid for the annual fee of the card and then credited back after closure.

- Redeemed credit card rewards to the account which took it negative.

- Amex Offer posted to the account after my payment was made.

- Statement credit posted to the account after payment was made (card perk credit etc.)

How To Get An Amex Credit Balance Refund

Now that we know what causes a negative balance on your credit card account we need to go over how to get an Amex credit balance refund. I'll list all 5 options I am aware of from easiest option to most difficult / time consuming option.

Spend More Money On Your Card

The easiest thing to do is spend more money on your card to use up the negative balance. If it is a card you use regularly, like the Amex Gold, then this should be easy to do. If it is a card you were just using to take advantage of an Amex Offer, or card perk like with the Business Platinum, then this may not be a great option for you. That is because the earning structure on some cards makes it not worth spending on them outside of perks and other offers. If it is a card you use all of the time this is the easiest option though.

Do Nothing & Wait

If you don't mind waiting a few months for your money then you can simply do nothing. After around 3 – 4 months American Express will mail you a check for the negative credit card balance on the account. This won't be a great option if the credit is a larger amount and you don't want to wait that long. This is the approach I often take when I have a $10 or $20 American Express credit balance.

I should note, this will likely not work on a closed card. I let a credit sit for 6 months on a closed account and they never mailed a check. It required me being proactive with one of the following options on this list to get my Amex credit balance refund.

Fill Out A Refund Request Online

American Express lets you file a negative balance refund request online too. Word of caution here too, do not request the refund to a card that doesn't have a large enough balance to cover it. Even if there are enough charges pending it will not work. They will end up reverting to mailing you a check and it is kind of a mess. Send it to an account that has enough of a balance to cover the entire thing. If you don't have that then wait until you do, or ask for a check instead.

Here are the steps required for an Amex credit balance refund request online:

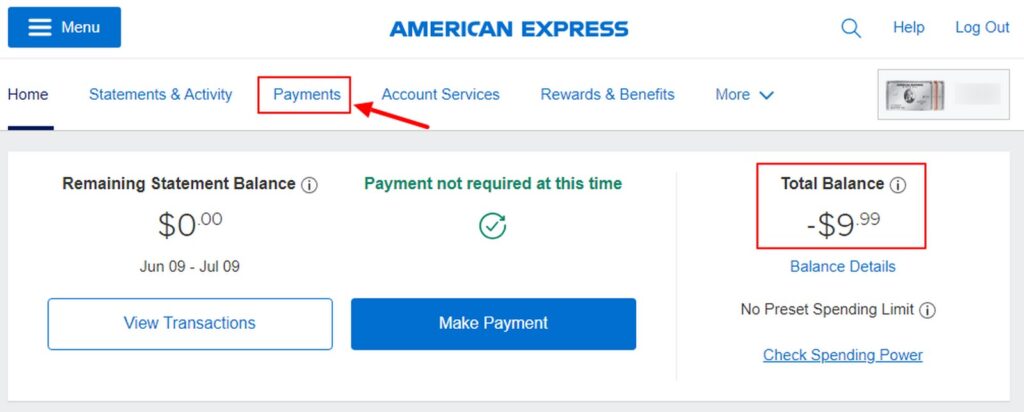

Payments

First up you want to go to the account with a negative balance on your desktop. Once there select Payments from the ToP of the screen.

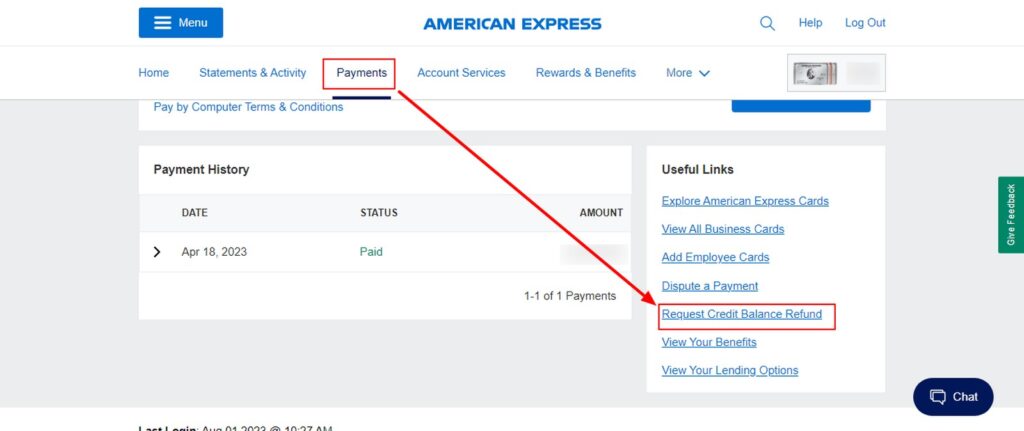

Request Credit Balance Refund

After you hit Payments you need to go to Request Credit Balance Refund on the right hand side under useful links.

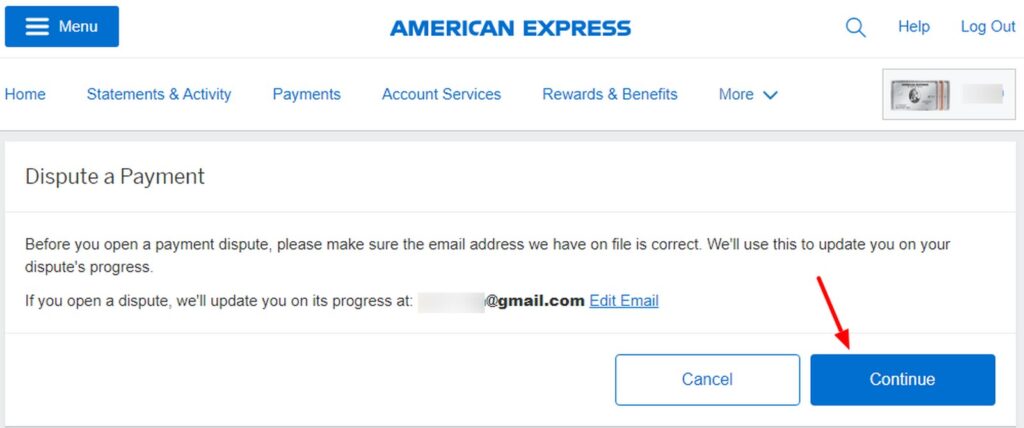

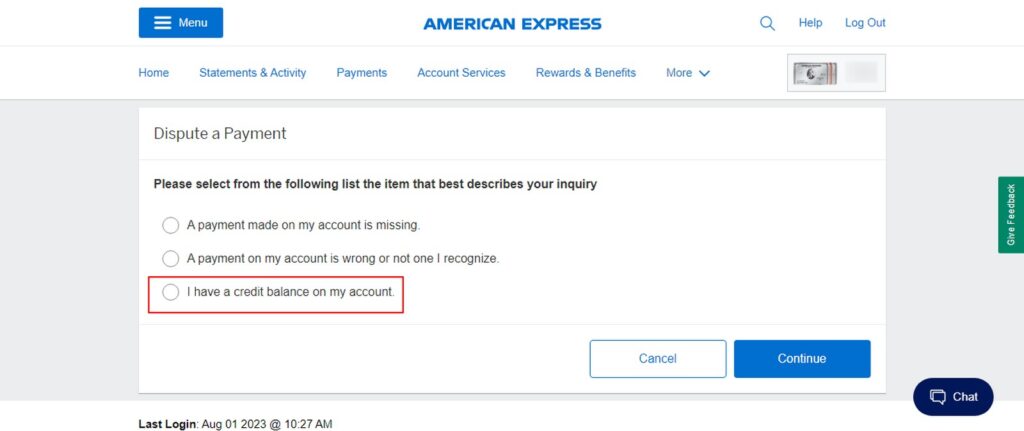

Dispute A Payment

This seems a bit off but the next step is to Dispute A Payment.

Credit Balance

Once you select you want to Dispute A Payment you will get 3 options. You will want to select I Have A Credit Balance On My Account and then hit submit.

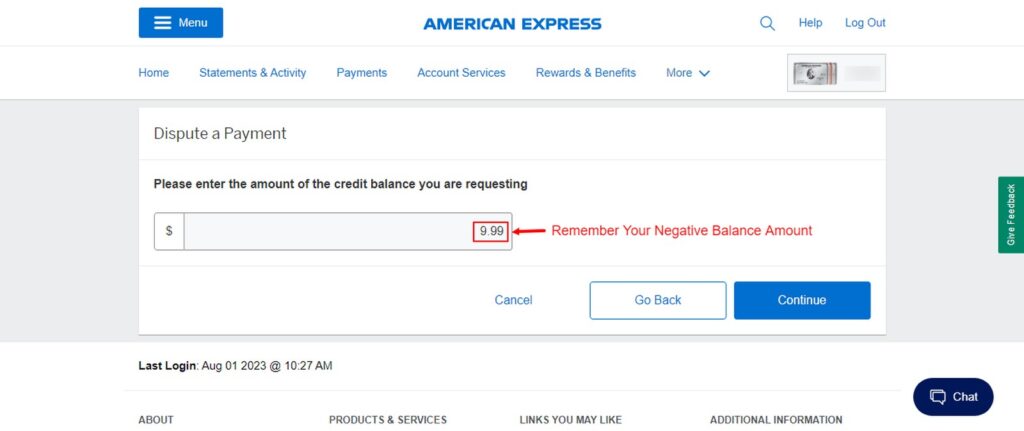

Enter Credit Balance Amount

I find this step mildly annoying since it doesn't prompt you with your negative balance amount. You may want to write it down before getting started if it is a weird amount. Enter your credit balance amount and select continue.

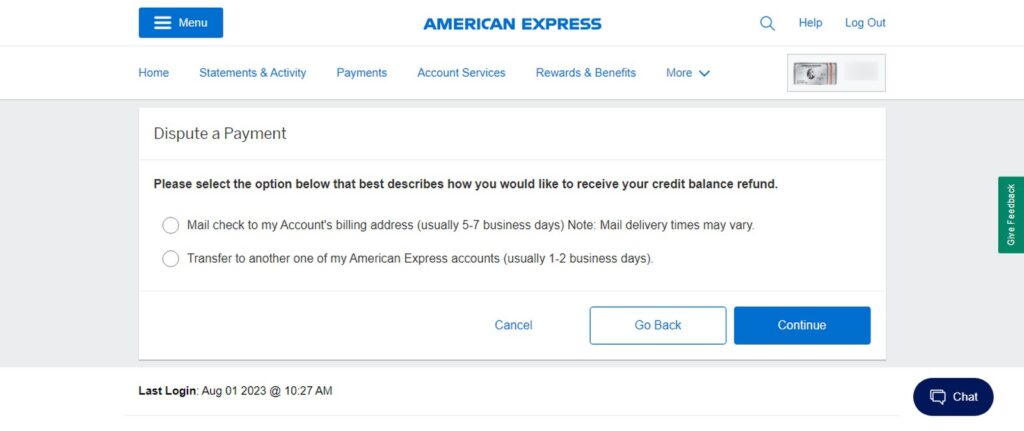

Select Payment Method

This is the decision I alluded to earlier in this thread. If you have a card with a balance substantial enough to cover the negative balance select that. It will be the quicker option and there is no chance of the USPS losing the check in the mail. If not, then you need to select to have a check mailed to you.

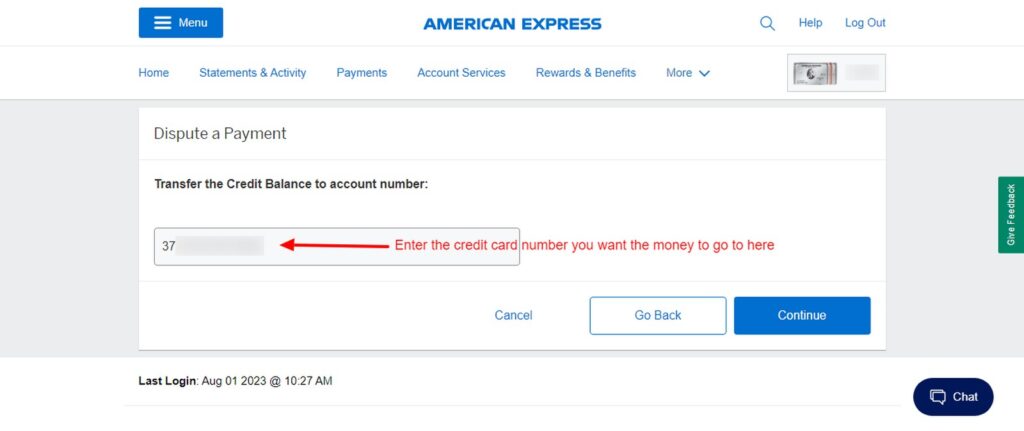

Enter Credit Card Info (If You Select That Option)

Instead of giving you a drop down option of your cards and balances you will need to now manually input the card number you want the Amex credit balance refund to go to.

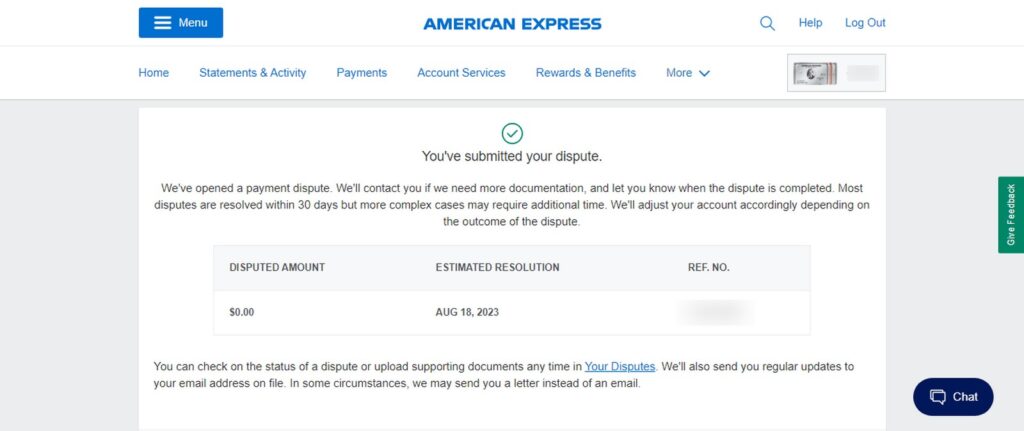

Estimated Resolution

On the last page they will give you an estimated resolution for the credit. It took a day or two for me.

Amex Chat

The next easiest option is to just fire up Amex Chat and ask the rep to handle it for you. They can mail you a check or apply it to another card on your account with a balance. This will take a little longer than doing it yourself online, but there is less of a chance you mess something up.

Call In

The last, and most time consuming option, is to call the number on the back of your card and request a transfer to another card or check via mail. The reps will be happy to help, but you will likely be on hold to get one, and it could take a while to get it all processed.

Amex Credit Balance Refund: ToP Thoughts

I think I have all of the bases covered, but if I missed an Amex credit balance refund option please let me know. Which one works best for you will depend on the balance amount, what other cards you have and if you prefer speed or the hands off approach. There should be an option that works for everyone though.

Let me know which route you go when you have a negative balance with American Express over in the ToP Facebook Group.