I typically have not been a status chaser, although I love challenges and status matches and hacks to achieve status without having to really chase it. I consider the term “status chasing” to mean anytime you are paying out of pocket or making extra stays or flights just to get elite status. Mileage running or mattress running would be other terms used for this concept. I thought I would share my Delta journey which began with no intention of attaining status until the offers were too good to pass up.

Table of Contents

ToggleDelta Status Basics

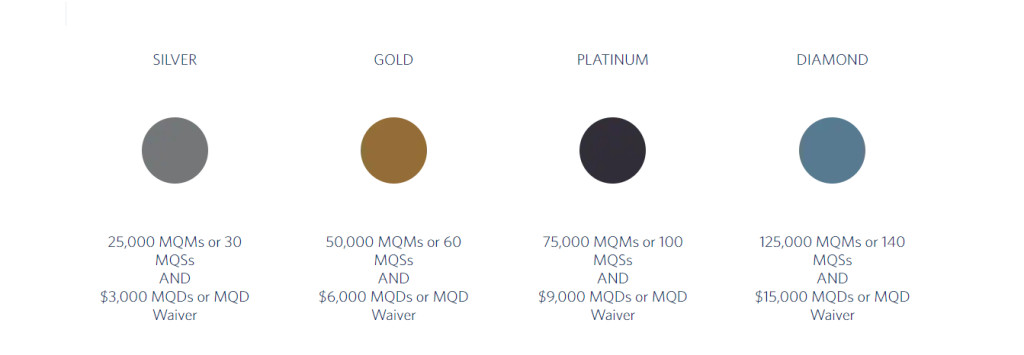

Outside of a status match, you achieve Delta status by meeting two requirements. First, you must spend enough money on your flights known as Medallion Qualifying Dollars (MQD). MQDs are earned based on your annual spending on Delta flights and on many partner flights. You can earn a waiver for the MQD with eligible American Express Delta cards and $25,000 in spend.

Next, you must earn enough Medallion Qualifying Miles (MQM) for the required status levels. MQMs are based on distance flown and fare class. You can earn extra MQM through a spending booster on your American Express Delta cards as well. For me, with my Delta Reserve card, I get 15,000 MQM for every $30,000 in spend up to $120,000 in spend on the card.

MQMs are not redeemable miles. Redeemable miles, as it pertains to flights, are earned at a rate of 5 miles for each $1 spent. You also earn redeemable miles on credit card spend with an eligible American Express card, shopping portals, or things like linking your account to Lyft. If you have Medallion Status you can earn even more MQMs based on status level, up to 11 miles per $1.

The miles, MQM, and MQD numbers you earn are all accessible in the Delta App or the website. I find the app to be much more friendly for navigation. You can also view a breakdown of all your activity easily.

How it Began

In January 2019, I had United Silver which was free through Marriott Titanium, which I also happened to use a challenge to achieve. I always research on status matcher website to check for latest data points. Before my status ended, I did a status match to Delta Silver. I felt flying the second largest carrier out of my home airport (SEA) would provide benefits of upgrade possibilities. That held true in 2019 and throughout my Silver status, I earned upgrades at a 85% rate. Half of those were to first class. Yes, many were western U.S. trips, but upgrades nonetheless. And flying in more comfort and with more leg room was great for someone tall, like me. Fast forward to 2020, I figured I could get to Gold (50,000 MQM) based just on flights I had planned to take.

Prior to 2020, I was paying for my cash flights via the Chase Travel Portal available via my Chase Sapphire Reserve card to avoid out of pocket expenses. My main personal goal is to limit any money being spent on flights and hotels so that I can save my cash for other costs while traveling. Expenses such as food, beverages, and any activities, I cover with my cash savings. Since Chase has instituted the Pay Yourself Back feature for Sapphire Preferred and Sapphire Reserve cardholders, I have been utilizing that for most of my flight spending.

I also use deals on gift cards by using sites and apps like Raise, which has saved me money on flights. You can read about my use of Raise here.

Finally, I picked up the Delta Reserve card at the end of 2019. This allowed me to earn more MQMs and the ability to earn the MQD spending waiver I mentioned. The Reserve card also bumps me to the top of the upgrade list within my status level. This meant I was ahead of other Silver Medallions who aren't Reserve cardholders.

Getting to Gold

My flights that were flown weren't too crazy as far as frequency or mileage compared to a normal year for many people. With that being said, it is not unusual for me to fly every other weekend. In early 2020, I made a trip to Hawaii as well as a multi-leg trip to the East Coast and Southern U.S. But then travel halted when the pandemic hit and I did not fly Delta again until July. When everything shut down, I was at just over 13,000 MQM needing 25,000 to maintain Silver. Gold seemed to be a far reach at this point. Nonetheless, I began putting enough of my side business spend on the card to meet the MQD waiver just in case.

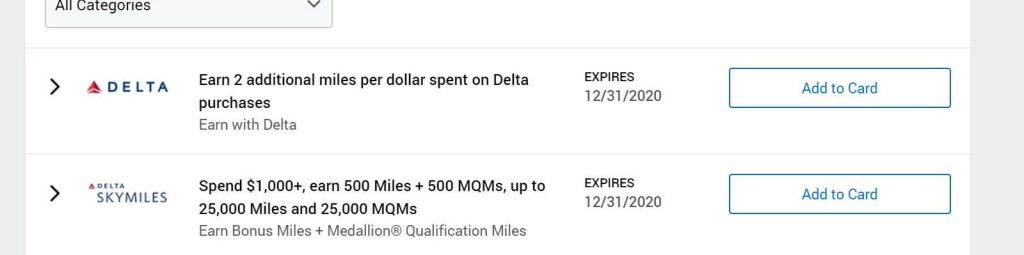

August came, and with it, the offer that changed everything. American Express came out with the Amex offer that would be a game-changer: earn 500 MQM and 500 miles (redeemable) for every $1,000 in spend. Additionally, they also began offering additional points for Delta flights purchased. I wrote about my initial thoughts here.

With these offers, I could put my spending to good use. The spending on the card for the waiver was already going to happen, but now I could also earn MQM for that spend. Shifting credit lines between cards can be a useful tool for deals like this. I moved my credit limit from another Amex card to my Delta Reserve card. This gave me more spending capability. I had some business trips to the East Coast which was boosting my MQM as well. At the end of October, I hit 50,000 MQM which earned me Gold Medallion status. But then I realized Platinum Medallion status was within my reach.

Platinum Run

Many Delta frequent fliers may ask: “Why the Platinum run, now?” Typically, Delta rolls over any MQMs earned above your current status level. That means If I earned 55,000, I would be at Gold (50,000) and the other 5,000 would roll over towards the next year. However, Delta then announced due to COVID they would allow everything to roll over. That means in the scenario above, all 55,000 would roll over, leaving me just 20,000 short of Platinum. However, I would need to earn the MQD waiver again in 2021 and consider the time it takes me to spend $25,000. That may have taken me a few months depending on my business spending. Because of this, I wanted to take advantage of the opportunity to go for Platinum Medallion now, especially with the current trend of lower-priced flights.

As I mentioned, my upgrade rate out of Seattle was impressive at 85% with half of those being to First. The First Class upgrades increased once I achieved Gold status and also coincided with a time when less people were flying. I began to research domestic routes with Delta One seats available.

I discovered that some Delta One seats still show as First Class fare as opposed to Delta One when booking. Because of Delta's upgrade rules for Medallion members, this meant I could clear some of those upgrades early rather than on the day of flight. In addition, all the Delta One seats were still practically empty leading up to the day of flight. When I considered all of this, it seemed that if I was to make a run for Platinum Status (75,000) MQM, I could do it while getting a much higher upgrade rate. Perhaps even while upgraded to a lie-flat seat for extra comfort on the longer domestic flights.

I wrote a detailed breakdown on a mileage run I did that you can read here. These were a bit different than normal mileage runs, in that I was essentially extending an already planned trip. The cost was close to the same amount as my intended trips. I could fly to the East Coast and back Lasto Vegas cheaper than I could from Seattle. Many of these flights were just over $100, but I was flying in first class or Delta One lie flat seats.

How it Ended

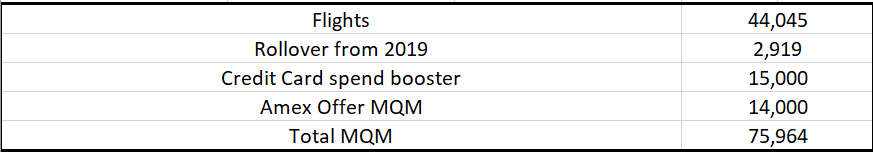

It did not all go smoothly, as you can read here with one of my travel blunders. However, when my December American Express statement closed on the 25th, I secured Platinum status. I went over by just 964 MQM. Overall, here was my breakdown of MQM earned:

In the end, I spent very little extra out of pocket over my already planned trips. I earned almost 30,000 in MQM from the Amex offer and spending boost. I plan on putting my status to good use. With the extended rollover Delta is providing, I only need to meet my spending waiver in 2021. Essentially, this lines me up for Platinum status through 2022. I was happy to have the offers and really fortunate to have gotten the Delta Reserve card.

Do you fly Delta? Have you ever chased status? Thinking about a Delta card? Want to find out more? Come over to our Facebook group and let us know your thoughts. Don’t forget to follow us on Instagram too!