Credit Card Car Rental Insurance

Many credit cards offer some type of insurance for rental cars. This benefit can be helpful if an unfortunate accident or theft happens to your rental. Credit card coverage is even more important if you don't own a car and have your own insurance. However, insurance varies by card issuer and by credit card. Below, we explain how credit card car rental insurance benefits work for some of the most popular travel credit cards out there.

Table of Contents

ToggleHow does car rental insurance work?

Generally, car rental insurance can be either primary or secondary. The difference between the two is very important. Primary coverage pays for claims before your personal car insurance kicks in. This means you don’t have to use your personal insurance or the rental company’s insurance to get full coverage for your rental. In other words, primary rental car insurance prevents you from having to submit a claim with your insurance and paying a deductible.

Secondary rental car insurance, also known as supplemental insurance, kicks in only after you’ve used the coverage you already have in place–whether it’s your personal insurance or the rental company’s insurance that you signed up for. This means you must first file a claim with your personal insurance or the rental company’s, and then file a separate claim with the credit card company as your secondary insurer.

Clearly, primary rental car insurance is a better option than secondary, if available. First, it’s easier to use because you only submit one claim directly with the credit card company. Second, you avoid the risk of a rate increase with your personal insurance for submitting a claim.

Collision Coverage vs Liability Coverage

It's also important to understand the type of coverage your credit card offers. The main distinction here is collision damage coverage and liability coverage. The vast majority of cards offer collision damage coverage but not liability coverage.

A collision damage waiver only covers damage caused to your own vehicle in the event of an accident or theft of the vehicle. It does not cover injuries to passengers or damage to other vehicles or property. So you will not be off the hook for all expenses in the case of an accident just because you paid for your rental with a credit card that offers primary collision coverage.

Which credit cards offer insurance?

Chase, Capital One, American Express, and Citi credit cards offer car rental insurance to varying degrees. Chase and Capital One are by far the most comprehensive. Amex's offerings are quite lackluster, and Citi has all but scrapped this benefit from its credit card line-up.

Chase Cards

Chase offers complimentary primary collision damage waiver across several cards. Our ToP picks for Chase cards with primary coverage are:

- Chase Sapphire Reserve

- Annual fee: $550

- Points earned for car rental: 3x Ultimate Rewards

- Protection offered: Primary rental car coverage globally with no foreign transaction fees.

- Chase Sapphire Preferred

- Annual fee: $95

- Points earned for car rental: 2x Ultimate Rewards

- Protection offered: Primary rental car coverage globally with no foreign transaction fees.

- Ink Business Preferred

- Annual fee: $95

- Points earned for car rental: 3x Ultimate Rewards

- Protection offered: Primary coverage for car rentals in your home country are limited to business travel only (personal travel receives secondary coverage). Rentals abroad received primary coverage for both personal and business travel. No foreign transaction fees.

To use Chase's rental car insurance, you must book and pay for your rental car with your Chase credit card. Also, you must decline the rental company’s collision damage waiver and loss damage waiver.

Coverage is different for Chase business cards. Primary coverage is only available in your home country for business travel. If you use a business card like the Chase Ink Business Preferred or the Chase Ink Cash to rent a car for personal use, you will only have secondary coverage. But if you are renting a car abroad, then you will have primary coverage regardless of whether the rental is for business or personal use.

In addition to the cards listed above, some Chase cards with no annual fee offer primary rental car insurance while traveling outside the U.S., though their coverage is secondary for U.S. rentals. These cards include the Chase Freedom Flex, Chase Freedom Unlimited, the Chase Ink Cash, and Chase Ink Unlimited. However, since those cards charge foreign transaction fees, it’s best to avoid using them to rent abroad, even if renting from a U.S. company.

Chase also offers car rental protection through many of its co-branded credit cards. Some of these offer primary coverage, while others are limited to secondary coverage. Make sure to review your specific card's benefits guide to understand the extent and limitations of coverage.

Capital One Cards

Multiple Capital One cards provide primary rental collision damage waiver. As with other cards, you must reserve and pay for your rental car with your Capital One credit card and decline the rental company’s collision damage waiver. Our ToP picks for car rental coverage from Capital One are the Venture X and the Venture X Business.

Capital One Venture X

- Annual fee: $395

- Points earned for car rental: 2x Venture miles (10x if booked via Capital One Travel)

- Protection offered: Primary rental car coverage globally with no foreign transaction fees

The Venture X benefit covers theft, damage, valid loss-of-use charges imposed and substantiated by the auto rental company, administrative fees and reasonable and customary towing charges. Coverage is limited to rentals of 15 consecutive days within your home country, and 31 consecutive days abroad.

Capital One Venture X Business

- Annual fee: $395

- Points earned for car rental: 2x Venture miles (5x if booked via Capital One Travel)

- Protection offered: Primary rental cover coverage globally for business travel only, with no foreign transaction fees

The Venture X Business benefit is limited to vehicles rented primarily for business purposes. It covers theft, damage, valid loss-of-use charges imposed and substantiated by the auto rental company, administrative fees and reasonable and customary towing charges. Coverage is limited to rentals of 31 consecutive days within your home country, and 31 consecutive days abroad. If your rental is for personal purposes, the coverage is secondary.

Other Capital One Cards

Other Capital One cards offer slightly different car rental protection benefits. These cards include the Venture Rewards and the Spark Miles for Business. Make sure to consult your card's benefits guide, as these terms are subject to change.

American Express Cards

Car rental protection is actually a glaring hole among the benefits offered across Amex cards. Despite having so many premium cards, Amex does not offer complimentary primary coverage for any of its credit cards.

Many American Express cards do offer complimentary secondary car rental insurance for when your rental car is damaged or stolen. Enrollment is not required. You just have to use your Amex card to reserve and pay for your rental, and decline the collision damage waiver offered by the rental car company. A list of Amex cards offering secondary coverage and their individual policies is available here.

Amex Premium Car Rental Protection

Most Amex cards offer the opportunity to purchase primary coverage at a flat rate cost per rental. When you enroll to purchase premium car rental protection, you receive coverage for your rental for up to 42 consecutive days. The flat rate also includes eligible luxury cars, SUVs, and pickup trucks.

Enrollment is required, but you only pay for the coverage when you actually rent a vehicle. The premium protection will be automatically charged to your enrolled card when you make a reservation, unless you cancel enrollment beforehand. To enroll, click on the Benefits tab on Amex’s website and select “Premium Car Rental Protection” among your card benefits:

Premium coverage varies among Amex cards. For example, here is what the American Express Platinum consumer card version offers:

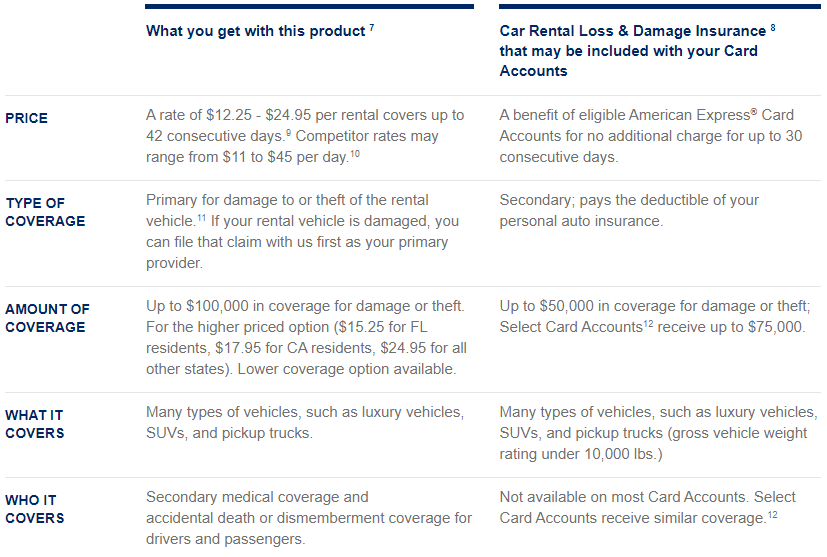

The card charges a flat rate of $19.95 or $24.95 per rental, not per day ($15.95 / $17.95 for California residents; $12.25 / $15.25 for Florida residents). The lower rate provides up to $75,000 in coverage, while the higher end covers up to $100,000. Amex’s premium coverage also includes secondary medical coverage and accidental death or dismemberment coverage. Premium coverage does not cover liability. Amex’s website offers a useful chart to help assess whether premium coverage is the right option for you:

Amex’s coverage is available worldwide, except in Australia, Ireland, Israel, Italy, Jamaica, and New Zealand, or in any instance where coverage would be in violation of US economic or trade sanctions.

Citi Cards

Citi eliminated car rental insurance from nearly all of its cards back in 2019. Now, the Citi/AAdvantage Executive World Elite Mastercard is one of the few Citi cards that offers any car rental protection. The card's coverage is secondary in the US, but primary outside of the US.

Coverage is limited to damage to the rental car by an accident or if your rental car is stolen. The Citi AA Executive card covers up to $75,000 toward the cost of repairs or the cash value of the car, whichever is less. You must decline the rental company’s collision loss/damage insurance and pay for the rental with your card.

The card does not cover damage to other cards, personal property, or injury to any party. Coverage also does not include charges or expenses for the loss of use of the rental car, rental agency fees, or taxes.

Credit Card Car Rental Insurance: ToP Thoughts

Credit card car rental insurance is one of those benefits we never want to have to use but that can save us a lot of money. Chase clearly leads the pack when it comes to primary coverage for rental car insurance, and Capital One isn't too far off. Meanwhile, this is an area where Amex and Citi have fallen behind significantly.

What is your favorite card for car rentals? Come join the discussion in our Facebook group, and follow us on Instagram!