Last month, many Delta fans were happy to see a new round of some intriguing Amex Offers. After my initial delight, I have now dove into the offers and the fine print to analyze a plan.

The Offers

The offers varied depending on what card you held. For those with the American Express Delta Gold or Business Delta Gold, the offer was 4x on eligible restaurant spend. Additionally, you can earn 5x earning on eligible Delta spend. This is an increase from the normal 2x earning in those categories.

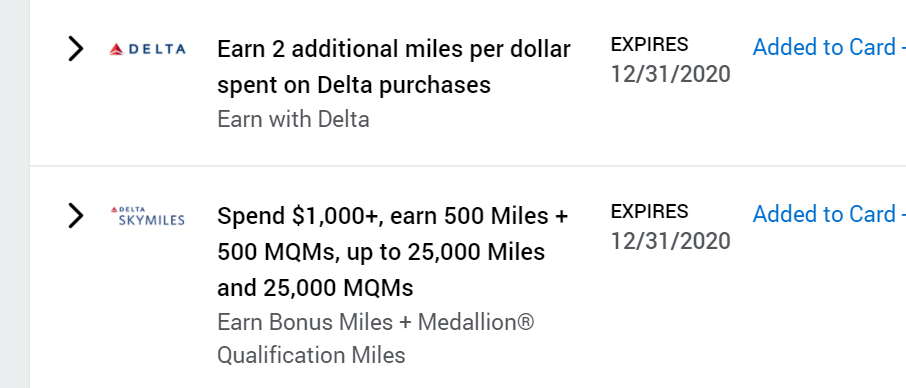

On the other hand, for those with Delta Reserve or Platinum cards which included business cards, there were two offers as well. The first was earning 2x additional on delta eligible purchase for 5x total. Secondly, the ability to earn 500 bonus miles and 500 Medallion Qualification Miles (MQM) for every $1,000 spent on the card. All offers run through December 31,2020.

Analysis

It is important to know in order to obtain or maintain Delta status, you must spend a certain amount on flights annually, referred to as Medallion Qualifying Dollars (MQD). Additionally, you must earn a certain number of Medallion Qualification Miles (MQM). Typically, MQM are earned by flying or via Delta credit card spend of $25,000 or more with flying being the primary way. In addition, I can earn 15k MQM bonus by spending $30,000 in a year. I hold the Delta Reserve card which I obtained in December of 2019.

To begin with, the 5x on Delta purchases does not move the needle much for me. As a rule, I prefer to use my Chase Sapphire Reserve for airfare for the trip delay protections. If you wanted to earn some SkyMiles, you could use it for the flights from your home city as a delay would not trigger protections. For the most part, I book separate one ways on my itineraries which makes this option possible. Finally, on this offer, I rank my Chase Ultimate Rewards as much more valuable and therefore defer to earning those when possible.

Then we have the second offer, which intrigues me the most. For every, $1,000 in spend, you will receive 500 miles and 500 MQM. The Maximum earning allowed is 25,000 of each or $50,000 in spend. I have no intention of ramping up my Delta credit card spend from an average of $3,000 a month to $12,500 to earn the maximum amount. First off, I do not trust American Express to not claw back the offer like the Hilton one. Secondly, you always must be wary of increasing spend on a card by that much. Finally, I have other cards to focus my spend on to meet my 2020 goals.

My Plan

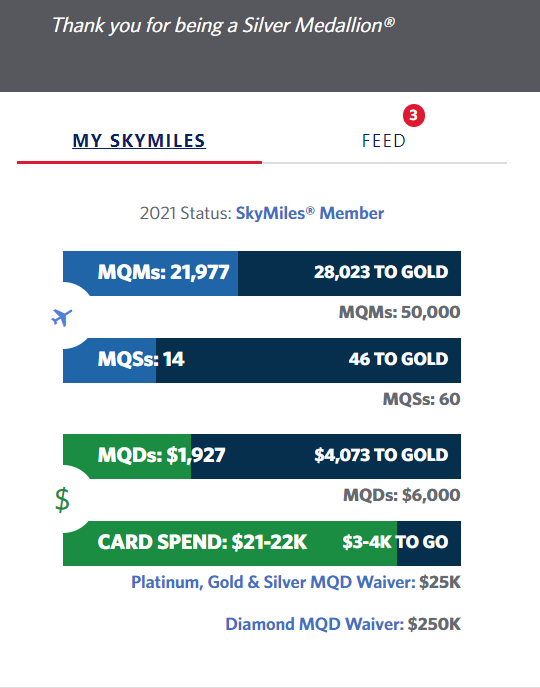

Although Delta is rolling over all Medallion Qualification Miles and status until January 31, 2022, I will use my status as an example. I had Silver to start the year which means to re-qualify, I would need to earn 25,000 MQM. However, I had my sights set on Gold (50k) this year based on my initial travel goals this year. Obviously, things changed so I then became set on maintaining Silver until this offer came along.

With just over 21,000 MQM currently, I plan increase my spending to a reasonable amount of $6,500 per month for a total of $26,000 for the remainder of the year. Again, this spend will earn 500 MQM per $1,000 or in this case plus the miles, so 13,000 MQM. This will take me to 34,000.

Additionally, I am going to earn 15,000 MQM bonus based on my normal spend which puts me at 49,000. This means I would only need one more flight this year to make Gold. I will have many more Delta flights albeit domestically, therefore, I could drop my spend on the card as my MQM increase.

Finally, anything I earn over the 50,000 MQM would normally roll over as well. So, if I earned 60k, I would start with Gold status and 10k, only needing 40k to requalify. If I am analyzing Deltas rollover plan for COVID and 2021 correctly, this could set me up for a potential Platinum run in 2021.

Final Thoughts

When deals like this come along, we must look at an offer from every angle to see if it is worth it. This offer makes sense for me and any Delta fans that value status and can shift spend to their American Express Delta cards.

Many do not believe in chasing status; however, I think this requires truly little effort on my part currently based on spending and travel habits. As a Seattle based traveler with Delta Silver status, I averaged an 85% upgrade rate in 2019. Half of those were to first class. In 2020, I am at a 70% upgrade rate with 63% of my upgrades being to first. Keep in mind, that is not with all my flights being on Delta as well.

In closing, always check your Amex offers and add them if you think you might use them. Do not miss out on some free miles or Medallion Qualifying Miles.

Will you use these offers? Do you have airline status? Are you considering it? Come over to our Facebook group and let us know your thoughts.