Many times, especially after you've been in the award travel world for a while, you may be approved for a smaller credit limit than you wanted or expected. This could be for various reasons, such as issues on your credit report, credit extended to you with that specific credit card company, total available credit, or low credit utilization or non-use of your existing credit cards.

Table of Contents

ToggleReallocating or moving credit limits between cards is a valuable tool in expanding your earning capabilities. In most cases, it's a very quick and painless process. You are not requesting more credit, which could possibly trigger a hard pull on your credit report. Rather, you are simply taking part of your credit limit from one card and moving it to another.

Why Would I Want or Need to Reallocate Credit?

We may all have different reasons, but here are a few to consider: the ability to meet a minimum spend may be easier if you have a larger credit line, especially if you’re planning on making a large purchase. Additionally, perhaps a card has a higher elevated earning rate, as we recently saw with Chase and American Express. Finally, you may not be using a card as much or want to put more spend on a different card as goals change.

The Credit Reallocation Process

The process can vary by credit card company but here are some examples from a couple of major credit card companies. I utilized both recently and the process is easy.

Chase

Chase allows you to call and make the request to reallocate credit. With current wait times running long during the pandemic, however, there is a better option: a secure message! It is as simple as sending a secure message explaining how much you want to move from card A and to put the extra credit limit on card B, C or D. Wait times for the transaction to be completed can vary. It's best to plan ahead and expect a day or two wait, especially if the credit limit increase is time-sensitive for a large purchase. This certainly can be better than sitting on hold for hours if wait times are long.

Here is an example of the recent request I made via secure message:

I need to move $4,000 from card XXXX to XXXX as I am not traveling much currently for obvious reasons. Thank you

This was the extent of my message and my request was completed the next day!

American Express

This one may be the easiest ever and I just recently used it. Begin by logging into your American Express account and then click this link:

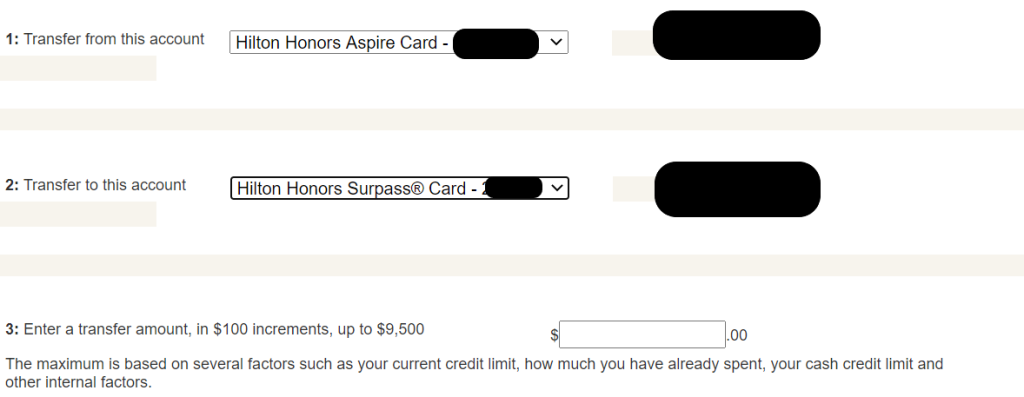

You will then get this easy to use screen with drop down boxes. The drop-down menu will have your American Express credit cards listed. Choose each card and it will show you the current credit limits. Just enter the amount you wish to transfer and click “continue” to complete the process. I did this instantly after activating my new card. The credit allocation takes effect immediately.

Other Banks

With other companies, you usually need to call and may experience a variety of rules and conditions. For Citi, you can attempt to reallocate credit via chat or by calling. However, your mileage may vary and many customer service representatives state it is not possible or make it very difficult. Discover often requires you to wait at least 90 days after opening the card to request a credit reallocation. Lastly, it seems Capital One has stopped allowing voluntary credit reallocations between accounts. As always, with any requests with credit card companies, we always like to remind you to hang up, call again (HUCA) if you do not receive the answer you want or expect to hear. You never know when your request is granted with another call.

Final Thoughts

Reallocating credit lines can be beneficial to assist with getting more spending power on whichever card is benefiting you the most at any given time. This can also be valuable during promotions or meeting minimum spends. Finally, while we often recommend downgrading a card first, you can also reallocate credit prior to closing a card, if needed. Remember, the travel rewards life is a marathon and not a sprint! Using the tools available to us and remembering to reallocate credit lines can be beneficial for your long-term success!

As always, please come to our Facebook group and share your data points on reallocating credit with the various banks and credit cards companies.