Properly Evaluate Credit Card Perks

I wanted to share a showdown of sorts I recently had, between the perks of my IHG Premier card and my Amex Business Platinum. This happened when I was looking at flights for my insane hotel redemption trip. I have gone back and forth on writing about it since it is kind of a niche example, but I figured it shows how to properly evaluate credit card perks. A common mistake is taking credit card perks at face value, and assuming that is what you are going to get in return. Be sure to weigh them against other card perks and other prices out there. Let's run through my example to give you a better idea of what I am talking about.

Table of Contents

Toggle

Booking A Return Flight From My Crazy Football Redemption

If you remember, I redeemed Choice Privileges points for a crazy college football weekend. It included field access, pre-game tailgating, suite tickets, $1500 in gift cards and more. I talked about it as a guest on a recent MtM Podcast, if you are interested in more details about the experience.

One thing that wasn't included in the package were the flights to and from New Jersey. That is what the $1,500 in gift cards were for. I had found an award flight out on Delta pretty easily, but the return flights were not the best.

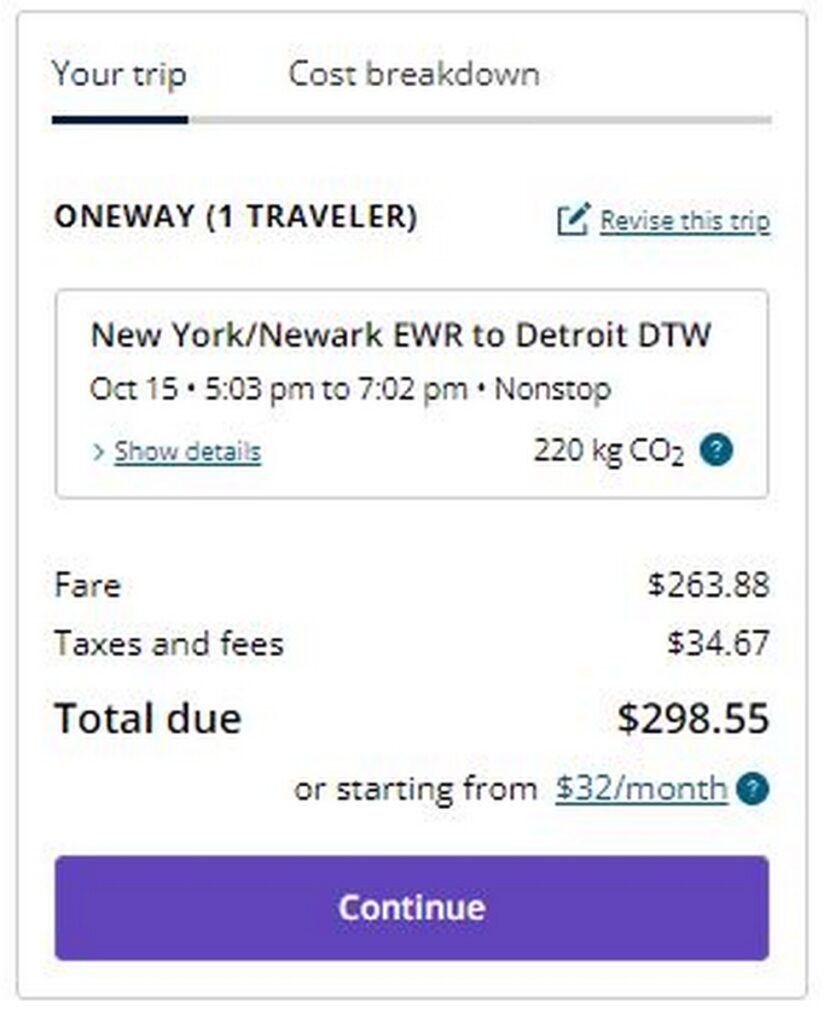

After a few weeks of continued searching I came across a Untied flight home that left early evening, like I wanted, and first class was only $298.55. I thought that was reasonable, even if it is a really short flight, and I decided to spoil myself since I had that gift card cash to burn. If I could use miles I wanted to do that though, and just pocket the money.

Amex Business Platinum 35% Rebate

My first thought was to take advantage of the Amex Business Platinum 35% rebate. Crazy enough, I have never used this card perk over the years. I was excited to give it a try and write about my experience booking it.

If you are not aware of what I am talking about, this is a perk of the American Express Business Platinum card. You can redeem Membership Rewards on some flights at 1 cent per point. You then get a 35% rebate on the points you used, netting you a more palpable 1.5 cents per point after the rebate. This only works on the airline you select for your airline incidental credit or business / first class tickets on any airline. This $298.55 flight on United would work, even though Delta was my selected airline, because it was a first class flight.

I could redeem 29,855 Membership Rewards to book the flight and then get a rebate of 10,449 points back after the flight. Not too shabby. The problem is, it didn't quite work out that way though.

The Pricing On Amex's Travel Portal Was The First Red Flag

I had found the flight on Google Flights first and checked United's site to confirm the price. I had also checked the award cost just in case that was a decent deal with United miles. Spoiler alert, it was not. Next, I went to the American Express travel portal to book the flight with the 35% rebate credit. The problem was that the pricing was different, it was pricing around $20 higher. Have I mentioned that I HATE bank travel portals?

While this wasn't a huge difference, it did drop the realistic value I was getting for my Membership Rewards points. Since I could book the flight directly for less, that is the number I should use to calculate the value I am getting for my points.

I would be paying 20,729 Membership Rewards for this flight, after the 35% rebate, that would have only cost me $298.55 out of pocket if booking direct. That is a value of only 1.44 cents per point, below my desired 1.5+ cents per point for Membership Rewards redemptions. It wasn't terrible though, and I figured I would still go ahead with it, until I remembered my recently upgraded IHG Premier card.

IHG Premier United Travel Bank Credit

A few weeks earlier I had upgraded my old IHG Mastercard to the IHG Premier even though there was no upgrade offer. I did that for several reasons, which you can read here, but the United Travel Bank credit wasn't one of them. If I am being honest, I assumed I would pretty much never use the perk since I fly United like once every 5 years. Even less so on cash tickets.

It dawned on me that I had this credit available now and that gave me even more pause on my booking. If I added in this $25 credit to the calculations, dropping the out of pocket cost to $273.55, that would net me only 1.32 cents per point for the Amex portal booking. That dropped the value to a level I just wasn't interested in.

I decided to go ahead and add the United Travel Bank credit to my account, which was really easy to do (process detailed here), and booked the flight directly with cash for $273.55 out of pocket.

Properly Evaluate Credit Card Perks: ToP Thoughts

Hopefully this is a reminder to check all of the tools in your toolbelt before making a decision on each and every booking. That is how to properly evaluate credit card perks. I could have just gone ahead and taken the Amex travel portal's price and booked my flight with Membership Rewards. Then I could have felt good about getting a first class seat and netting me 1.5 cents per point for my trouble. That wouldn't have been living in reality though, and it would have been lazy math overall.

Remember to always check the travel portal prices versus booking directly to see how the deal really lines up. Also, remember to compare the redemption to every available credit and perk you have available to yourself before making a decision. That is the true net value you are getting for your points. At that point you can make a well informed choice.

This time around the $99 annual fee IHG Premier card was the reason I had to kick my super expensive ($695) Amex Business Platinum card perk to the curb. Have you ever done something similar? Let me know over in the ToP Facebook Group.