When Buying Points Makes Sense

For one of the first times ever I actually purchased points to make a booking for an upcoming trip. This is not something that I would normally do, and outside of topping off an account for an award, it isn't something I have done in the past. Brian put together a good post on if buying points is ever worth it. The two times he points out that it could make sense is to top off an account for a specific award redemption or if it saves you money and you were going to pay cash anyway. I have an example that is kind of like a hybrid of those two. Let's take a look at the details.

Table of Contents

Toggle

Upcoming 40th Birthday Trip To Europe Hotel Booking

I should probably break down my booking for this trip in more detail in the near future. In a few months I turn from veteran young guy to rookie old guy and booked a nice trip to celebrate the occasion. The last leg of it has us in Copenhagen for a few nights before flying home. Copenhagen can be an expensive city and it doesn't have great Hilton or Hyatt points booking options, my two favorite hotel programs. So I had to look outside the box a bit and landed on Choice Hotels.

While Choice Hotels usually consists of roadside dumps in the US they have pretty nice hotels internationally that can offer massive value. We noticed that the Clairon hotel near the airport had a pretty good price on points. The fact that I had an early flight out made it extra appealing. There is also a train station right out front and we could be in the city center after a quick 15 minute ride. I also remember my buddy Shawn staying there and enjoying the property. The problem was I didn't have enough points to book the hotel, coming up 13,000 points short. My friends going on the trip with me also needed rooms too and didn't have Choice points so we had to figure that out as well.

Clarion Copenhagen Airport Hotel Cost

The Clarion Copenhagen Airport hotel was pricing out at an affordable 20,000 points per night. That seemed like a steal, but it looked even better after checking the cash price. It was pricing out at 3,780 DKK for the two night stay, which is $550.66 per Google's currency exchange. That is a value of 1.38 cents per point! Move over Hyatt, Choice is coming through. I kid of course, but that is a great return on some also-ran hotel points.

If you check out our ToP Partner Transfer Tool you will see that Choice Hotels is a transfer partner of the following programs:

- Amex Membership Rewards – 1 to 1

- Capital One – 1 to 1

- Citi ThankYou points – 1 to 2

Citi is the clear winner here, giving you two Choice points for every ThankYou point. That means you can get this hotel for 10,000 ThankYou points a night, or a return of 2.75 cents per point. Heck yeah! The problem was I don't have Citi ThankYou points (that is a story for a meet up some time) so I was left with the other two options.

While I value Membership Rewards at slightly more than 1.38 cents per point I would probably make the transfer. My first choice would be Capital One miles, since I value them less than Membership Rewards points. Especially since I usually use them as travel eraser points. That makes this hotel booking a 37% boost to my normal redemption. #Winning

What About Buying Points?

I figured I had my mind made up, I would transfer enough Capital One miles to cover both rooms and get it booked. I was feeling pretty good about it, getting a good return on my transfer and a amazing redemption on the 27,000 Choice points in my account. It would have been even better if I had some ThankYou points, but hey, you can't win them all.

Just out of curiosity I checked the cost to buy the points needed. Choice, as do most hotel programs, run sales on their points quite often. I normally don't pay much attention to them because it is often a breakeven price at best. That is unless a hotel's cash price is inflated versus the points cost, which was just the situation I had on my hands here.

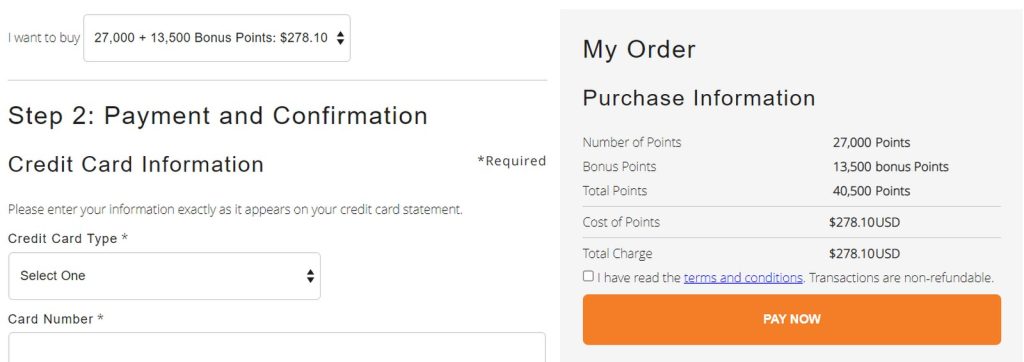

Choice is currently running a deal on purchasing their points, where you can get 50% more points when you purchase at least 8,000 points. Because of the sale I would get 13,500 bonus points for buying 27,000 points. That gets me just over the 40,000 points needed for a two night stay at the hotel. The cost for this purchase was a shocking $278.10. So wait, I could buy the points needed for a $550.66 room for only $278.10? How does that make sense? It doesn't!

Buying Points WITH Points

This left me with a decision. I could buy the points needed for only $278.10 or transfer in 40,000. Even though the transfer made sense from a value perspective when looking at the cash price it looks a heck of a lot worse now. That is because the true cost of the two nights is $278.10, not $550.66.

At the cash rate you would get the following value per point:

- Citi ThankYou Points – 2.75 cents per point

- Membership Rewards & Capital One – 1.38 cents per point

At the purchasing points cost I would get the following return though:

- Citi ThankYou Points – 1.39 cents per point

- Membership Rewards & Capital One – .69 cents per point

Whoa, look at the difference there. We just broke the glass on valuing points based off of cash rates, didn't we?

If I had Citi ThankYou points it would probably still make sense to do the transfer for a 1.39 cents per point return. That is unless you personally value them more than that. I personally don't so I would move the points over.

As for the Capital One and Amex points, oh heck no! That isn't a transfer I would ever make at .69 cents per point. It would be cheaper to cash them out and pay for it … wait a second there. Eureka!

The Math On Cashing Out To Buy Points

I have the Charles Schwab Platinum card which allows me to cash out Membership Rewards at 1.1 cents per point. The other option is if you have a Business Platinum card and a business checking account, which I do as well, then you can cash out points at 1 cent per point via that route. That option comes with a cap of 1 million points a year though.

If I cashed out Membership Rewards at 1.1 cents each I would need 25,281 points to cover the purchase, a far cry from the 40,000 needed via transfer. The business account option you would need 27,810 points at 1 cent each, still a vast improvement versus transferring. If you compare this to the cash rate for the hotel those 25,281 points brings you a 2.18 cents per point redemption. Math really can twist things in your mind, can't it?

For Capital One the hope is a points purchase codes as travel and you can wipe them away as such at 1 cent per point. It will depend on if the hotel runs their points purchases through a third party or not etc. I am not sure how these code for Capital One so it may be a moot point.

What Did I End Up Doing?

I ended up just buying the points with a card I was working on minimum spend for. If I end up needing cash for it I can redeem some Membership Rewards points, but for now I plan on just covering the cost. Heck, what are those bank bonuses for after all? On my Amex card it shows as POINTS CHOICE REWARDSAN FRANCISCO CA and since the Business Platinum earns 1x on most everything I can't tell you if it codes as travel or not. Each issuer could code it differently anyway.

When Buying Points Makes Sense: ToP Thoughts

This just goes to show you, there is more than one way to skin a cat. What looked like a pretty good point transfer option at the start didn't end up being so sexy when we took a look under the hood. While buying points usually won't make sense, sometimes it can come in pretty clutch. So much so that buying points with points will actually give you the better redemption. This is especially true when the awards are not dynamic and the cash price is inflated.

I know that this gives you one more thing to think about, and who needs that, but it is something to keep in the back of your mind. This time around it really did save the day … and a ton of points!