US Bank Business Payment Issues

Wow, I mean … WOW! I didn't think it was possible to find a bill payment system worse than Bank of America's. Which, to be fair, has gotten better since I found this work around. It is just too bad that the fix doesn't work for everyone. I figured that was by far the worst out there, but then walks in US Bank business payment issues. It caught me by surprise, because it is the first time I have run into it with them. I think I may know why that is too, though. Let's get into it.

Table of Contents

ToggleUS Bank Leverage Card

Towards the end of last year I grabbed the US Bank Leverage card. It comes with a very rewarding welcome offer, $750 after spending $7,500 within the first 120 days of card opening, but isn't great for much after that. The peak earning rate for the card is only 2% cash back in select categories. I earned the welcome offer without issue though, paid it off and moved on.

After my experience, I decided to have my wife grab one as well. This was our 4th or 5th US Bank business card over the years and we have never had issues. That was true, until this latest round with my wife though. What changed? She added me as an authorized user, the first time we had done that. And there in lies the rub, adding an authorized user seems to turn this into a US Bank corporate account.

US Bank Corporate Account

Adding the authorized user is my best guess at least, it is the only change we made. I say that because I never had a corporate account set up for any of our US Bank business cards before. It feels eerily similar to the Bank of America set up with the credit card having one number and then a corporate account having another. Only, it. Is. Worse!

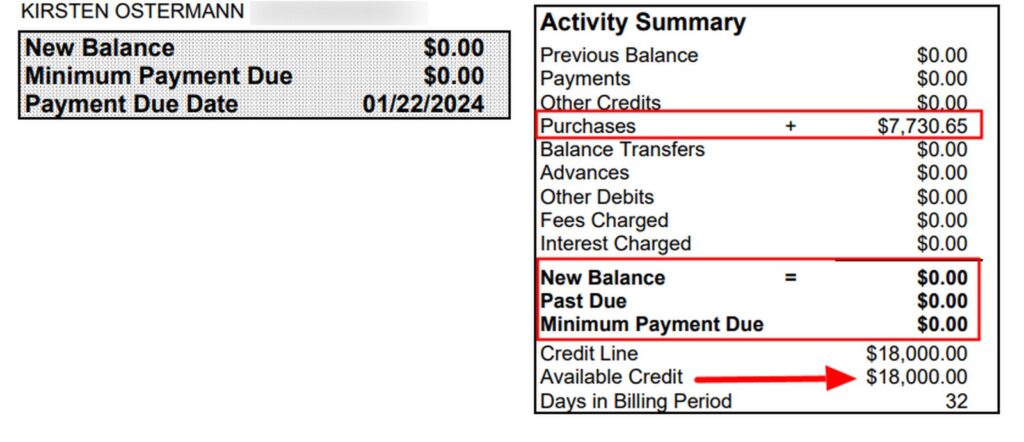

You may be wondering what were my US Bank payment issues exactly? The first issue was that I started to notice the charges were not tracking on my wife's login portal. The charges were showing in the activity, but there was no balance tallied on the account overall. It was also showing that the entire credit limit was available even after we had spent over the required $7,500. Weird, no doubt. I figured it was just a glitch on their site.

After a few more weeks the bonus points posted for my $750 welcome offer. Great, things were working as they should, or so I thought. I redeemed the points and waited a few days for it to show as a credit in the card's history, but it never came.

Next up, I went to take a look at my wife's statement, and this is when things got really weird. It showed no balance at all. The purchases showed but there was no balance and no reduction in our available credit. Oh well, I would just pay what was owed after I added it all up. Except there was no pay now button on the US Bank website. Ugh! I just want to pay our dang bill!

US Bank Business Payment Issues, My Workaround

After being perplexed by all of this I reached out to some friends to see what the heck was going on. That is when my buddy Larry said he ran into the same US Bank business payment issues. It was because they created a corporate account and you need to set that up to view all of the activity and such. Can we pause a second to take in how horrible of a set up all of this is?

Set Up A Corporate Account

I poked around the US Bank website and found some stuff on corporate accounts but could not for the life of me figure out how to set one up. You think they would make it easy for people to just pay their bills, wouldn't you?

Calling In For An Agent?

I didn't really want to call in and deal with an agent to get it all figured out. Instead, I decided to call in and see if I could get the balance info that way and make sure the cash back was at least redeemed properly. When I called on my wife's card I was given a card option, or corporate option. Listening to the card details was a waste of time, since it said there was nothing spent and nothing owed, just like the statement.

Calling The Automated System

Calling in again and hitting the corporate option is when I got what I needed. This is when they gave me my actual statement balance and my current balance. The cash back from the welcome offer had been correctly applied after all! Miracle one down.

Payment By Phone Was My Best Course Of Action

After all of this I decided to call in a third time and just make a payment over the phone. I added our checking account info and made a payment for the remaining balance. I then called for a fourth time, a few days later, to ensure the payment was settled properly. That is when the prompt told me there was no balance. Victory was finally mine!

US Bank Business Payment Issues: ToP Thoughts

Lessen one of all of this is don't add an authorized user to your US Bank business card, unless you want to have some US Bank business payment issues. I don't understand why banks make this all so complicated at times. You would think they would have people testing these systems and telling them how horrible they are. Corporate accounts blow! Please, we beg of you, stop using them US Bank and Bank of America.

While the pay by phone option isn't great, it was a quick workaround. I could have sent a payment from an outside bank, or tried to force one in the US Bank bill pay feature. I figured paying by phone had the best chance of working without problems. The real issue is I can never quickly check my accounts to see if any balance, or fraudulent charges, are on the account because it just won't show on my wife's main login page. I'll have to check the recent transactions, or call in. This is going to be annoying.

I already put a reminder on my calendar to cancel the card in 11 months, so I don't get hit with late charges on the annual fee. What an absolute mess that never needed to happen.

Has anyone else have these US Bank business payment issues? Let me know over in the ToP Facebook Group.